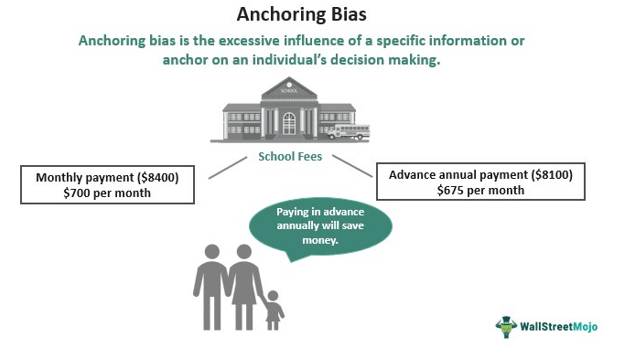

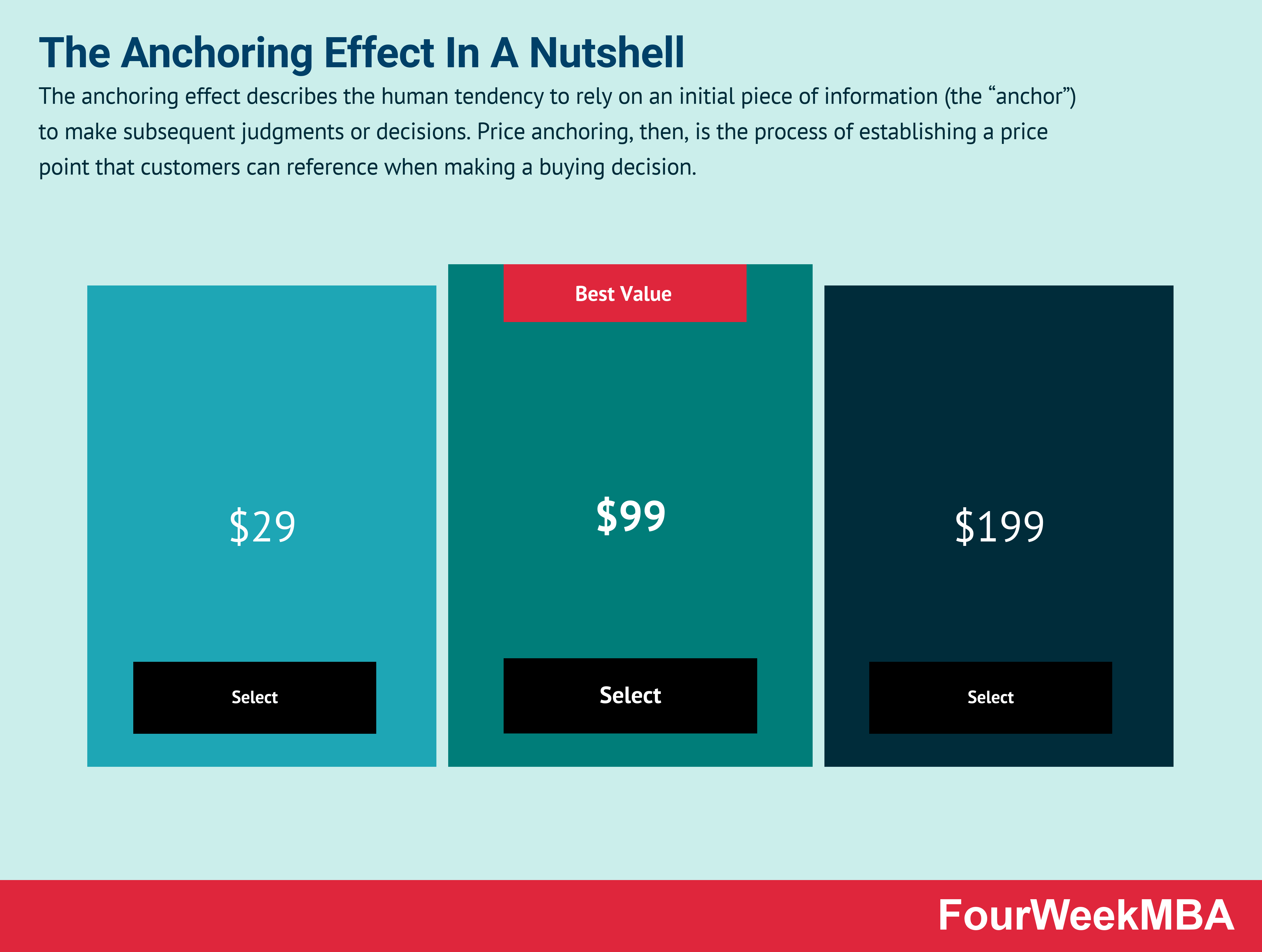

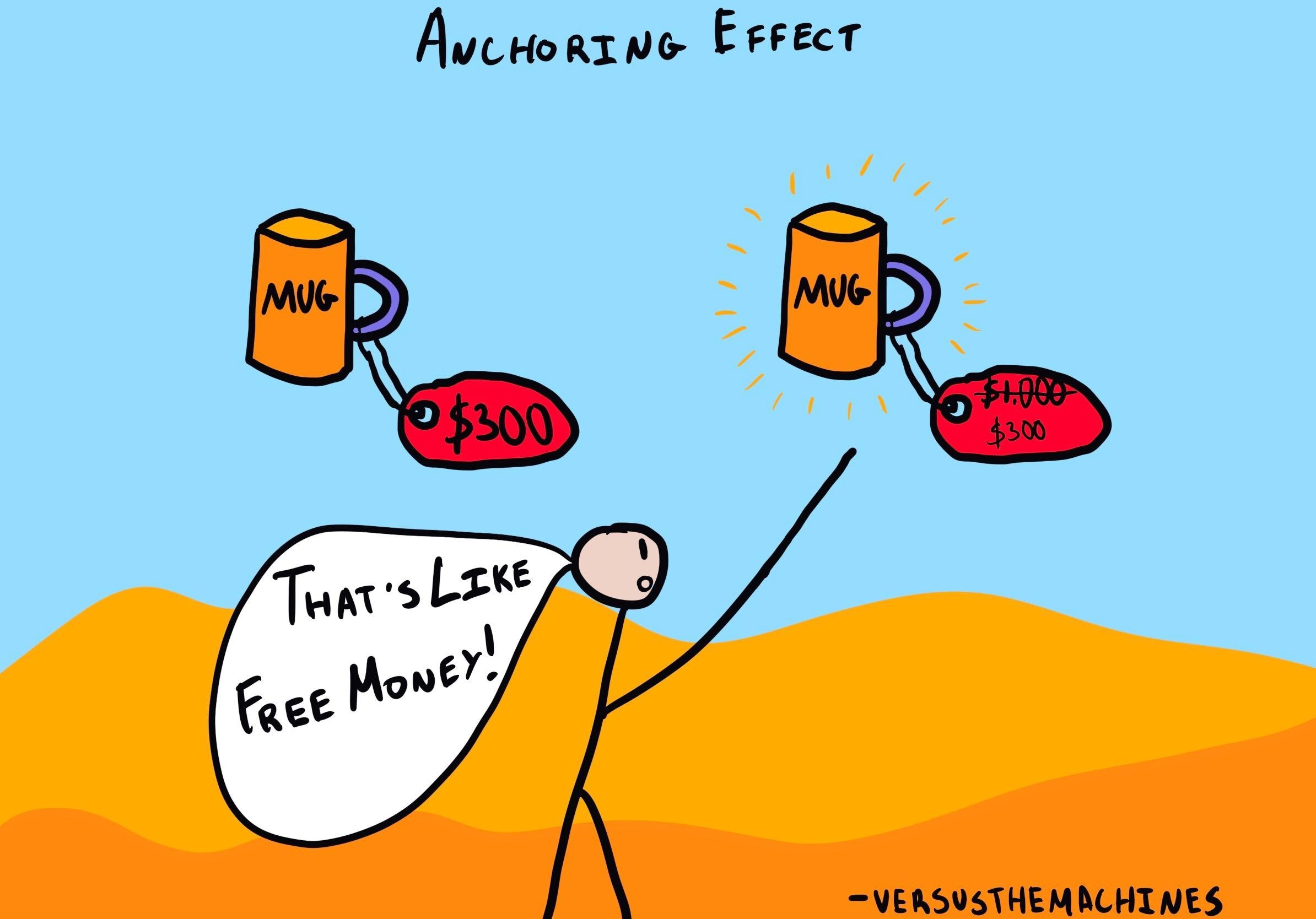

Anchoring is an important concept in finance that has become increasingly relevant in today’s economy. Anchoring is the process of setting a reference point for a transaction, such as a price, rate, or term, that helps guide negotiations and decision-making. By anchoring a price, rate, or term, parties can negotiate a better deal and maximize the value of their transaction. This article will discuss the concept of anchoring, the financial definition of anchoring, and how it can be used to improve financial decision-making.

Definition of Anchoring: What is the Meaning of Anchoring in Finance?

Anchoring is a financial concept that can help you make smart decisions when it comes to investing. It’s based on the idea that when you already have an idea in your head of what something is worth, it can influence the way you view other options. For example, if you know that a stock is worth $50, you may think that anything less than that isn’t a good deal. This is known as anchoring, and it can be a useful tool in helping you make sound financial decisions. Anchoring can be a great way to ensure you’re making the most of your money and not getting caught up in the moment and making decisions that aren’t in your best interest.

How Anchoring Can Impact Your Financial Decisions

Anchoring can be a powerful force when it comes to making financial decisions. It can cause us to make irrational decisions, as we become fixated on a particular number or price. For example, if you are shopping around for a car and you see a car that is much more expensive than it should be, you are likely to anchor on that price and think that all cars are that expensive. This can lead you to paying more for a car than you otherwise would have. To avoid anchoring, try to be mindful of the price you are anchoring on, and make sure you are shopping around for the best deal. Don’t get fixated on one particular price, as that could cost you more money in the long run.

Tips for Avoiding Anchoring and Making Smart Financial Decisions

If you’re trying to make smart financial decisions and avoid anchoring, there are a few tips that can help. First, it’s important to keep your emotions out of the equation. Anchoring can lead to decisions that are based more on feelings than on logic, so make sure to always stay rational. Additionally, it’s important to do your research and stay informed about the market; that way, you can make decisions based on actual facts and data, rather than on a vague feeling of “liking” one option more than another. Finally, it’s a good idea to seek advice from a trusted financial advisor or mentor who can provide a more objective opinion on any decisions you might have to make. With these tips in mind, you can stay on top of your finances and make smart decisions, free from the influence of anchoring.

Anchoring: The Pros and Cons of This Financial Technique

Anchoring can be a great way to keep your finances on track, but it’s important to consider the pros and cons of this financial technique before you decide to use it. On the plus side, anchoring can help you stay disciplined in your spending and saving habits, as it forces you to make decisions based on the amount of money you have set aside. On the other hand, anchoring can cause you to miss out on potential opportunities, as it can inhibit decision making based on the latest market trends. Ultimately, anchoring can be a great tool if used correctly, but you should be sure to weigh the pros and cons before committing to this financial strategy.

How to Use Anchoring in Financial Planning and Investment Strategies

Anchoring is a powerful tool for financial planning and investment strategies. It involves setting a goal and then using that goal to measure and guide your decisions. By anchoring your financial goals, you can make better decisions that are based on your long-term objectives, rather than short-term impulses. Anchoring can help you make sure that you are on track to reach your financial targets, and that you are investing in the right areas to help you reach them. It can also help you identify areas where you may need to make adjustments or changes to your strategies to stay on track. Anchoring can be used in all aspects of financial planning, from budgeting and saving, to investing and retirement. With the right strategy, it can help you stay on top of your finances and ensure that you are investing for the long-term.