Asset/Liability Management is a critical financial tool used by organizations and individuals to ensure that their investments and liabilities are managed in a way that maximizes the return on investment while minimizing risk. Asset/Liability Management is a strategic process that allows organizations to evaluate the risks associated with various investments and liabilities, account for their short and long-term effects, and make adjustments to keep their finances in order. By implementing an effective asset/liability management strategy, organizations can ensure that their finances are managed in a way that maximizes their success.

What Asset/Liability Management Entails

Asset/Liability Management (ALM) is a strategy that helps financial institutions balance their assets and liabilities. This strategy is used to manage risk, optimize returns, and ensure liquidity. It includes monitoring, analyzing, and adjusting the balance of assets and liabilities depending on market conditions, the institution’s goals, and other factors. ALM also involves forecasting and stress-testing to identify potential risks and plan for future scenarios. ALM helps organizations achieve their financial objectives by ensuring a healthy balance between assets and liabilities. It also helps them make informed decisions about their investments, capital structure, and other financial aspects. With ALM, financial institutions can effectively manage the risks associated with their assets and liabilities and make informed decisions about their financial future.

Benefits of Asset/Liability Management

Asset/Liability Management (ALM) is a powerful tool for any business. It helps you manage your assets and liabilities, so that you can maximize your profits. ALM provides a comprehensive framework for monitoring and controlling the composition of your financial portfolio. It allows you to analyze and identify opportunities to optimize your assets and liabilities, as well as take proactive steps to manage risk. ALM can help you make more informed decisions, minimize losses, and increase profits.The benefits of ALM are numerous. It helps businesses optimize their financial portfolios, identify areas for improvement, and reduce their overall financial risk. ALM also helps businesses forecast potential cash flows, plan for liquidity needs, and analyze the effects of potential changes in the market. This helps them to make more informed decisions and increase their profits. ALM also helps businesses manage their liabilities, such as loans and debts, so they can better manage their cash flow and overall financial health. Finally, ALM can help businesses identify and take advantage of opportunities in the market, so they can maximize their profits.

Risks of Asset/Liability Management

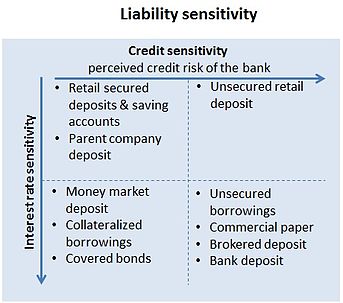

Asset/Liability Management is a core component of financial management. It helps to identify and manage the risks associated with a company’s assets and liabilities. Asset/Liability Management involves analyzing the relationship between assets, liabilities, and company objectives, while also looking at the risks associated with various strategies. By understanding the risks and potential rewards associated with various strategies, a company can make better decisions on how to allocate resources and manage its assets and liabilities. Risks associated with Asset/Liability Management include the risks associated with the ability to meet financial obligations, the risk of default, and the risk of inadequate liquidity. Companies must therefore carefully consider the risks associated with their particular situation and develop appropriate strategies to manage them. Companies should also consider the potential benefits of implementing Asset/Liability Management strategies, such as improved cash flow and better capital structure. By taking the time to analyze their assets and liabilities and develop appropriate strategies for managing them, companies can ensure that their assets and liabilities are managed in an effective and efficient manner.

Steps to Effective Asset/Liability Management

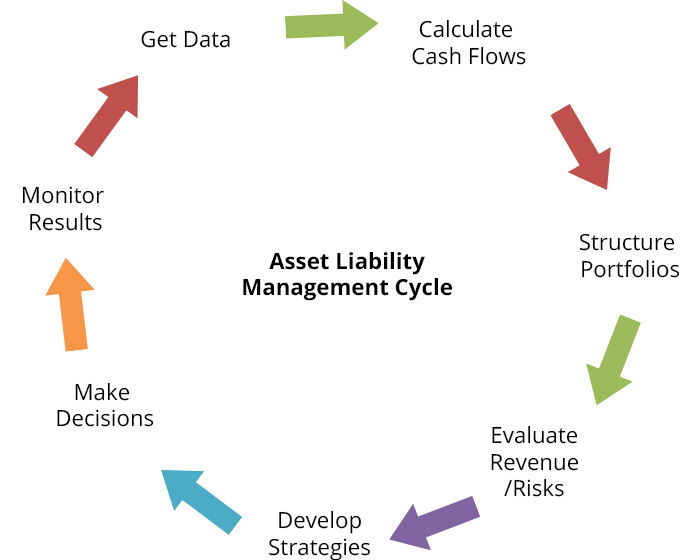

Asset/Liability Management is an important financial strategy that helps businesses to manage their assets and liabilities in order to maximize profits and reduce risk. It involves assessing the risks associated with each asset and liability and making decisions to mitigate those risks while taking advantage of opportunities to increase returns. Effective asset/liability management requires a comprehensive understanding of the business, its financial objectives, and the associated risks. To ensure success, businesses should follow a few steps to effectively manage their assets and liabilities. First, it is important to accurately identify and assess the business’s assets and liabilities. This means understanding the types of assets and liabilities held, their current values, and their expected future values. Businesses should also consider the risks associated with each asset/liability and analyze the potential impacts of any changes on the business’s overall financial health. Second, businesses should create a strategy to effectively manage their assets and liabilities. This includes setting goals, determining the best timing and methods for achieving those goals, and deciding which assets and liabilities should be managed. It is also important to implement controls to monitor the performance of investments and make adjustments as needed. Finally, businesses should regularly review their asset/liability management strategy and make adjustments as

Common Pitfalls of Asset/Liability Management

Asset/Liability Management (ALM) is a process of managing an organization’s assets and liabilities to minimize risks and maximize profits. It can be a tricky thing to master, and it’s important to understand the common pitfalls associated with it. First off, it’s easy to be overly aggressive in your ALM strategy. While it’s important to be strategic and mindful of potential risks, it’s important to remember that too much risk can lead to losses. Another potential pitfall is not having the right team in place to properly implement and manage the strategy. Having a team of knowledgeable, experienced professionals is essential for success. Finally, it’s important to stay on top of changes in the market and adjust your strategy accordingly. Asset/Liability Management is an important tool for any organization, but it’s important to be aware of the common pitfalls and take the necessary steps to avoid them.