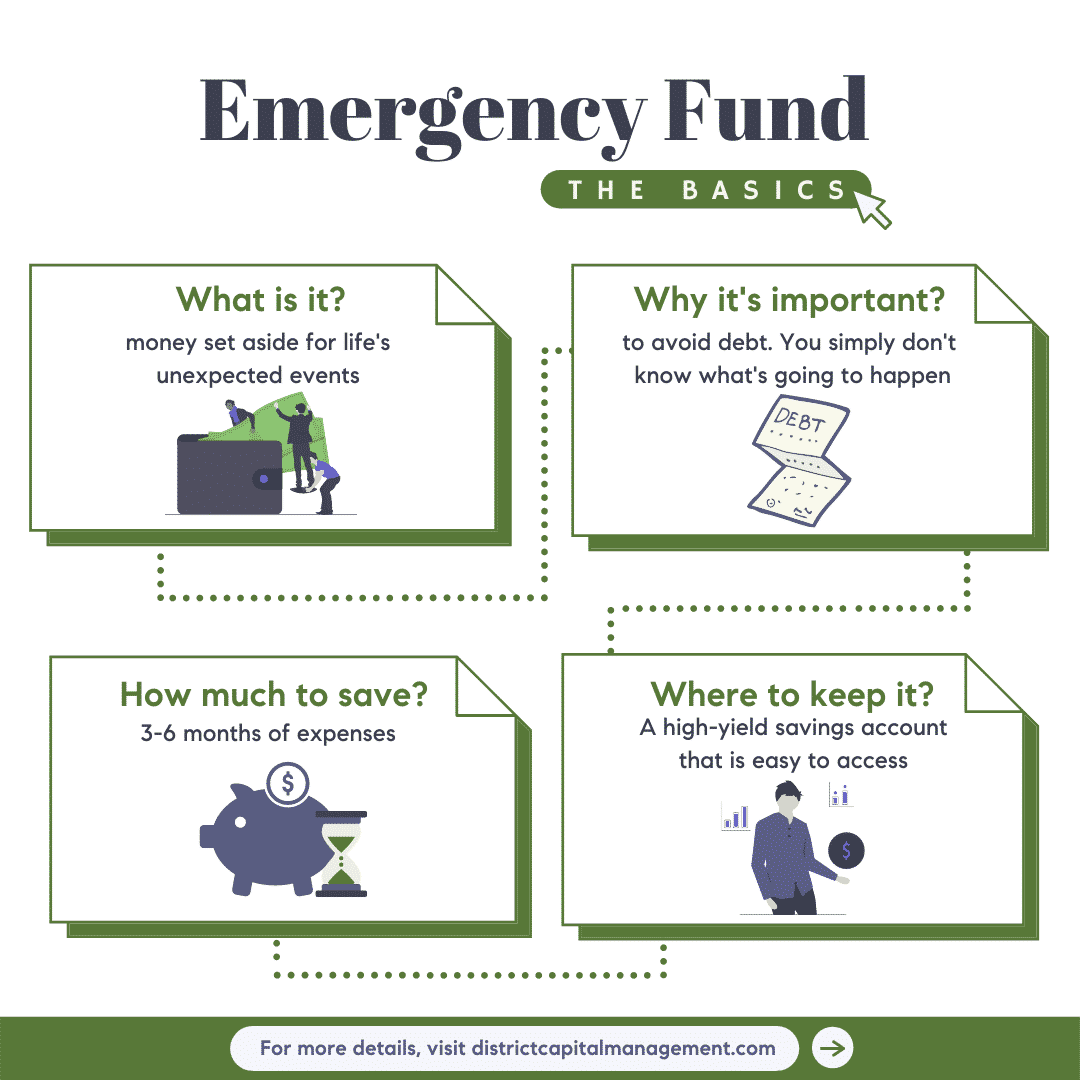

Having an emergency fund in your back pocket is essential for anyone, but especially for college students who are just starting out in life. It can be hard to save up for those unexpected expenses, especially when you have to budget for tuition, books, and other necessities. However, having an emergency fund is an incredibly important part of financial stability and can be the difference between getting through a financial crisis and getting into a deep hole of debt. In this article, I will go through some tips on how to build an emergency fund for unexpected expenses so you can stay afloat no matter what life throws your way.

Create budget plan.

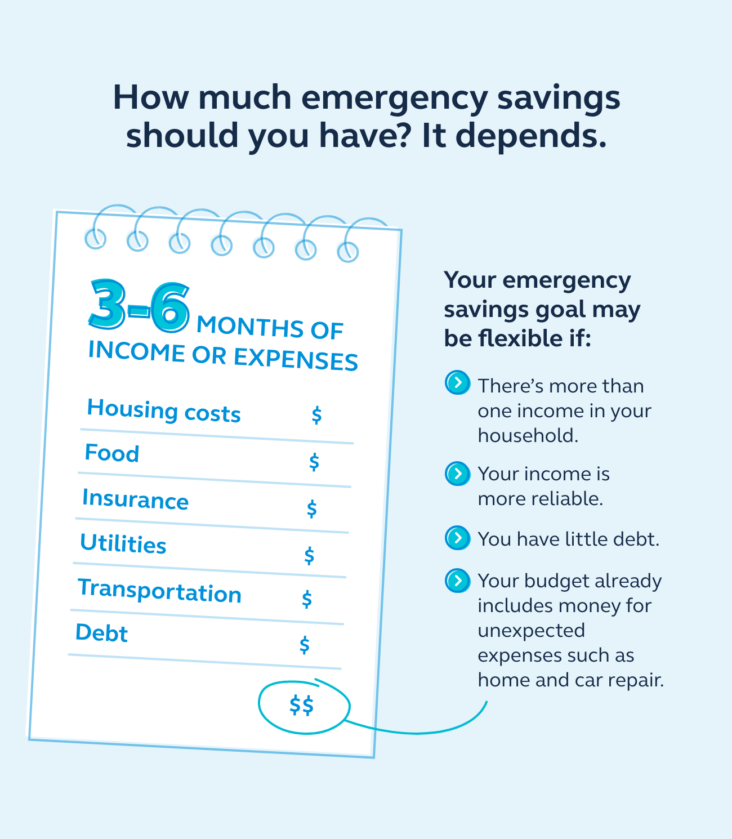

As a student, it’s important to create a budget plan to help you save money and create an emergency fund for unexpected expenses. Start by setting a goal on how much you want to save each month and plan how you want to reach that goal. Make sure to include bills, rent, food, and anything else you need to pay for in your budget. Once you have a plan, stick to it and watch your emergency fund grow!

Set aside extra income.

If you’re a student like me, you probably don’t have a lot of extra money lying around, but that doesn’t mean you can’t start building an emergency fund. With a little bit of effort, you can start setting aside extra money each month. You can start by cutting back on unnecessary expenses or picking up a side hustle to make some extra money. It’s all up to you how much you want to save, but the important thing is to start right away.

Automate savings transfers.

Automating savings transfers is probably the easiest way to build an emergency fund. I set up an automatic transfer from my checking account to my savings account each month. It’s really convenient and it helps me save without having to think about it. Plus, I know that I’m always prepared for unexpected expenses.We recommend buying your favorite toothbrush at super low prices with free shipping, and you can also pick up your order at the store on the same day.

Cut down unnecessary expenses.

It’s important to cut down on unnecessary expenses when building an emergency fund. As a student, I’m always looking for ways to save, whether that’s eating out less, or canceling services I’m not using. It’s tough to make sacrifices, but it’ll be worth it in the long run and help you reach your financial goals faster.

Monitor fund growth.

Monitoring my emergency fund growth is super important! I always make sure to check in and make sure I’m on track to hit my goals. I use budgeting apps to help me keep an eye on my progress and make sure I’m sticking to my plan. I’m also mindful of how I’m spending my money and adjust accordingly so I stay on track.

Use for unexpected expenses.

Unexpected expenses can come in all shapes and sizes, from medical bills, to a broken down car, to a sudden job loss. Having an emergency fund set aside can be a lifesaver in these situations, allowing you to cover the costs without breaking the bank. Not only will it give you peace of mind, but it can also save you a lot of stress in the long run.