Are you looking to diversify your investment portfolio and maximize returns in 2023? Look no further! In this must-read article, we’ve carefully curated a list of the top-performing ETFs that have consistently outshined the market, providing investors with unparalleled growth opportunities. Discover the best ETFs to buy in 2023, and learn why these exceptional funds are the key to unlocking your financial success in the ever-evolving world of investing. Don’t miss out on these unbeatable investment vehicles that have the potential to skyrocket your wealth and secure your financial future!

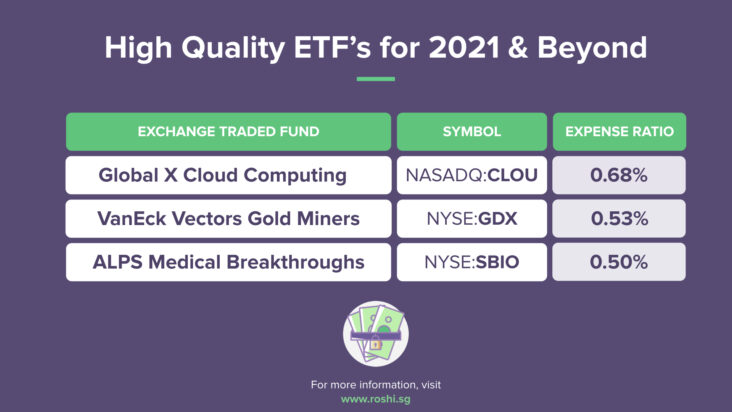

However, as of now, these are some of the best ETFs that have performed well in recent years and could potentially continue to do well in 2023:

In the ever-changing financial landscape, it’s crucial to stay updated on the top-performing ETFs to maximize your investment potential. As we look ahead to 2023, several standout ETFs have demonstrated impressive performance in recent years and are poised to continue their upward trajectory. These top-tier funds encompass various sectors, offering a diversified approach to your investment strategy. By focusing on these high-performing ETFs, you can capitalize on market trends and position yourself for success in the coming years. Continue reading to discover the best ETFs to buy in 2023 and learn how to optimize your portfolio for long-term growth.

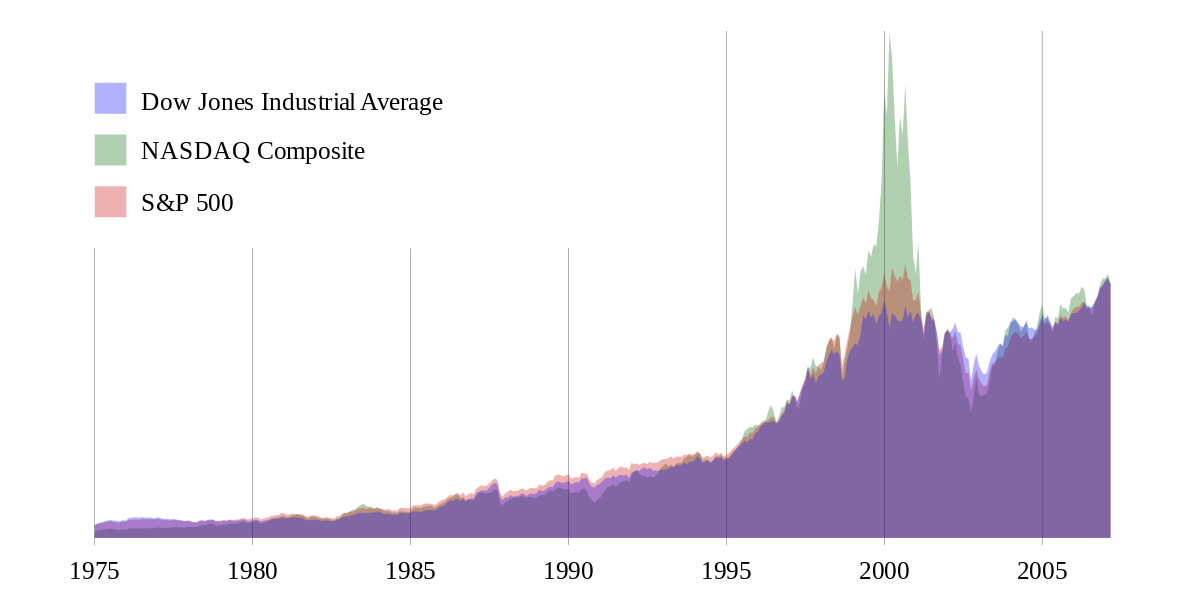

Invesco QQQ Trust (QQQ): This ETF tracks the Nasdaq-100 Index, which includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market

Invesco QQQ Trust (QQQ) is a top ETF choice for investors seeking exposure to the leading edge of innovation and technology in 2023. Tracking the Nasdaq-100 Index, QQQ offers a diverse portfolio containing 100 of the largest domestic and global non-financial companies listed on the Nasdaq Stock Market. This ETF focuses on high-growth industries, such as technology, healthcare, and consumer services, making it a great option for investors looking to capitalize on the rapid advancements in these sectors. With its solid track record, low expense ratio, and exceptional performance, Invesco QQQ Trust is an ideal investment for those seeking long-term growth and a competitive edge in the evolving market landscape.

It provides exposure to major technology and innovative companies, which are expected to continue growing in the future.

The Invesco QQQ ETF (NASDAQ: QQQ) is a top choice for investors seeking exposure to major technology and innovative companies poised for sustained growth in 2023 and beyond. This exchange-traded fund (ETF) tracks the Nasdaq-100 Index, comprising industry giants such as Apple, Microsoft, and Amazon, as well as emerging leaders in areas like artificial intelligence, cloud computing, and cybersecurity. With its diversified portfolio and strong performance history, QQQ offers an attractive opportunity to capitalize on the increasing reliance on technology in various sectors of the economy. By investing in this ETF, you can harness the potential of cutting-edge industries and position your portfolio for long-term success.

Vanguard Total Stock Market ETF (VTI): This ETF seeks to track the performance of the CRSP US Total Market Index, which represents nearly 100% of the U.S

The Vanguard Total Stock Market ETF (VTI) is an exceptional choice for investors seeking diversified exposure to the U.S. stock market in 2023. As a low-cost, tax-efficient fund, VTI tracks the CRSP US Total Market Index, offering investors access to a broad range of companies across various sectors and market capitalizations. By investing in almost the entire U.S. equity market, VTI provides a comprehensive, balanced portfolio that minimizes risk while maximizing potential returns. With its proven record of strong performance and a minimal expense ratio of just 0.03%, VTI remains a top choice for investors looking to build a solid foundation for their investment portfolios.

invest

In 2023, savvy investors are seeking the best ETFs to buy, aiming to maximize returns and diversify their portfolios. Exchange-traded funds (ETFs) have gained immense popularity due to their low costs, tax efficiency, and ease of trading. To identify the top performers, it’s crucial to consider factors such as historical returns, expense ratios, and portfolio composition. Keep an eye on ETFs focusing on innovative sectors like clean energy, artificial intelligence, and biotechnology, as well as those providing exposure to traditional industries and emerging markets. By carefully researching and selecting the best ETFs, investors can create a well-rounded, future-proof investment strategy.