Credit cards can be a great way to build credit and access money for emergencies, but if you don’t use them responsibly, it can lead to debt that can be hard to get out of. As a college student, I’ve learned the importance of using credit cards responsibly, and I wanted to share what I’ve learned so other people my age can avoid getting into debt.

In this article, I’ll discuss how to use credit cards responsibly and avoid debt so you can enjoy the benefits of having one without the worry of owing money.

Create a budget and track spending.

Creating a budget and tracking my spending has been a great way for me to stay on top of my finances. I use budgeting apps to help me stay organized and to ensure I don’t overspend.

I also review my credit card statements every month and make sure I’m not going beyond my limits. It’s a great way to be responsible with my credit and keep debt at bay.

Set spending limits.

Setting spending limits for yourself is really important when using a credit card. You should decide on a monthly budget and stick to it – that way you won’t end up getting into debt.

Make sure you track your expenses and be aware of your balance at all times to prevent overspending. It’s all too easy to get caught up in a spending spree and not realize how much money you’re actually spending. Setting limits will help you stay in control and avoid getting yourself into debt.

Use credit for emergencies only.

As a student, it’s essential to know how to responsibly use credit cards and avoid getting into debt. When it comes to emergencies, it’s best to use credit cards only if you know you can pay it back right away.

Otherwise, you could end up with a pile of debt that will take months to pay off. By using credit cards responsibly, you can avoid the stress and worry of being in debt.

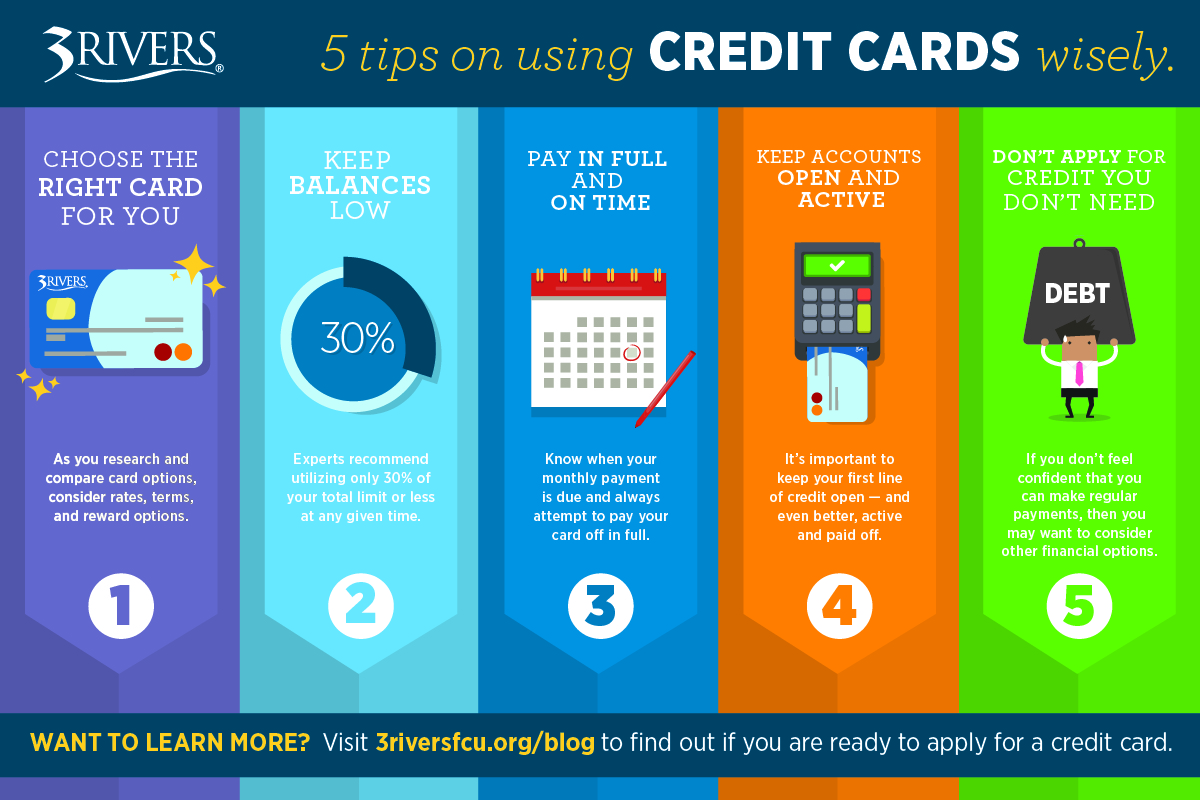

Pay the balance in full each month.

As a student, I know how tempting it is to just pay the minimum balance on my credit card each month, but I have learned that the best way to use a credit card responsibly is to make sure I pay off the full balance each month.

Doing this prevents me from getting into debt, and it helps me build a good credit score by not carrying a balance from month to month.

Stay within the credit limit.

Staying within your credit limit is essential to using credit cards responsibly and avoiding debt. It can be tough to resist the temptation to overspend, but setting a budget and tracking your spending can help.

It’s also important to pay attention to your credit utilization ratio, which is the amount of credit you’re using compared to your available credit. Even if you’re using less than your full credit limit, try to keep your ratio below 30%, as this can help your credit score.

Monitor statements regularly.

As a college student, monitoring your credit card statements is essential to staying on track with your finances. I make sure to check my statements every month.

It’s easy to be tempted to buy something you can’t really afford, so staying up-to-date with my statement helps me manage my spending and prevent debt. Keeping an eye on your credit card statement also helps spot any fraudulent charges quickly.