Are you eager to revamp your investment portfolio and ride the wave of financial success in 2023? Look no further! Our comprehensive guide on the best stocks to buy in 2023 is your ultimate roadmap to a prosperous future. Gain in-depth insights into the top-performing companies and industries that are poised for explosive growth, and learn how to make savvy investment decisions that will maximize your returns. Don’t miss this golden opportunity to capitalize on today’s most promising stocks and secure your financial future. Let’s dive into the world of wealth-building and uncover the hidden gems of the stock market in 2023!

However, I can list some industries and companies that are expected to continue growing in the coming years based on current trends and market conditions

In the rapidly evolving global market of 2023, identifying key industries and companies poised for growth is crucial for savvy investors. Based on current trends and market conditions, sectors such as renewable energy, e-commerce, and artificial intelligence are expected to flourish. For instance, leading renewable energy companies like NextEra Energy and Orsted offer promising investment opportunities, while e-commerce giants such as Amazon and Alibaba continue to expand their reach. Moreover, AI-driven companies like NVIDIA and Alphabet are at the forefront of technological advancements, making them prime candidates for long-term growth. By focusing on these innovative industries and market leaders, investors can capitalize on the opportunities presented by emerging trends and position themselves for success in the coming years.

Please consult a financial advisor before making any investment decisions.

It is crucial to emphasize the importance of consulting with a financial advisor before making any investment decisions, as they possess the necessary expertise and experience to guide you towards the best stocks to buy in 2023. These professionals can help you assess your risk tolerance, financial goals, and overall investment strategy, ensuring that you make informed decisions that align with your objectives. Remember, investing in stocks carries inherent risks, and the performance of the market is never guaranteed. Therefore, seeking professional guidance from a financial advisor is a wise move to safeguard your investments and optimize your financial growth potential.

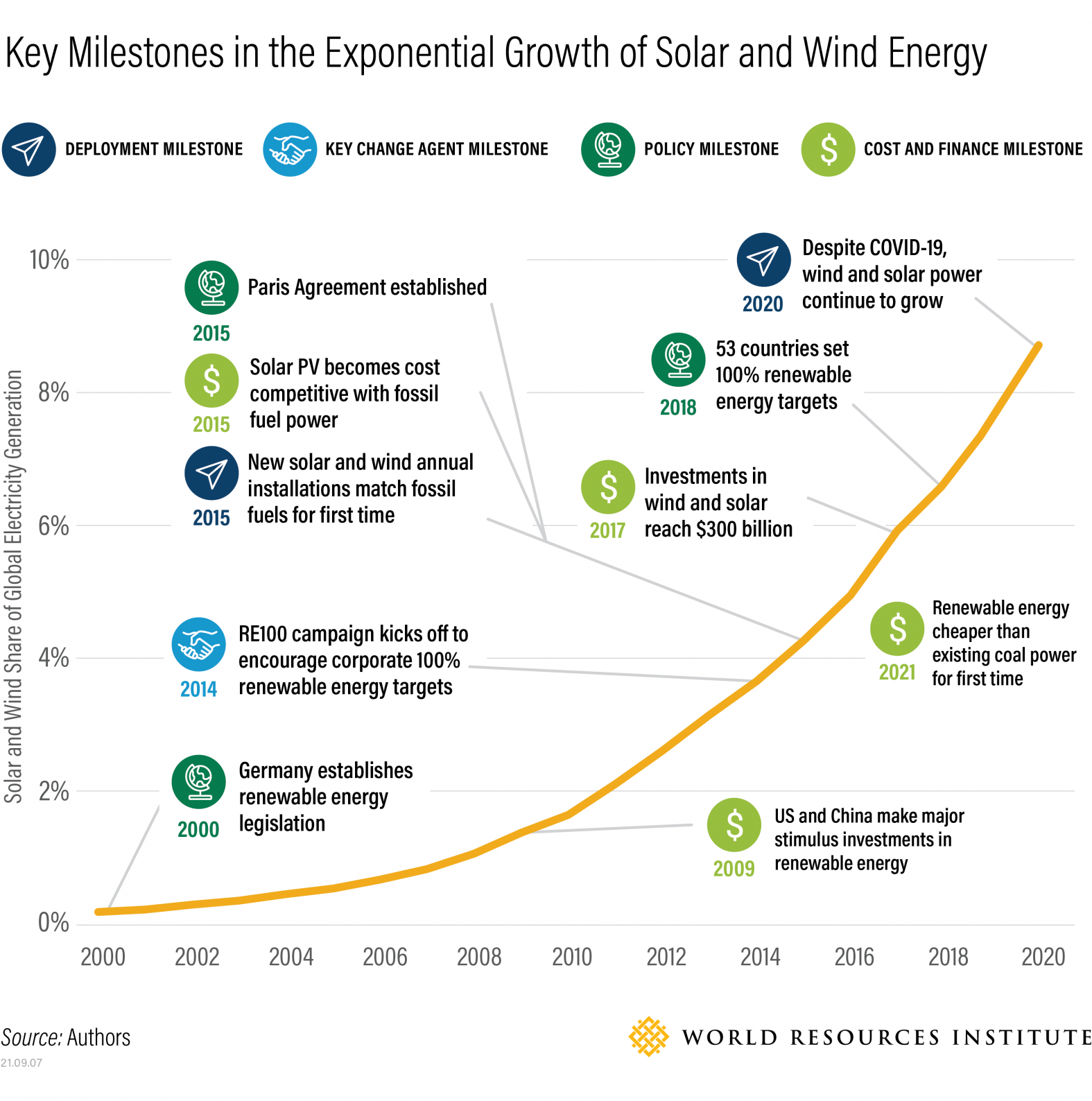

Green Energy: Clean and renewable energy companies are expected to prosper as countries look for ways to reduce their carbon footprint

The Green Energy sector is poised for phenomenal growth in 2023, as nations worldwide strive to minimize their carbon emissions and embrace eco-friendly alternatives. Clean and renewable energy companies, including solar, wind, hydro, and bioenergy providers, are predicted to flourish in this era of sustainable development. Investing in top-performing green energy stocks offers a lucrative opportunity for forward-thinking investors to capitalize on the global shift towards environmentally responsible power generation. By diversifying your portfolio with these high-potential stocks, you can play a crucial role in supporting the clean energy transition while reaping substantial financial rewards in the long run.

Examples include NextEra Energy (NEE), Enphase Energy (ENPH), and First Solar (FSLR).

In 2023, investors seeking lucrative opportunities should consider top-performing renewable energy stocks, such as NextEra Energy (NEE), Enphase Energy (ENPH), and First Solar (FSLR). These industry-leading companies are well-positioned for growth as the global shift towards clean energy intensifies. NextEra Energy, a pioneer in wind and solar power generation, boasts a robust project pipeline and impressive dividend growth. Similarly, Enphase Energy, a global leader in microinverter technology, promises substantial market expansion and revenue potential. Lastly, First Solar, with its advanced thin-film solar panels, offers investors a strong foothold in the rapidly growing solar industry. Each of these innovative companies represents a promising investment in the thriving renewable energy sector.

Electric Vehicles: The EV market is expected to grow substantially as more countries move towards sustainable transportation

The Electric Vehicle (EV) sector is poised for significant expansion in 2023, driven by global efforts to embrace eco-friendly transportation solutions. With governments implementing stricter emission regulations and offering enticing incentives for EV adoption, consumer demand for electric cars is skyrocketing. This presents a golden opportunity for investors to capitalize on leading-edge companies at the forefront of this green revolution. As EV technology continues to advance and charging infrastructure expands, stocks in this industry are likely to experience substantial growth. Stay ahead of the curve by exploring the best electric vehicle stocks to buy in 2023 and ride the wave of a more sustainable future.

Potential investments include Tesla (TSLA), NIO Inc

In 2023, savvy investors should keep an eye on prominent electric vehicle (EV) manufacturers like Tesla (TSLA) and NIO Inc. As global demand for sustainable transport options continues to surge, these innovative companies have the potential to dominate the market. Tesla, with its ever-expanding product line and Gigafactory network, remains a formidable force in the industry. Meanwhile, NIO, often dubbed as the ‘Tesla of China,’ has demonstrated impressive growth and is swiftly gaining traction among consumers. By investing in these pioneering EV stocks, you’ll be positioning yourself to reap the benefits of the clean energy revolution, while simultaneously supporting a greener future.

(NIO), and ChargePoint Holdings (CHPT

In 2023, electric vehicle (EV) stocks such as NIO Inc. (NIO) and ChargePoint Holdings Inc. (CHPT) are slated to be among the top-performing investments. As the global shift towards sustainable transportation accelerates, NIO, a leading Chinese EV manufacturer, is rapidly expanding its market presence, boasting cutting-edge technology and innovative battery solutions. Meanwhile, ChargePoint (CHPT), the largest EV charging network in the US, is poised for exponential growth as EV adoption surges, with a vast array of charging infrastructure solutions catering to both public and private sectors. Investing in these two environmentally-conscious companies can potentially yield significant returns for forward-thinking investors.