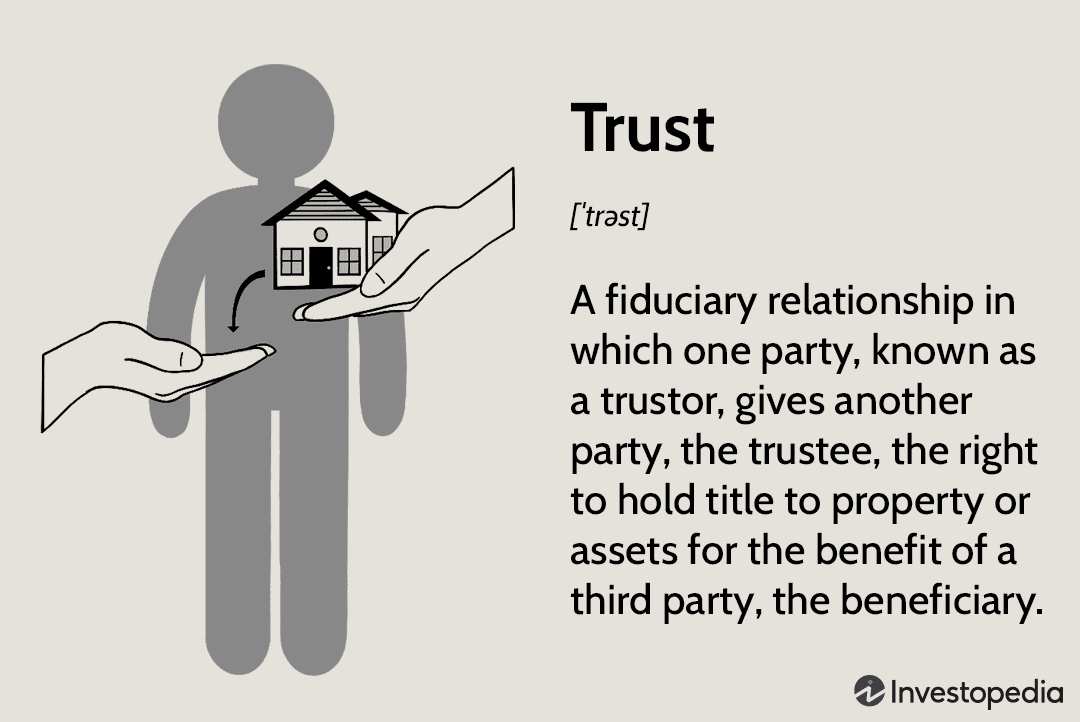

If you’ve been wondering what is account in trust, you’re not alone. It’s a phrase that’s used a lot in the financial world, but its meaning isn’t always clear. In this blog post, we’ll explore the definition of account in trust and how it might affect you.

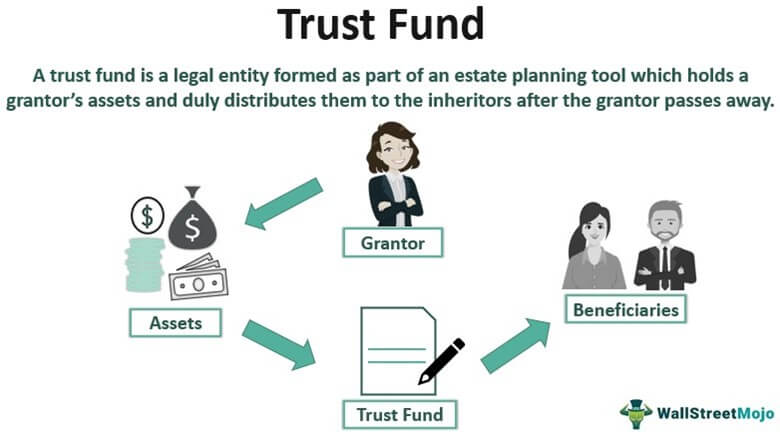

An account in trust is an arrangement where one party (the trustee) holds property or assets for the benefit of another party (the beneficiary). The trustee has a legal duty to manage the assets in the best interests of the beneficiary and may be held liable if they don’t do so.

There are many different types of trusts, but they all have one thing in common: they’re created to provide some sort of financial benefit to the beneficiary. For example, a trust might be created to help pay for the beneficiary’s education or medical expenses.

If you have an account in trust, it’s important to understand how it works and what your rights and obligations are. Otherwise, you could end up losing out on the benefits you’re entitled to.

What are different types of trusts?

A trust is a legal arrangement in which one party, called a trustee, holds property or assets for the benefit of another party, called a beneficiary. Trusts can be used for a variety of purposes, including avoiding probate, minimizing taxes, and protecting assets from creditors.

There are many different types of trusts, each with its own advantages and disadvantages. The most common types of trusts are living trusts, irrevocable trusts, testamentary trusts, and charitable trusts.

Living trusts are created during the lifetime of the grantor and can be revocable or irrevocable. Revocable living trusts can be modified or revoked at any time by the grantor, while irrevocable living trusts cannot be changed once they have been created.

Testamentary trusts are created through a will and only come into effect after the death of the grantor. They cannot be changed or revoked after the grantor’s death.

Charitable trusts are created for the purpose of benefiting a charity. They can be either revocable or irrevocable.

Each type of trust has its own unique benefits and drawbacks. It is important to consult with an experienced attorney or financial advisor to determine which type of trust is right for your particular situation.

What benefits do they provide?

There are a few key benefits that come along with having an account in trust. Perhaps the most notable benefit is that it provides protection for the assets within the account from creditors. This means that if the account holder were to ever find themselves in a difficult financial situation, their account in trust would be safe from being seized by creditors.

Another key benefit of having an account in trust is that it can help to avoid probate. Probate is the legal process through which a person’s estate is distributed after they pass away. This can be a lengthy and expensive process, but if an account is held in trust, it can bypass probate and be distributed directly to the beneficiaries named in the trust agreement.

Lastly, holding an account in trust can also provide peace of mind. Knowing that your assets are protected and that your loved ones will be taken care of after you’re gone can provide a great sense of comfort.

How to setup an account in trust

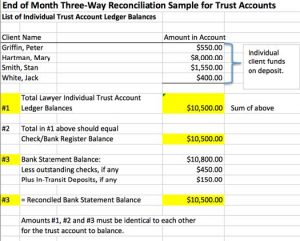

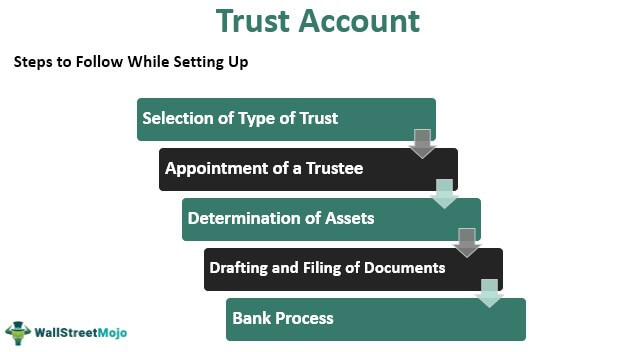

If you want to set up an account in trust, there are a few steps you need to follow. First, you need to find a trustee. A trustee is a person or organization that will hold and manage the assets in the trust. Once you have found a trustee, you need to decide what type of trust you want to set up. There are many different types of trusts, so it is important to do some research and choose the one that best suits your needs. After you have chosen the type of trust, you need to draft a trust agreement. This document will outline the terms of the trust and how the assets will be managed. Once the trust agreement is signed by both parties, the account can be opened and funded.

What Is Account in Trust? – Account in Trust Financial Definition

An account in trust is a type of financial account in which the funds are held by a third party on behalf of the account holder. The third party may be a bank, investment firm, or other financial institution. The account holder may be an individual, business, or other entity.

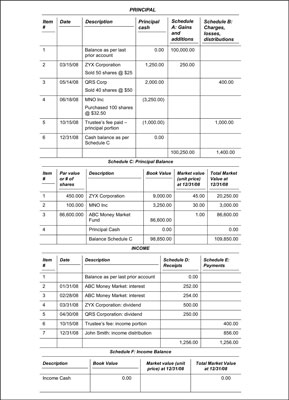

The funds in an account in trust are typically invested and managed by the third party. The account holder may have some input on how the funds are invested, but the ultimate decision rests with the third party. The account holder may also be able to withdraw funds from the account, but there may be restrictions on how often this can be done and how much can be withdrawn at one time.

Accounts in trust can be used for a variety of purposes, such as saving for retirement, investing for future goals, or providing for loved ones in the event of death. Trusts can also be created for charitable purposes.

If you are considering opening an account in trust, it is important to research different types of trusts and find one that best suits your needs. You should also carefully consider who you want to serve as the trustee of your trust. This person will be responsible for managing the trust and ensuring that it is used according to your wishes.