Arc elasticity is an important concept for anyone interested in understanding financial markets. Arc elasticity is a measure of the responsiveness of a demand or supply curve to changes in prices. It measures the percentage change in one variable (demand or supply) given a certain percentage change in another variable (price). Arc elasticity helps investors and economists understand the way different markets react to changes in prices, allowing them to make informed decisions about their investments. This article will provide an in-depth look at arc elasticity and its uses in financial markets.

Overview of Arc Elasticity and Its Applications

Arc elasticity measures the responsiveness of a good or service to a change in price. It looks at how much the demand for the good or service changes when the price increases or decreases. This is different from regular elasticity because it takes into account how the demand changes over any given period. It is a useful tool for economists and business owners to understand how price changes will affect their demand. Arc elasticity can be used to measure the price elasticity of demand over a period of time, and to determine the potential impact of a price change on sales and profits. It is also useful in forecasting price changes, and can be used to evaluate the potential effectiveness of a price increase or decrease. Arc elasticity can be applied in a variety of situations, such as determining the optimal pricing strategies for goods and services, and assessing the impacts of promotional activities. By understanding how price changes will affect demand, businesses can make more informed decisions about their pricing strategies.

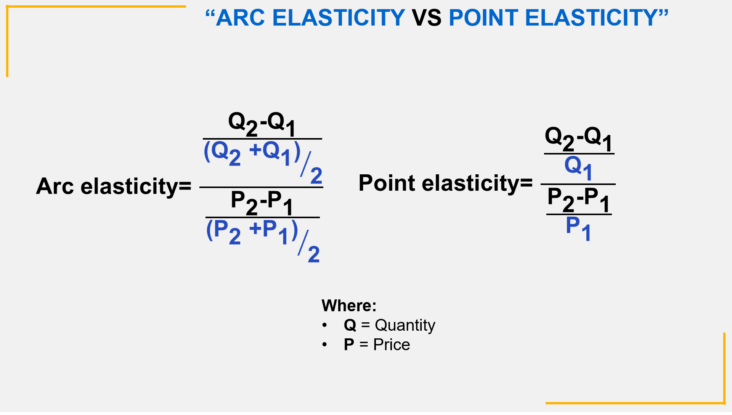

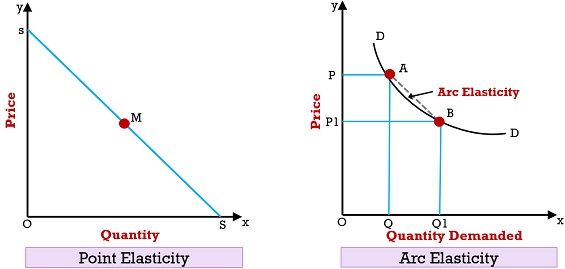

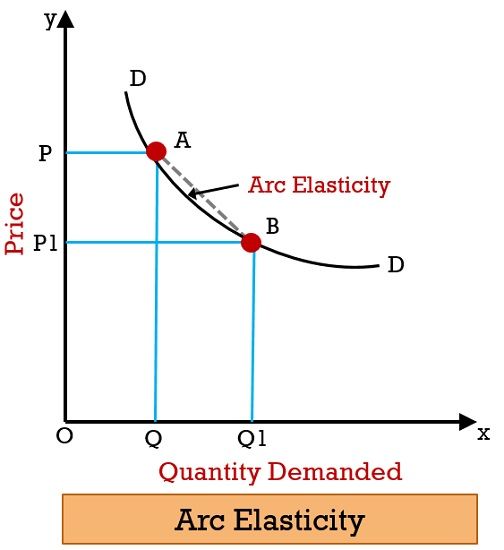

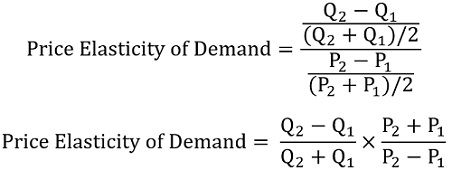

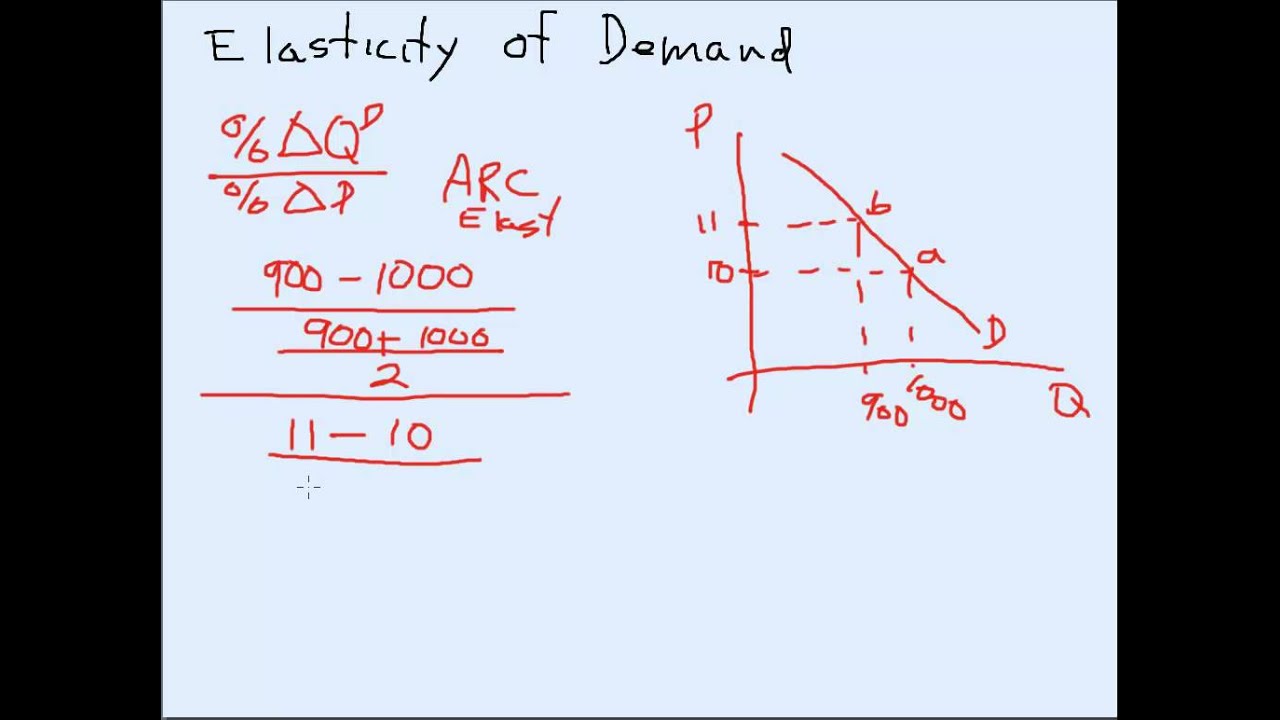

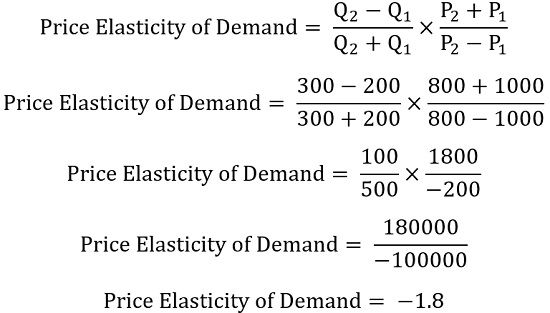

How to Calculate Arc Elasticity

Calculating arc elasticity is an important part of understanding the behavior of markets and their products. Arc elasticity is a measure of the responsiveness of a given quantity of a good or service to changes in price. It is calculated by finding the percentage change in quantity divided by the percentage change in price. The resulting value is the arc elasticity of the given quantity in relation to the given price. To calculate arc elasticity, you need to know the initial quantity and price, as well as the new quantity and price. You then take the percentage change in quantity and divide it by the percentage change in price. The result is the arc elasticity of the given quantity. Arc elasticity is useful in understanding how changes in price affect demand for a given product or service, and can help businesses make better pricing decisions.

Advantages and Disadvantages of Arc Elasticity

Arc elasticity is an important concept in economics and finance because it helps to measure changes in demand for a product or service over time. Arc elasticity is especially useful when studying long-term trends in the market, and can provide valuable insights into how demand for a product or service may change over time. Arc elasticity can be used to compare the demand for a product or service over different time periods, allowing for more accurate predictions about future trends.The main advantage of arc elasticity is that it takes into account changes in the demand for a product or service over time, allowing for more accurate predictions about future trends. Additionally, arc elasticity can be used to compare the demand for a product or service over different time periods, which is useful for making more informed decisions about investments and other financial decisions.The main disadvantage of arc elasticity is that it can be difficult to accurately measure changes in demand when there are numerous factors that can affect the market. Additionally, arc elasticity does not take into account other factors such as supply and demand, which can have a significant impact on the market. As such, arc elasticity should not be used as the sole source of information when making financial decisions.Arc elasticity is an important concept in

Examples of Arc Elasticity in Practice

Arc elasticity is an important concept in economics, finance, and other business-related fields. It measures the responsiveness of a change in one variable to a corresponding change in another variable. The arc elasticity formula takes into account changes in the entire range of the two variables and is used to calculate the average rate of change in the two variables over the range. In practice, arc elasticity is primarily used to measure the responsiveness of demand for a good or service to changes in its price. For example, if the price of a good or service increases by 10% and the quantity demanded decreases by 8%, the arc elasticity of demand would be -0.8. This means that a 10% increase in the price of the good or service caused an 8% decrease in the quantity demanded. Arc elasticity can also be used to measure the responsiveness of a change in one variable to changes in another variable other than price. For example, arc elasticity can be used to measure the responsiveness of demand for a good or service to changes in income, population, or other external factors. Arc elasticity is an important tool for understanding the behavior of consumers, firms, and markets. It is an important factor to consider when making

Strategies for Avoiding Plagiarism when Discussing Arc Elasticity

It’s important to be mindful and avoid plagiarism when discussing arc elasticity. There are a few strategies to keep in mind to make sure you’re not using someone else’s words as your own. First, research the topic thoroughly and get familiar with the material. Then, make sure to cite any sources you use and double check that all quotes are properly attributed. Additionally, try to use your own words instead of directly quoting another source. Finally, if you do use someone else’s words, make sure to include quotation marks and provide the source for the quote. With these strategies in mind, you can avoid plagiarism and discuss arc elasticity with confidence.