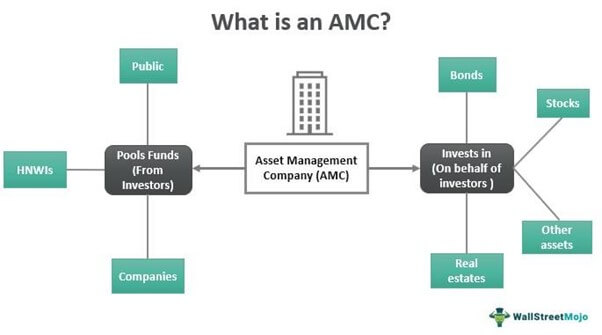

Asset Management Companies (AMC) provide a service that is essential in the world of finance. They are responsible for the management of a wide range of investments, including stocks, bonds, mutual funds and other financial instruments. An AMC has the specialized knowledge and expertise to help investors manage their portfolios in an efficient, cost-effective manner. Their main goal is to maximize investment returns while minimizing risk. Through proper asset management, investors can benefit from the long-term growth potential of their investments, while still protecting their capital.

What Is an Asset Management Company (AMC)?

An Asset Management Company (AMC) is a company that specializes in investing and managing the portfolios of individuals and institutions. They provide professional advice and services to help clients meet their financial goals. An AMC provides a variety of services including portfolio management, financial planning, and retirement planning. They also provide research and analysis to help clients make informed investment decisions. An AMC works with clients to create an individualized investment plan tailored to their financial objectives. They also provide advice and guidance on how to best use their investments to reach their goals. An AMC is a great option for those looking for professional advice and assistance in their investing needs.

What Services Does an AMC Provide?

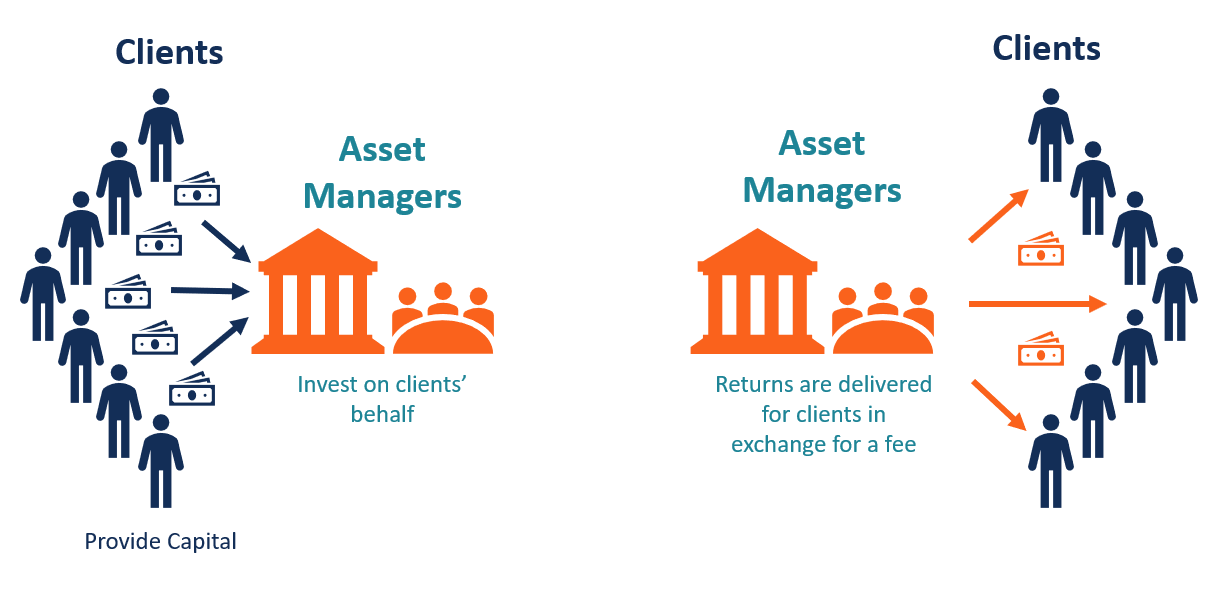

An Asset Management Company (AMC) is a professional organization that provides a variety of services to help individuals and companies manage their investments and assets. These services include portfolio management, research into investment options, risk management, financial planning, and more. AMCs provide a range of services for individuals, businesses, and financial institutions. They work to identify potential investments and manage an individual or company’s portfolio. They can help create investment plans tailored to specific needs, provide analysis of the current market, and suggest strategies to maximize returns. They also provide advice on tax and estate planning and monitor performance to ensure that investors meet their goals. An AMC can help manage the risks associated with investing and provide the expertise necessary to make informed decisions.

What Benefits Does Having an AMC Offer?

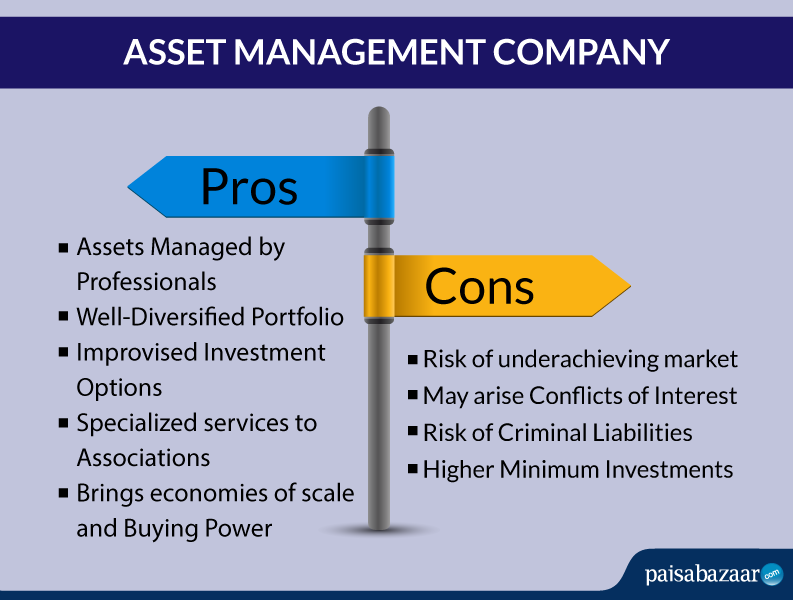

Having an AMC can be incredibly beneficial to both individuals and businesses. An AMC offers a variety of services, such as portfolio and risk management, investment advice, and financial planning. With an AMC, you’ll have access to experienced and knowledgeable professionals who can give you sound financial advice and manage your investments in the best possible way. Additionally, an AMC can provide you with a more diversified portfolio that is tailored to your individual needs. Furthermore, an AMC can provide you with access to a variety of investment options and products, giving you more flexibility and options in your investments. With an AMC, you can be sure that your investments are managed safely and efficiently, allowing you to enjoy greater peace of mind.

How to Choose the Right AMC for Your Needs

Finding the right Asset Management Company (AMC) for your needs can be tricky. With so many different AMCs in the market, it can be hard to decide which one is right for you. You need to consider factors such as the fees, investment strategies, and the track record of the AMC in order to make a well-informed decision. Doing your research and reading reviews can help you narrow down your options. Additionally, you should make sure that the AMC you choose is regulated and compliant with local regulations. Finally, make sure to ask questions and understand the AMC’s services before signing up. Taking the time to research your options can help you find the best AMC for your financial goals.

What Are the Risks of Investing Through an AMC?

Investing through an Asset Management Company (AMC) can be a great way to diversify your portfolio and spread your risk. However, there are some risks associated with this type of investment. One of the most common risks is the potential for conflicts of interest. AMCs may be pressured to invest in companies or products that may not be in the best interest of the investor. Additionally, AMCs may have access to certain funds or products that are not available to the general public, which can result in higher fees and reduced returns. Lastly, some AMCs may have limited funds available to investors, leaving them unable to take advantage of potential opportunities. It is important to do your research and understand the risks associated with an AMC before investing.