Are you interested in learning what an American Option is and how it can impact your financial goals? An American Option is a type of financial instrument that allows the holder to exercise the option at any time before the expiration date. This type of option can be used to hedge against a variety of risks, such as price fluctuations in stocks and commodities, and to take advantage of market opportunities. In this article, we will discuss the definition of an American Option, the advantages and disadvantages of this type of instrument, and the different strategies available to investors when using an American Option.

What Is an American Option?

An American option is a type of financial instrument that gives the holder the right to buy or sell an underlying asset at a predetermined price before the expiration date. This type of option is more flexible than a European option, allowing the investor to exercise their rights at any time up until the expiration date. American options are favored by investors who want to protect against the potential for large losses due to price movements, as they can exercise their option before the expiration date. American options are also beneficial to those who are looking to benefit from short-term price movements, as they can exercise their option before the expiration date and take advantage of any price change. Despite the flexibility of American options, they are more costly than European options due to their ability to be exercised at any time before the expiration date.

Advantages and Disadvantages of American Options

American options offer investors a lot of flexibility and potential for profits. They allow investors to buy, sell, or exercise the options at any time before the expiration date. With American options, investors can take advantage of price movements, which can be beneficial if the market is volatile. The main advantage of American options is the ability to take profits quickly if the stock moves in the desired direction. On the other hand, American options also have some disadvantages. The main disadvantage is the potential for time decay, which may cause the option to become less valuable as the expiration date approaches. Additionally, if the stock does not move in the desired direction, the investor can end up losing money. Despite the potential for losses, American options offer investors the chance to take advantage of price movements and potentially make profits.

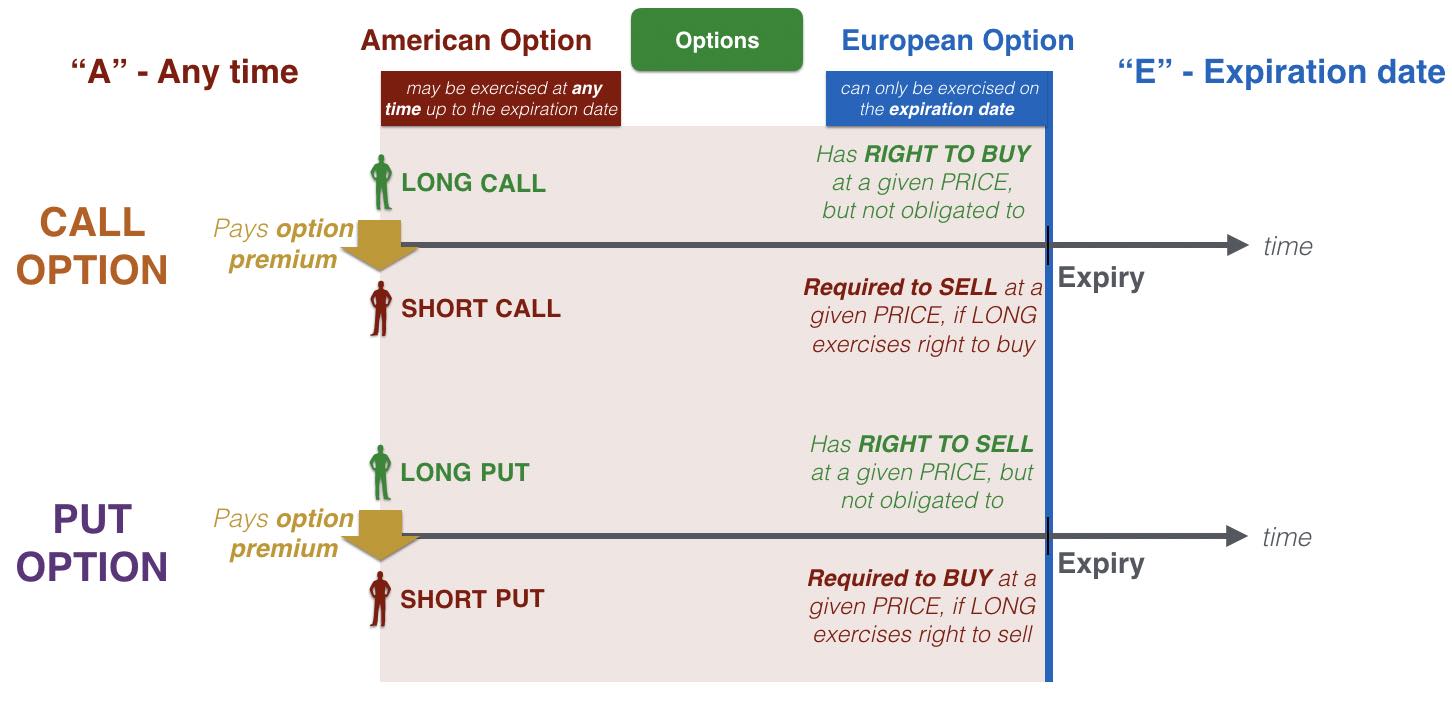

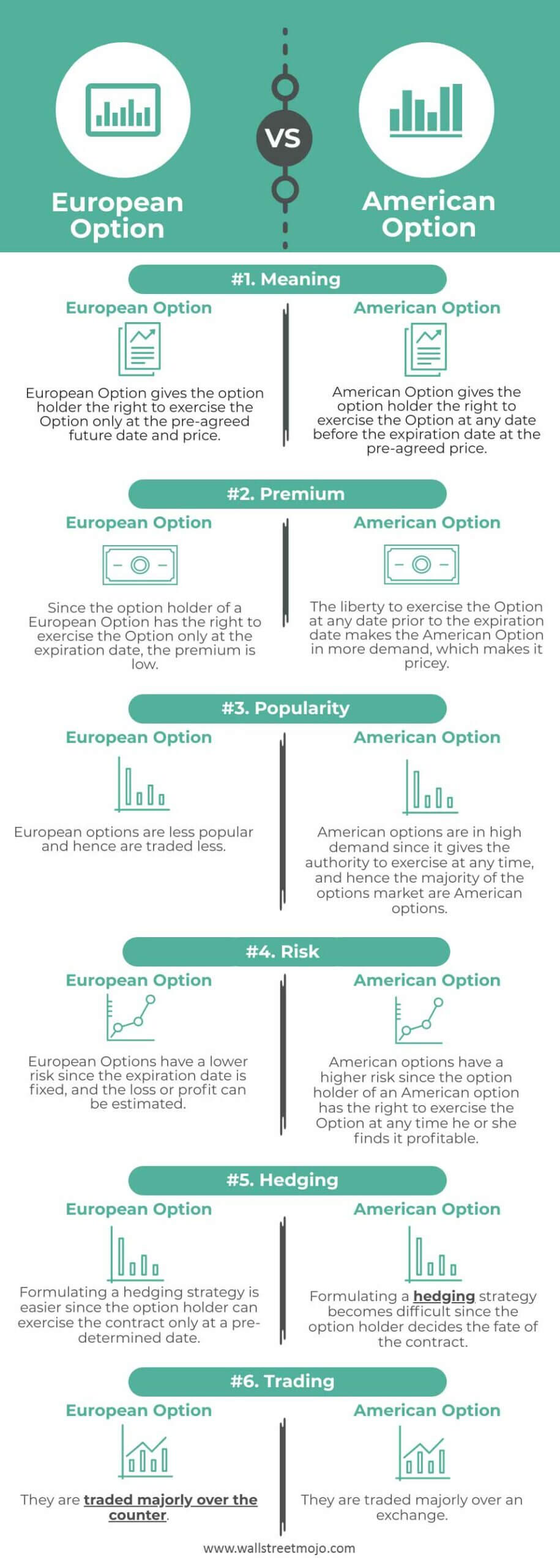

How American Options Differ from European Options

American options differ from European options in a few distinct ways. European options can only be exercised at the expiration date of the option while American options can be exercised at any time up to the expiration date. This means that if the underlying asset reaches a certain price before the expiration date, the American option holder can take advantage of the opportunity and sell or buy the underlying asset at the predetermined price. Additionally, American options offer more flexibility in trading strategies, allowing for greater potential profits and losses. American options are generally more expensive than European options as it provides the holder more opportunity for a profitable trade.

Strategies for Investing with American Options

Investing in American options can be a great way to get the most out of your money. These options offer investors the opportunity to take advantage of both rising and falling prices in the market, giving you more flexibility when making decisions. American options also allow you to set your own expiration date, meaning you can tailor the investment to your specific needs and goals. When considering investing in American options, there are several strategies that can be employed to maximize returns. For example, you can buy a “call” option, a “put” option, or even a combination of the two. A call option gives you the right to buy a certain asset at a certain price, while a put option gives you the right to sell the asset at a certain price. Combining both of these strategies can help you take advantage of both rising and falling stock prices. Additionally, you can use options to limit the amount of risk you take on while still allowing yourself to benefit from the potential upside of the stock. Finally, you can also use American options to hedge against volatility in the market by purchasing options with different expiration dates. With these strategies in place, investing in American options can be a great way to make the most of your money.

Tax Implications of American Options

When it comes to American options, it’s important to understand that there are tax implications to consider. These options are taxed differently than other forms of investment, and as such, it’s important to be aware of the potential tax liabilities you could face. American options are subject to short term capital gains tax, which is based on how long the option has been held. Additionally, any income earned from exercising an American option is taxed as ordinary income. It’s important to work with a financial advisor to understand the full tax implications of investing in American options, as there may be a number of deductions and incentives that could reduce the amount of tax you have to pay.