Adverse selection is an economic concept that affects the insurance industry, as well as other markets. It’s a phenomenon that happens when buyers or sellers are better informed than the other party, creating a situation of imbalance. This inevitably leads to higher costs for the uninformed party, and can even cause a market to fail altogether. In this article, we’ll take a closer look at what adverse selection is, how it works, and the implications it has for the insurance and financial industries.

Understanding Adverse Selection and Its Impact on Financial Markets

Adverse selection is a concept that can have a huge impact on financial markets. In a nutshell, it’s the idea that buyers or sellers who have more knowledge about a product or situation have an advantage over those who don’t. For example, an insurer may be unaware of a person’s health history when they offer insurance, but the insured may be aware of any pre-existing conditions which could increase the cost of the policy. This is an example of adverse selection, where the insurer is at a disadvantage because of their lack of knowledge. In financial markets, adverse selection can lead to higher prices, reduced liquidity, and increased risk. As such, it’s important to understand how adverse selection works and how to mitigate its effects.

Adverse Selection and How it Affects Insurance and Investment Practices

:Adverse selection is a term used to describe a situation where buyers or sellers have more information than other players in the market. This can be a problem when it comes to insurance and investment practices. For example, if insurance companies are unaware of the health risks of a certain individual, they may offer them a lower premium because they don’t know the risks associated with that person. This can lead to higher premiums for the rest of the customers in the market. Similarly, if an investor has more insight into the future performance of a security than other investors, they can reap greater profits from their investments. Adverse selection can have a large impact on the insurance and investment industries and needs to be monitored to ensure fairness.

How to Minimize Risk of Adverse Selection in Business Ventures

When it comes to business ventures, minimizing the risk of adverse selection should be a priority. The best way to do this is to make sure you have all the information you need to make an informed decision. Doing research into the company, the market, and the potential risks is essential. Additionally, you should use a variety of tools to ensure you have all the necessary data to make a confident decision. This could include financial analyses, customer surveys, and competitive analysis. Furthermore, it’s important to ensure that any potential partners have the necessary experience and resources to ensure that the venture is successful. Finally, it’s important to always remain aware of the potential risks involved and to adjust your strategy accordingly. Taking these steps will help you to minimize the risk of adverse selection in business ventures.

Adverse Selection and the Role of Information Asymmetry

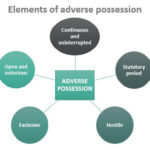

Adverse selection is a problem in economics and insurance that occurs when one party has more information than the other. It’s an example of information asymmetry, which is when one party has more knowledge than the other. Adverse selection is a major issue in the insurance market because insurers have to assess risk without having all the necessary information. Without knowing all the facts, they may end up insuring high-risk people and charging them lower rates, which can result in higher costs for everyone else. To help combat this problem, insurers use factors like medical histories, credit scores, and other risk indicators to determine premiums and coverage eligibility. While this helps to reduce the effects of adverse selection, it’s not a perfect solution, as it can lead to higher costs for those with lower risk profiles.

Strategies to Avoid Plagiarism in Adverse Selection Research and Analysis

Plagiarism is a major concern when researching and analyzing adverse selection. To make sure you don’t get caught up in it, you need to be extra careful when writing up your research and analysis on the subject. The best way to do this is to take the time to properly cite your sources, double check your facts, and make sure your work is unique to you. Also, be sure to use language that is appropriate for your age; not only will this make your work more accurate, but it will also help you avoid any suspicion of plagiarism. Having an individual and creative voice when writing about adverse selection will help ensure that your work is both original and credible.