Are you looking to understand the financial concept of At The Money? Many investors, novice and experienced alike, are unaware of the meaning and implications of At The Money investments. This article will discuss the definition of At The Money, and how this term is used in the financial world. We’ll also look at the risks and rewards associated with investing At The Money, as well as strategies for maximizing profits and minimizing losses. By the end of this article, you’ll have a thorough understanding of what At The Money means, and how to make the most of your investments.

What is At The Money in Financial Terms?

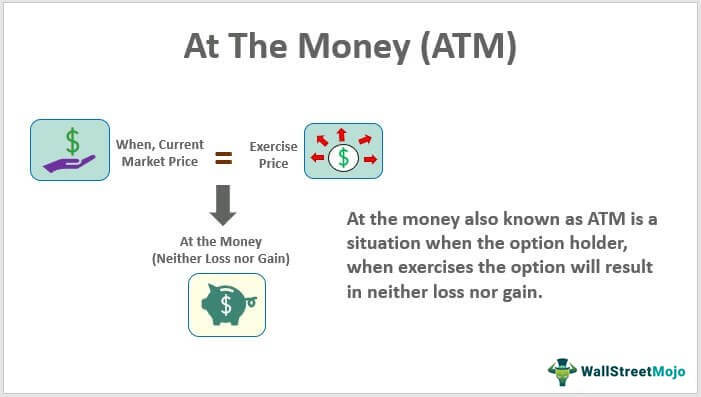

At the money is an investment term used to describe a situation where an option’s strike price is exactly the same as the underlying security’s market price. This means that if the option were exercised, the investor would receive no profit. This is in contrast to an in-the-money option, where the strike price is lower than the underlying security’s market price, meaning the investor would receive a profit if the option were exercised. Similarly, an out-of-the-money option has a strike price higher than the underlying security’s market price, meaning the investor would receive no profit and just get the option’s premium if the option were exercised. At the money options have time value built into their premiums, since there is still a chance that the underlying security’s price could move in favor of the option holder. This means that at the money options can still be profitable, and investors often use them as a hedge against their existing positions in the underlying security. As such, at the money options are incredibly popular among traders, particularly those looking to protect their gains or limit their losses.

The Benefits of Understanding At The Money Concepts

At the money is an incredibly useful concept for anyone interested in trading stocks, futures, options, and more. Not only does understanding at the money give you a better understanding of the markets, but it can also help you make smarter trading decisions and better manage your risk. With at the money, you can determine the likelihood of a stock moving in a certain direction, so you can make informed and profitable trades. Additionally, by understanding at the money, you can avoid being stuck in a bad position and help protect your capital. Knowing when and how to use at the money strategies can help you maximize your profits and minimize your risk.

How At The Money Impacts Your Financial Goals

When it comes to financial goals, being at the money can be a real game changer. At the money means that the option’s strike price and underlying asset’s price are the same. For example, if an option has a strike price of $50 and the underlying asset’s price is also $50, it is considered at the money. Being at the money can have a significant impact on your financial goals because it gives you the opportunity to take advantage of the current market conditions without having to make a large upfront investment. By being at the money, you can still make a profit, even if the underlying asset’s price doesn’t move as expected. Plus, you won’t have to worry about taking on too much risk if the underlying asset’s price moves in the opposite direction.

Analyzing At The Money Strategies for Investing

Investing in “At The Money” strategies can be a great way to maximize your returns and minimize your risk, while still achieving your long-term financial goals. At The Money strategies involve buying or selling an asset at its current price, which is usually close to the price it has been trading at in the past. This means that you can take advantage of the current market conditions without putting yourself at too much risk. With the right strategy, you can time your purchases and sales to get the most out of your investments. Additionally, you can use At The Money strategies to diversify your portfolio and reduce your exposure to any single asset. Investing in At The Money strategies can help you reach your financial goals while protecting you from the volatility of the market.

Tips for Avoiding Plagiarism When Learning About At The Money

When it comes to learning about At The Money, avoiding plagiarism is key. The best way to do this is to make sure you understand the material before you start writing about it. Do your research and take notes of what you learn. Read multiple sources and make sure you have a good understanding of the topic. Once you have done your research, start writing about the topic in your own words. Use your own voice and be sure to cite any sources you use. This will help ensure that you are not plagiarizing and will help you develop your own unique style.