Auditing is an essential process for any business or organization. It is a process of evaluating and assessing the accuracy and reliability of financial records and transactions. Auditing is a critical step in the financial management of a business, as it helps to ensure that all financial transactions are recorded accurately, and that all financial regulations are being met. An audit also helps to detect any potential fraud or misappropriation of funds. By conducting a thorough audit, businesses are able to protect their assets and ensure the accuracy of their financial statements.

Definition of an Audit: What It Is and What It Entails

An audit is basically a deep dive into your financials. It’s a look at your books, your records, and your financial statements to make sure everything is accurate and up-to-date. It’s an important part of running a successful business, and it’s a great way to make sure you’re staying on track and are compliant with any government regulations. An audit typically includes a review of your financials, as well as any internal controls you have in place. It also involves identifying any risks or weaknesses you may have in your system, and assessing how well you are managing those risks. The audit report is then used to give you a better understanding of your financial health and to help you make informed decisions about your business.

Benefits of an Audit: Why Businesses Should Conduct Them

Having an audit done for your business is a great way to make sure that everything is running smoothly and that everything is in order. Audits are important for any business, big or small, because they provide an independent review of your financial processes, systems, and records. An audit can help identify any weak spots in your financial operations and can help you take corrective action. The benefits of an audit don’t stop there. Audits can also provide a valuable source of feedback for management, help to ensure that your financial statements are accurate, and can help you comply with applicable laws and regulations. Plus, they can also help you gain a better understanding of your company’s financial position. With all of these potential benefits, it’s clear that conducting an audit is an important part of any business’ operations.

Types of Audits: Overview of Different Types of Audits

Audits are an important part of our financial landscape and understanding the different types of audits can help you navigate the world of finances and compliance. There are several types of audits, each with their own purpose and focus. These include financial audits, operational audits, compliance audits, information systems audits, internal audits, and forensic audits. Financial audits are used to evaluate the accuracy of financial statements and financial transactions. Operational audits are used to evaluate the effectiveness and efficiency of operations. Compliance audits are used to ensure that an organization is complying with laws, regulations, and policies. Information systems audits are used to evaluate the security and accuracy of information systems. Internal audits are used to evaluate the effectiveness of management processes. Forensic audits are used to uncover fraud, errors, or illegal activities. No matter the type of audit, they all serve the same purpose of providing assurance that an organization is meeting its goals and objectives.

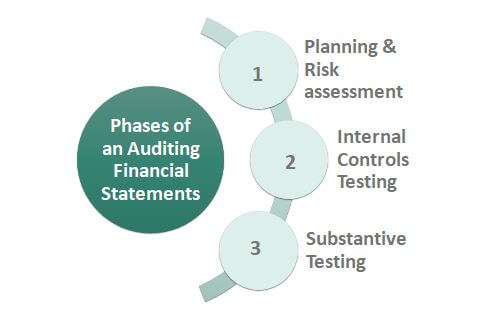

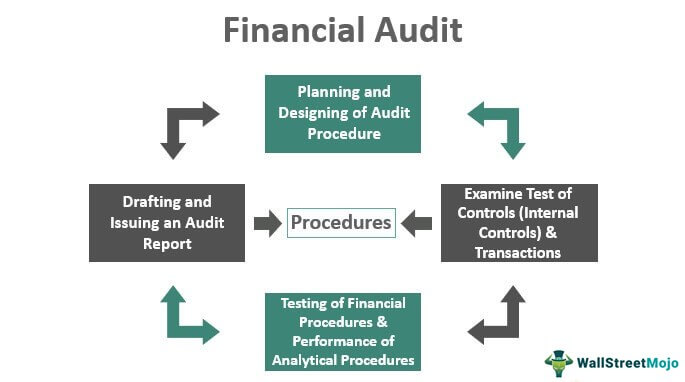

Steps Involved in an Audit: Understanding the Process

Auditing can seem like a daunting and overwhelming process, but it doesn’t have to be! Understanding the steps involved can help make it easier and more efficient. An audit typically consists of four steps: planning and understanding the process, testing and evaluating the process, reporting the findings, and then follow-up management. Planning the audit includes determining its scope, the criteria for evaluating the process, the resources needed, and the timeline for the audit. Understanding the process involves researching the company’s financials and operations to gain an understanding of the environment and the internal control structure. Next, the auditor tests and evaluates the process by identifying and assessing risk and performing tests to ensure accuracy. Finally, the auditor reports the audit findings and recommendations to management. This report should include both the findings and any recommended changes or improvements. Follow-up management is then required to ensure that the recommended changes have been implemented. Auditing can be a complex process, but understanding the steps involved will make it easier and more efficient. By following the four steps mentioned above, an auditor can ensure that the audit is completed in a timely and accurate manner.

Avoiding Plagiarism in Audits: How to Ensure Quality Assessment

When it comes to audit financials, it’s important to make sure that your assessment is of the highest quality possible. One way to ensure this is to avoid plagiarism when conducting an audit. Plagiarism is when someone takes someone else’s work, such as a report or a presentation, and uses it as their own. This can be damaging to both you and the company you are auditing. To avoid plagiarism, make sure that all information you use is properly cited and referenced. Additionally, make sure to use your own words to explain the audit process and the results. By following these steps, you can ensure that your audit is of the highest quality and that you have avoided any plagiarism.