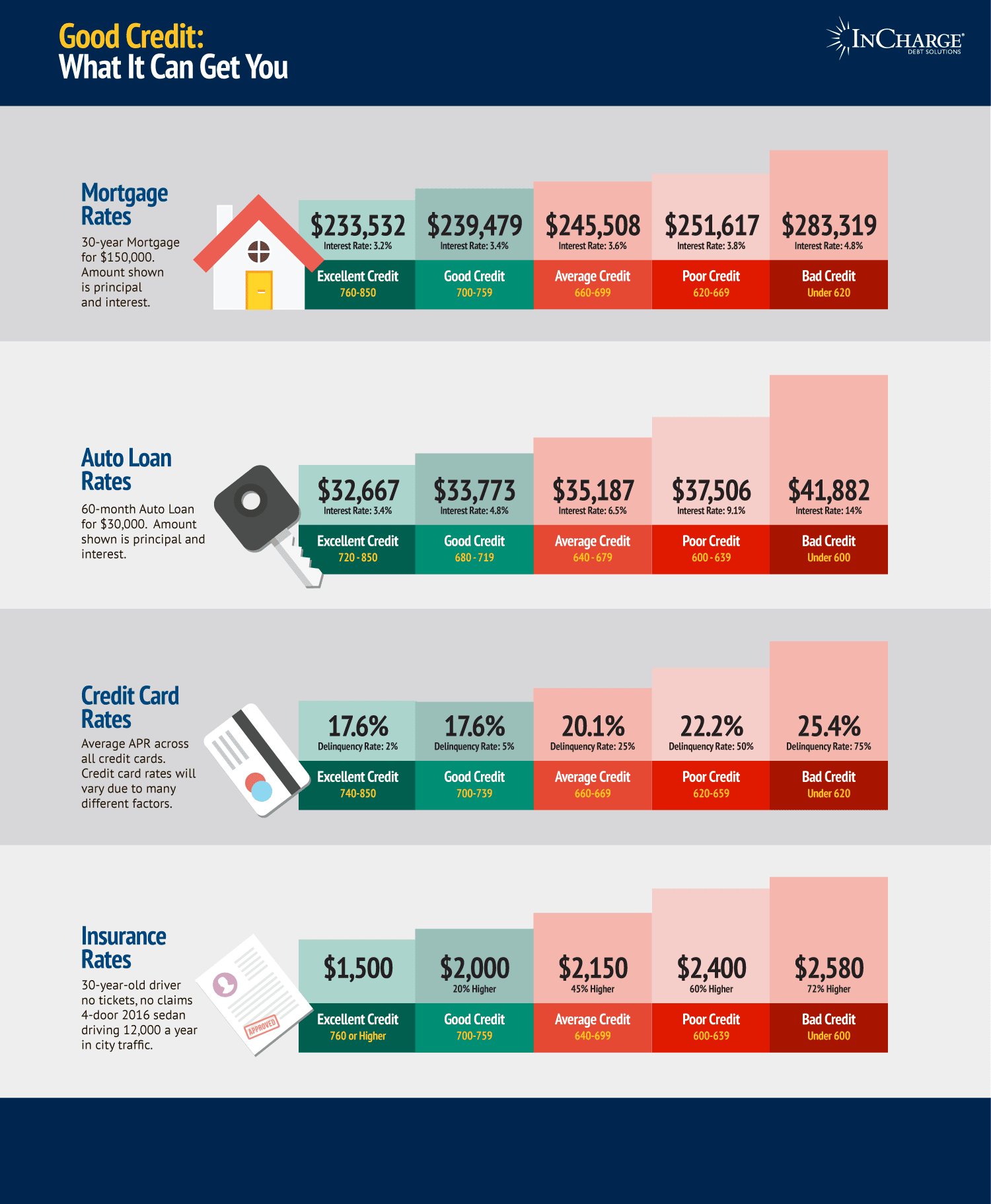

If you’re an 18 year old student looking to improve your credit score and get better loan rates, you’ve come to the right place. In this article, I’m going to provide some tips and tricks on how to increase your credit score and get loan rates that are more favorable. I’ll cover the importance of understanding your credit score, how to create and maintain a budget, and how to use credit cards and loans to your advantage. By the end of this article, you’ll have the confidence and knowledge to make smart financial decisions and start improving your credit score today!

Monitor credit reports regularly.

I’m 18 and I’m starting to think about my credit score and how I can make it better. I know that monitoring my credit report regularly is one of the best ways to keep track of my credit score and make sure I’m getting the best loan rates. Checking my credit report every month helps me spot any errors or suspicious activity quickly, so I can correct them to ensure my credit score stays in tip-top shape.

Pay bills on time.

Paying your bills on time is the most important factor when it comes to improving your credit score. Making sure to pay all your bills, from your credit cards to phone bills, by their due date is crucial to maintain a good credit score. Setting up auto payments can help you stay on top of things and never miss a payment.

Reduce debt load.

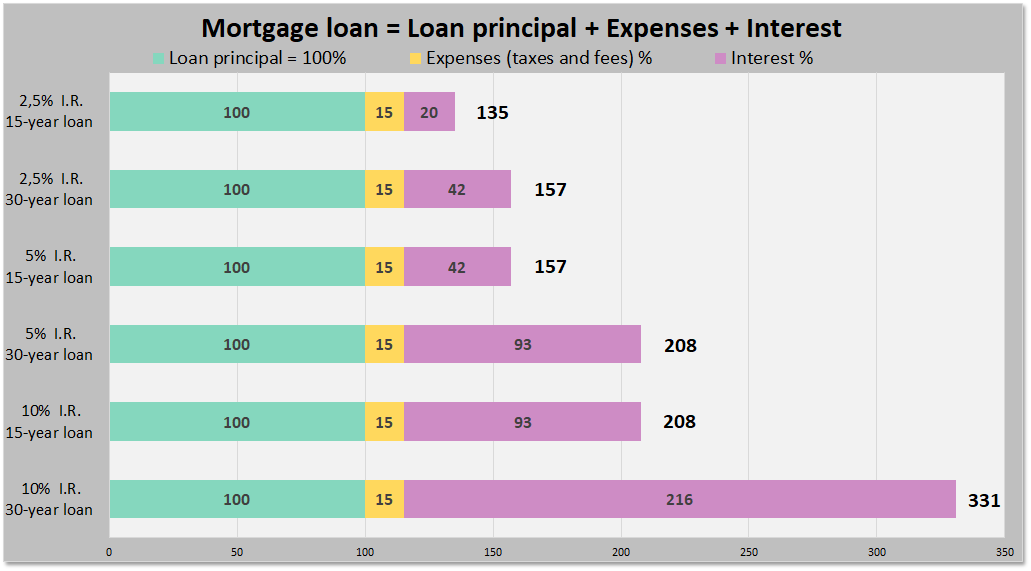

If you want to improve your credit score and get better loan rates, reducing your debt load is essential. To do this, try to pay off the highest interest accounts first, such as credit cards. You can also look into consolidating your debt into one loan with a lower interest rate. This will help you manage your debt payments better and help you improve your credit score over time.

Dispute erroneous items.

If you want to improve your credit score and get better loan rates, it’s important to dispute any erroneous items on your credit report. It’s easy to do, but it takes patience. To start, you’ll need to get a copy of your credit report and look for any errors. If you find any, dispute them with the credit bureaus. They’ll investigate and correct the errors, which can help your credit score and get you better loan rates.

Utilize credit cards responsibly.

Using a credit card responsibly is key to improving my credit score. I’m 18, so it’s important for me to learn how to use them right. I make sure I never miss a payment, pay my balance on time, and keep my credit utilization low. That way, I can get access to better loan rates and build a strong credit history.

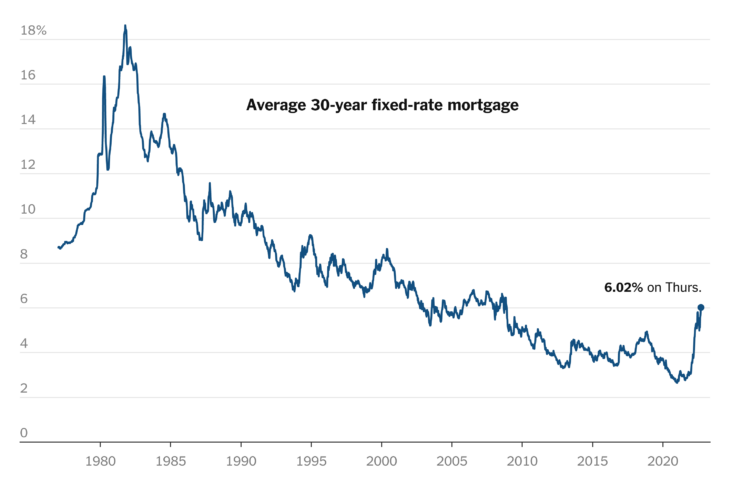

Shop around for loans.

Shopping around for loans is key when it comes to improving your credit score and getting better loan rates. As an 18 year old student, I understand the importance of getting the best rate possible. I’m sure there are plenty of loan options out there, so don’t just settle for the first one you find. Do your research, compare loan rates and make sure you’re getting the best deal possible.