Money laundering is a serious global issue that can have devastating impacts on the economy, security and public trust. Anti Money Laundering (AML) is a set of laws, regulations and procedures designed to combat the practice of money laundering. AML is an important tool used by governments, banks, and other financial institutions to identify, monitor, and report suspicious activity, helping to protect the global economy and preserve public trust. This article will discuss what AML is, why it is important, and the key elements of an effective AML compliance program.

What Is Anti Money Laundering (AML) and How Does It Work?

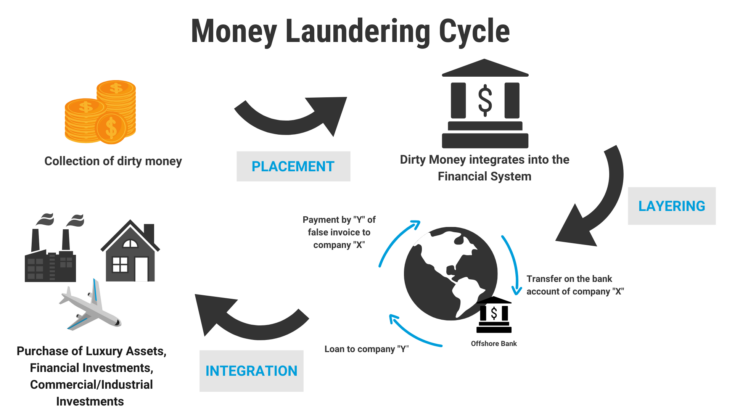

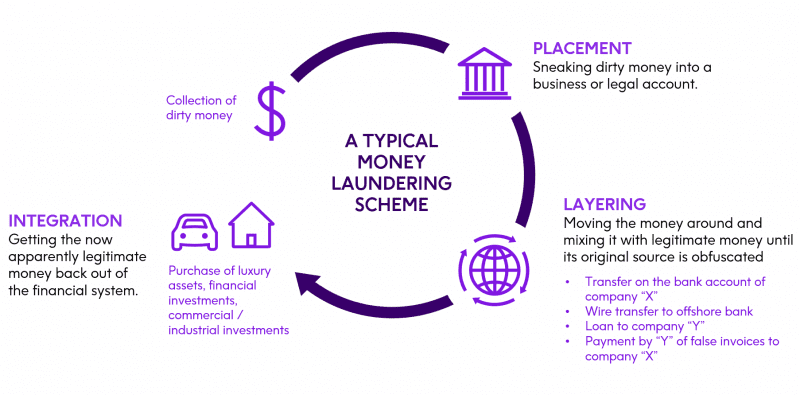

Anti-money laundering (AML) is a set of policies and procedures designed to stop the practice of generating income through illegal activities. It is a key component of any financial institution’s compliance program and is used to identify, prevent and report suspicious activity. In simple terms, AML helps to identify, prevent and report activities that could be related to money laundering, terrorist financing or fraud. It works by requiring banks and other financial institutions to monitor customers’ activities, report suspicious transactions and maintain records of customer information. Banks are also required to verify the identity of customers, report large transactions, and be aware of any unusual activity. AML helps to ensure that the financial system remains safe and secure by ensuring that criminals are not able to use the system for their own benefit. AML is an important part of the global effort to combat money laundering and terrorism financing. By implementing effective AML measures, financial institutions can help to protect their customers and the global economy from potential criminal activities.

The Benefits of Anti Money Laundering (AML)

Anti Money Laundering (AML) is a great way to protect your money and keep it safe from any potential fraudulent activities. AML is a set of laws and regulations that work to prevent money laundering and other financial crimes, such as fraud, terrorist financing and tax evasion. By implementing these regulations, businesses and financial institutions are able to detect and prevent suspicious activity, thereby reducing the risk of money laundering. There are many benefits that come with using AML, especially for businesses and financial institutions. By utilizing AML, businesses and financial institutions can ensure that their customer’s money is safe and secure, which can help to build trust and loyalty. Additionally, AML helps to prevent businesses and financial institutions from being used as a conduit for money laundering, thus reducing the risk of being held liable for any criminal activities. Finally, AML can help to increase transparency and accountability, both of which are key in promoting a positive and responsible financial environment. All in all, Anti Money Laundering (AML) is an important tool in protecting your money and keeping it safe from any potential fraudulent activities.

Common Anti Money Laundering (AML) Techniques

Anti Money Laundering (AML) is an important way to protect the integrity of the global financial system. AML techniques are used to prevent criminals from laundering money through the banking system. Common AML techniques include transaction monitoring, customer due diligence, and risk assessment. Transaction monitoring involves tracking customer transactions and looking for any suspicious activity. Customer due diligence involves verifying the identity of customers and understanding their source of funds. Risk assessment involves analyzing customer data to identify high-risk customers and transactions. AML techniques are essential to maintaining the security of the financial system and ensuring that criminals cannot get away with money laundering.

The Penalties for Violating Anti Money Laundering (AML) Regulations

If you think you can get away with violating Anti Money Laundering (AML) regulations, think again! Not only can you face hefty fines, but you can potentially face criminal charges. Depending on the severity of the violation, you could be subject to prison time and hefty fines. So, if you’re a business or individual who handles or deals in money, it’s important to be aware of and follow all AML regulations. Failing to do so could land you in serious legal trouble.

Tips for Compliance with Anti Money Laundering (AML) Laws

AML laws are an important part of keeping our financial system safe and secure. Compliance with these laws can be tricky, so here are some tips to make sure you’re on the right track. First, make sure you have a comprehensive AML program in place. This should include customer due diligence, risk assessments, transaction monitoring, suspicious activity reporting, and periodic reviews. Second, stay up to date on changes in the law. This includes keeping an eye on new regulations and staying in contact with your regulator. Finally, make sure you have an adequate system of internal controls in place to ensure compliance. This includes regular audits, training, and reporting. With these tips, you can ensure your business is compliant with AML laws and keep your finances safe.