You may have heard the term “accidental death benefits” before but not been quite sure what it meant. Accidental death benefits are insurance payouts that are given to the beneficiary of a policyholder who dies as the result of an accident.

This type of benefit can be included as part of a life insurance policy or as a standalone policy. It is important to know what accidental death benefits are and how they work so that you can make the best decision for your needs.

###

Does Your Job Offer Accidental Death Insurance?

If you’re like most people, you probably don’t think much about accidental death insurance. After all, why would you need it? Isn’t that something that only happens to other people?

Unfortunately, accidents do happen, and they can happen to anyone at any time. If you’re not prepared, an accident can have a devastating financial impact on your family.

That’s where accidental death insurance comes in. Also known as AD&D insurance, this type of policy provides financial protection in the event of your death due to an accident.

Most employers offer some form of AD&D insurance as part of their benefits package. However, the coverage is typically very limited. For example, many policies will only pay out a benefit if you die as a result of a covered accident within a certain period of time after the accident occurred.

If you’re concerned about protecting your family financially in the event of your death, you may want to consider purchasing a standalone AD&D policy. These policies are available from many different insurers, and they can provide much more comprehensive coverage than employer-provided plans.

Understanding the Limitations of Accidental Death Insurance

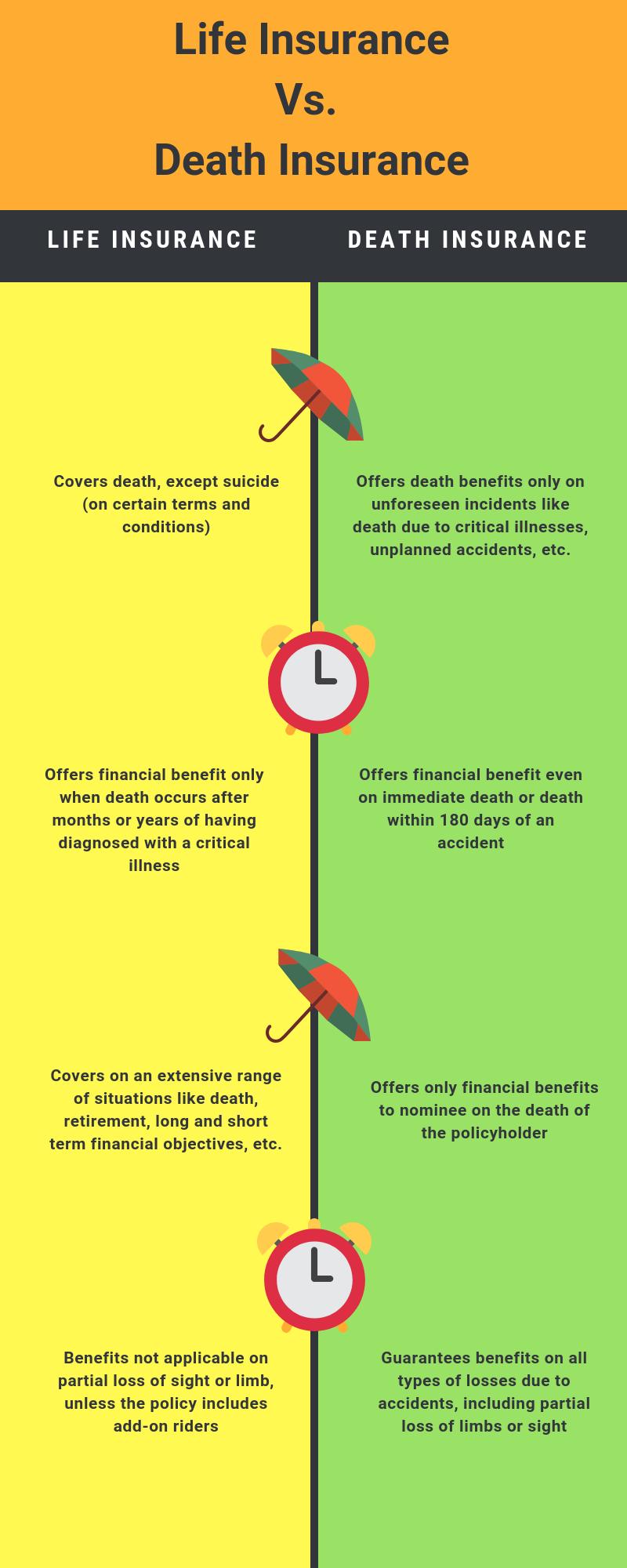

Most people are familiar with life insurance, which pays a death benefit to a policyholder’s beneficiaries in the event of the policyholder’s death. Accidental death insurance is a type of life insurance that pays a death benefit only if the policyholder dies as the result of an accident.

There are several limitations to accidental death insurance that you should be aware of before you purchase a policy. First, accidental death insurance only pays a death benefit if the policyholder dies as the result of an accident. This means that if the policyholder dies of natural causes, such as from an illness or old age, the beneficiaries will not receive any money from the policy.

Second, accidental death insurance typically has lower death benefits than traditional life insurance policies. This is because the insurer assumes less risk when insuring someone for an accidental death as opposed to a natural death.

Finally, most accidental death insurance policies have exclusions that limit what types of accidents are covered by the policy. For example, many policies exclude deaths caused by acts of war or terrorism. So, if you’re looking for coverage in these situations, you’ll need to purchase a separate policy.

Can You Collect on Your Own Life Insurance if You Die?

If you have a life insurance policy, you may be wondering if your beneficiaries can collect on the policy if you die due to an accident. The answer is yes, they can.

When you purchase a life insurance policy, you name one or more beneficiaries who will receive the death benefit payout in the event of your death. If you die due to an accident, your beneficiaries can collect on the policy just as they would if you had died from any other cause.

There is no need to prove that your death was accidental in order for your beneficiaries to collect on the policy. They will simply need to provide the insurance company with a copy of your death certificate and any other required documentation.

If you are concerned about your beneficiaries being able to collect on your life insurance in the event of your accidental death, you can purchase an accidental death rider. This rider will provide additional coverage in the event of your accidental death and will ensure that your beneficiaries receive the full death benefit payout.

What Happens If You Quit Your Job?

If you quit your job, your accidental death benefits will stop. If you are killed in an accident after you have quit your job, your beneficiaries will not receive any benefits from your employer.

When Can I Collect on my Accidental Death Benefit?

If you are the beneficiary of a life insurance policy, you may be able to collect on the death benefit if the policyholder dies as the result of an accident. The definition of an accident can vary from policy to policy, but it generally includes deaths resulting from a fall, car crash, or other unexpected event.

If you are wondering whether you can collect on your accidental death benefit, the best thing to do is check with the insurance company that issued the policy. They will be able to tell you whether the policyholder’s death qualifies as an accident and, if so, how much you are entitled to receive.

What Is Accidental Death Benefits? – Accidental Death Benefits Financial Definition

An accidental death benefit is a type of life insurance that pays out a death benefit in the event of an accidental death. The benefit can be used to cover final expenses, replace lost income, or any other purpose designated by the policyholder.

Accidental death benefits are typically paid in addition to any other life insurance coverage the policyholder may have, such as a term life or whole life policy. Some policies may have limits on how much they will pay out in accidental death benefits, while others may pay the full death benefit regardless of other coverage.