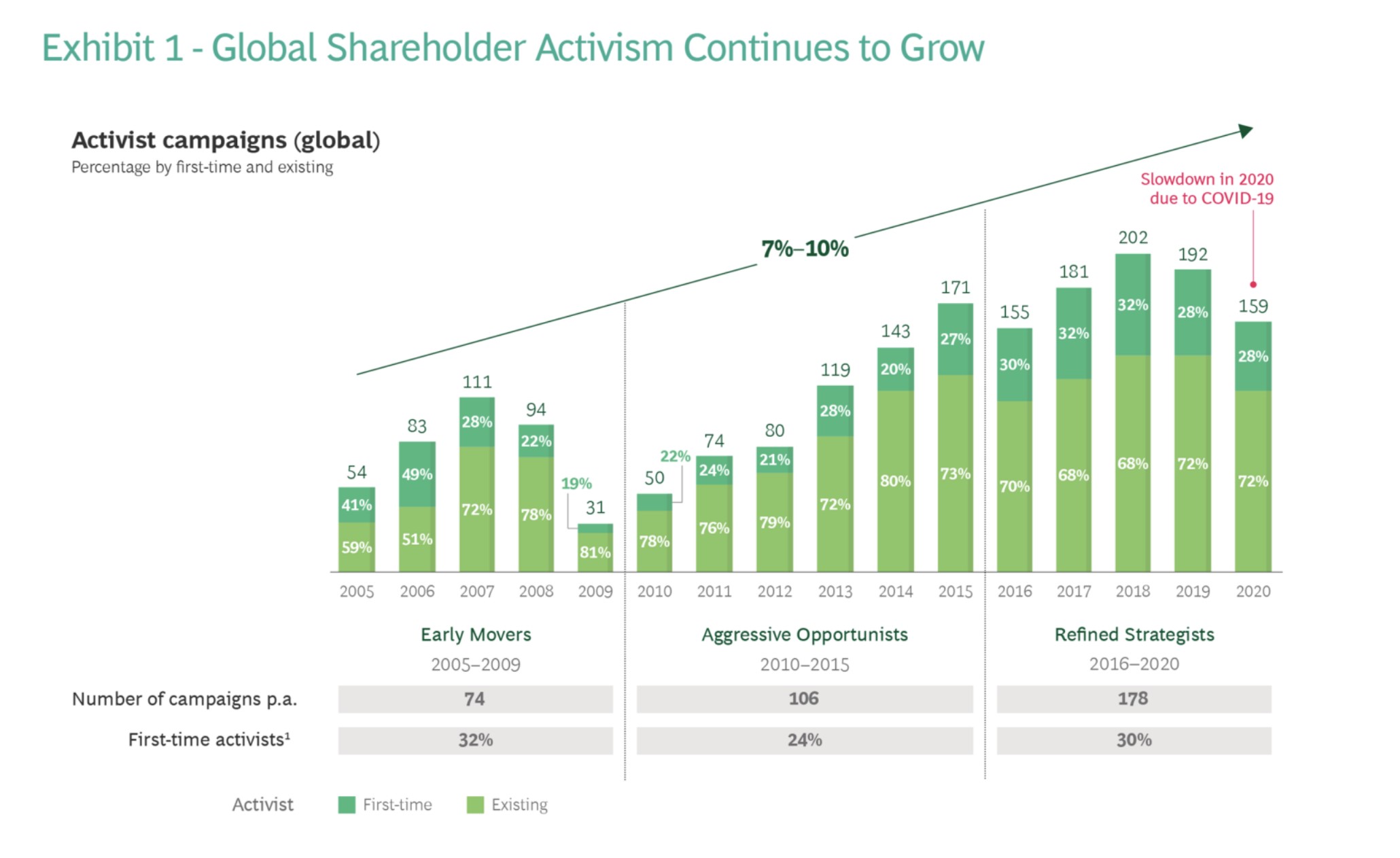

Are you an investor looking for a way to maximize your returns? Activist Investor may be the strategy you’re looking for. Activist Investors are shareholders who take an active role in the management of a publicly traded company to increase its market value. The goal is to influence the company’s decisions to improve profitability and increase shareholder value. In this article, we’ll discuss the fundamentals of Activist Investing, the benefits, and the risks involved.

What Are the Benefits of Activist Investing?

Activist investing can be a great way to make a big difference in the world of finance and investing. The benefits of investing in this way are vast, from increasing the value of your investments to helping to keep corporate boards honest and accountable. Activist investors take a hands-on approach to investing, utilizing shareholder rights to push for changes that benefit all shareholders. By having a voice in corporate decision-making, investors can ensure that the interests of shareholders always come first. Activist investors can also improve the overall efficiency of a company and increase its profitability, allowing investors to see a greater return on their investments. As an activist investor, you have the opportunity to make a meaningful impact on the world of finance, and the potential rewards can be great.

What Types of Activist Investors Exist?

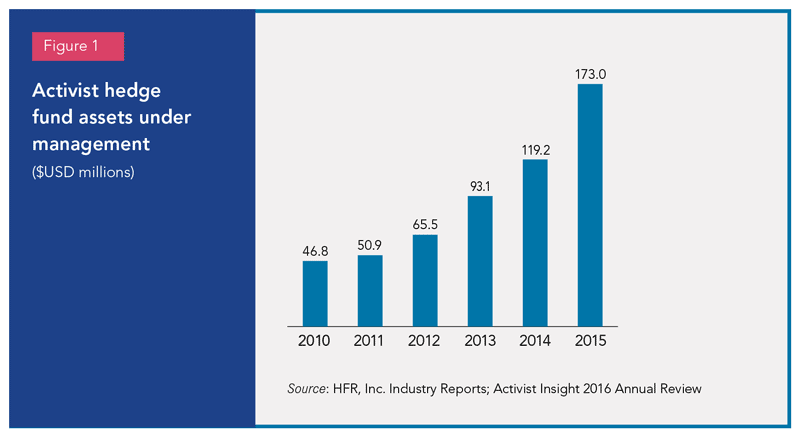

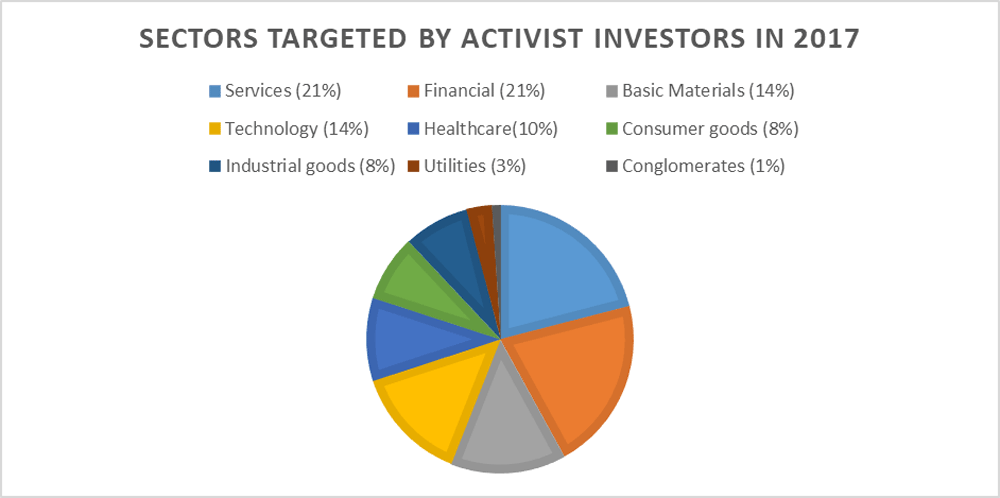

Activist investors come in all shapes and sizes, but there are three main types. First, there are the “corporate raiders” who buy large stakes in a company and then push for changes to increase shareholder value. Second, there are the “value investors” who look for undervalued companies and then push for changes to drive up the share price. Finally, there are the “activist hedge funds” which specialize in taking large stakes in companies and pushing for changes to increase returns. All three types of activist investors have the same basic goal – to maximize shareholder value – but they all have different strategies and tactics. No matter what type of activist investor you are dealing with, it is important to keep in mind that they are all in it for the long-term and will not be easily intimidated.

What Strategies Do Activist Investors Use?

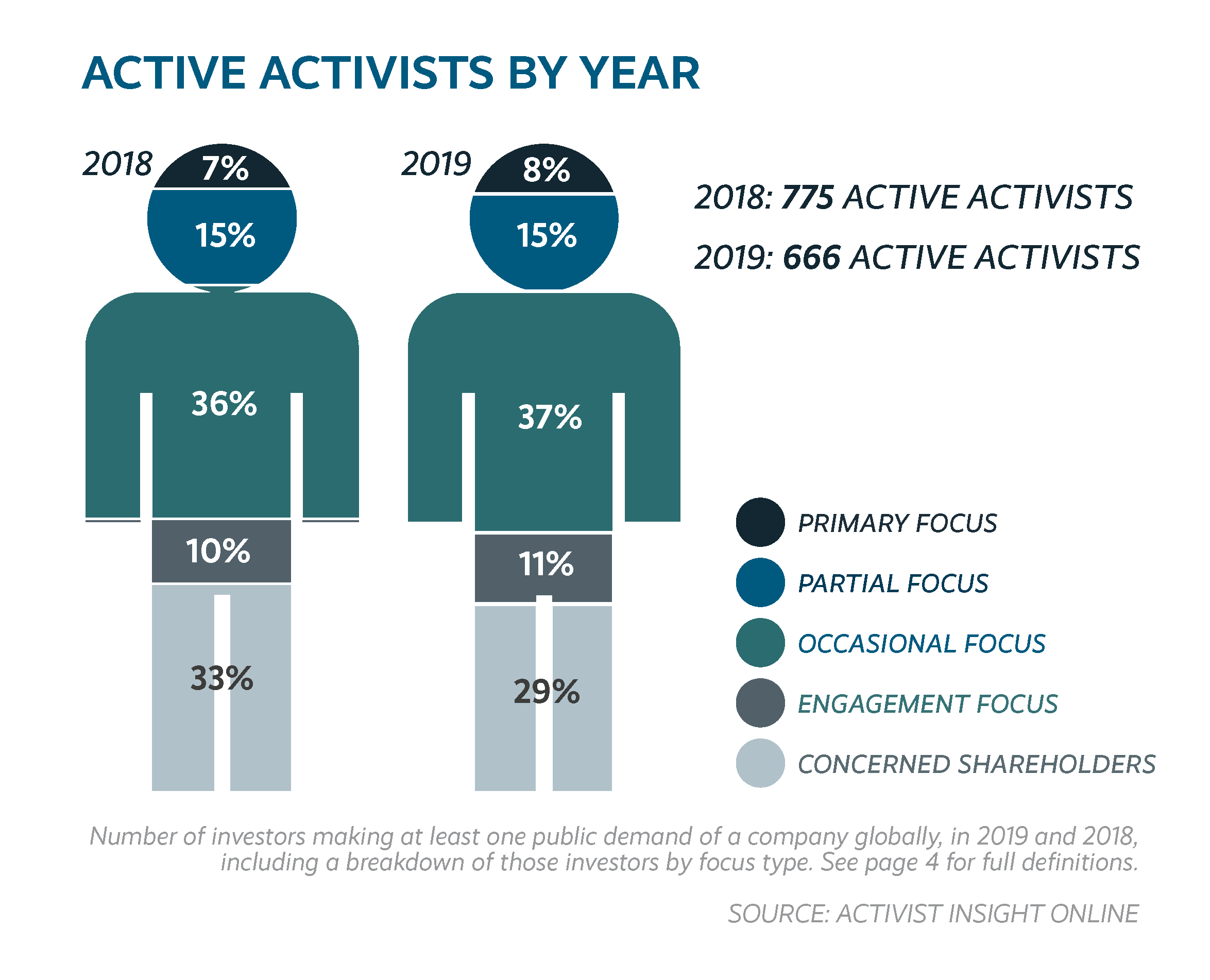

Activist investors are known for shaking up the status quo. They use a variety of strategies to influence companies and make changes. Some of the most common strategies include launching campaigns to replace board members, acquiring large chunks of stock in the company, and proposing changes to corporate strategy and structure. Activist investors also use tactics like publicizing their intentions, pressuring management, and engaging in proxy fights. These strategies can be used to increase shareholder value, improve corporate governance, and unlock hidden value. Activist investors often push for changes that are not always popular, but can help create long-term value for shareholders.

How to Define Success When Investing as an Activist?

When investing as an activist, it can be difficult to define what success looks like. It’s important to identify your goals before you invest and have a plan for how to reach them. This could mean setting a certain return on investment or a certain percentage of ownership in a company. It could also mean influencing the company to change its practices in a certain way that meets your environmental, social, or other goals. The key is to have a clear understanding of your expectations and to be able to measure them to determine if you have succeeded. It’s also important to remember that the success of an activist investor is not always a short-term gain. It may take several years to achieve the desired outcome, so it’s important to be patient and diligent in your efforts.

How to Identify Potential Activist Investors?

If you’re looking to identify potential activist investors, there are a few key things to keep an eye out for. Firstly, you should look out for an investor who is looking to take a significant stake in the company and is likely to be vocal about their views. You should also look out for an investor who is actively seeking out other investors to join them in their efforts, as well as an investor who is willing to push for changes to the company’s board of directors or management structure. Additionally, you should be on the lookout for an investor who is willing to use the media to try and garner public support for their proposed changes. By doing your research and keeping an eye out for these potential investors, you can help ensure that your company is prepared for any potential activism that may arise.