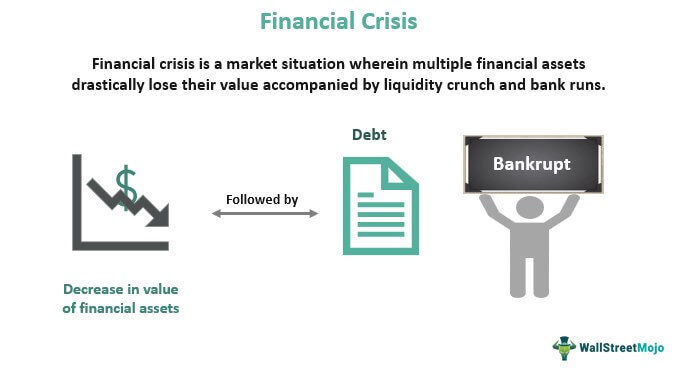

The Asian Financial Crisis of 1997-1998 shook the world’s financial markets and impacted the global economy. It was a period of financial turmoil for many Asian countries, but it also provided lessons about financial management and risk management that are still relevant today. To understand the Asian Financial Crisis, it’s important to understand what it was and what caused it. This article will provide an overview of the Asian Financial Crisis, including its causes and effects, as well as how it can serve as a warning sign for financial markets around the world.

Overview of the Asian Financial Crisis

The Asian Financial Crisis of 1997 is a historic event that had a major impact on many countries in Asia. The crisis was caused by a number of factors, including poor economic policies, high debt levels, and over-reliance on foreign investments. It began in Thailand when the country’s currency, the baht, was devalued. This devaluation caused a rapid outflow of foreign capital from other Asian countries, resulting in a major liquidity crisis. In response, many of these countries were forced to seek assistance from the International Monetary Fund (IMF). The crisis spread quickly and had a devastating effect on many Asian economies, resulting in a significant decrease in GDP and a sharp rise in unemployment. The crisis also highlighted the vulnerability of emerging markets to sudden shifts in global capital flows, and it was a major factor in the development of global financial regulations. Despite the economic hardship, the Asian Financial Crisis ultimately led to many positive economic reforms in the region, and it remains an important part of economic history.

Causes of the Asian Financial Crisis

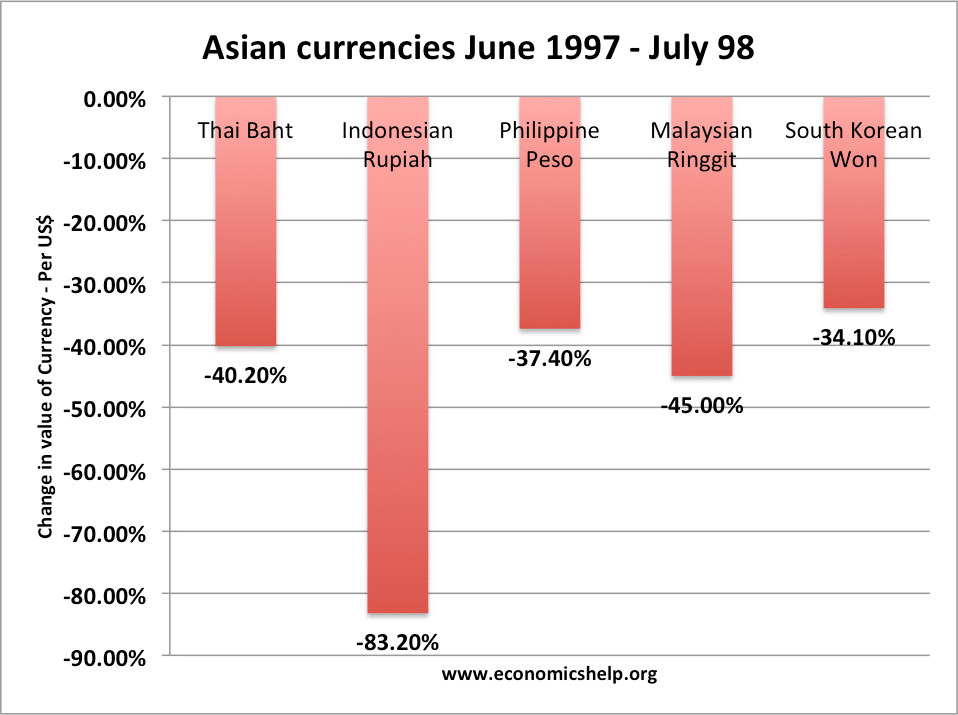

The Asian Financial Crisis of 1997-1998 was an economic disaster caused by a combination of several factors. The crisis began when Thailand’s currency, the baht, was forced to abandon its peg to the US dollar, causing a shockwave of currency devaluations throughout Southeast Asia. The devaluations caused a massive outflow of foreign capital, which in turn caused a sharp decline in domestic demand. This was compounded by the fact that many Asian countries had high levels of debt, which made it difficult for them to respond to the crisis. In addition, many countries had high levels of corruption, which led to a lack of confidence in the government’s ability to handle the situation. The result was a deep recession and a sharp drop in the value of the currencies of many Asian countries, leading to a crisis that lasted for several years.

Impact of the Asian Financial Crisis

The Asian Financial Crisis of 1997 had a devastating impact on the economies of East and Southeast Asia. The crisis had its roots in the mismanagement of financial policies and excessive borrowing by countries in the region. The crisis was exacerbated by the devaluation of the Thai baht, which led to a domino effect across the region. The crisis led to a sharp increase in unemployment, poverty and inequality, and an overall decline in economic growth. It also led to a sharp drop in the value of Asian currencies, leading to a decrease in the purchasing power of consumers. The Asian Financial Crisis had a major impact on the global economy, with many countries in the region suffering from severe economic and financial turmoil. The crisis also led to a decrease in investment in the region, leading to a decrease in economic activity and a decrease in foreign direct investment. The Asian Financial Crisis is a reminder of the importance of sound economic policies and prudent borrowing practices.

Strategies for Avoiding a Financial Crisis

If you want to avoid a financial crisis, it’s important to have a solid strategy in place. The best strategies involve budgeting, saving, and investing. Budgeting is key to staying on top of your finances and avoiding a financial crisis. Make sure to track your income, spending, and debts. Saving money is also important. Aim to save a percentage of your income each month, and consider setting up an emergency fund in case of unexpected expenses. Finally, investing is a good way to build wealth and avoid a financial crisis. Investing can be intimidating, but even a small amount of money can go far. Research different investment strategies and choose one that works for you and your financial goals.

Lessons Learned from the Asian Financial Crisis

The Asian Financial Crisis of 1997-1998 was an eye-opening experience for many countries in the region, as well as the global economy. The crisis highlighted the importance of careful economic management and the need for responsible lending and borrowing practices. One of the most important lessons learned from this crisis was that governments must ensure the stability of their banking systems by carefully regulating their financial markets and by reducing the level of risk associated with high levels of debt. Additionally, countries must have a sound fiscal policy in place in order to protect their economies from global economic shocks. Furthermore, it is essential that countries maintain a healthy balance of trade and current account deficits, as well as a sufficient level of foreign exchange reserves. Finally, it is important to have a strong and well-functioning capital market in order to facilitate efficient capital flows and the efficient allocation of resources. All of these lessons are important to remember in order to ensure that a similar crisis does not happen again.