An Actuarial Life Table is an important tool utilized by financial professionals to make decisions about life insurance, annuities, pensions, and other financial instruments. By considering factors such as mortality rates, age distributions, and other pertinent data, actuaries can use the Life Table to calculate the probability of an individual’s survival over a certain period of time. This article will provide an overview of the Actuarial Life Table and how it is used to make informed financial decisions.

Overview of the Actuarial Life Table

An Actuarial Life Table is an important tool used by actuaries to calculate the mortality rate of a population. It is a statistical tool used to estimate the average age at death of a population, and is used in a variety of industries including insurance and finance. The table is based on the mortality rates of different age groups and is used to help estimate the life expectancy of a population. Actuaries use the table to assess the risk associated with different types of insurance policies and to calculate premiums. Actuarial life tables are also used to determine the amount of money that needs to be set aside for pensions and other retirement plans. The table is regularly updated to reflect changing mortality rates in different age groups and provide an accurate representation of the current mortality rate of a population. Actuarial Life Tables provide an important tool for actuaries to accurately assess the risk of different types of policies and help ensure that customers receive the most accurate information when making financial decisions.

What Are the Components of an Actuarial Life Table?

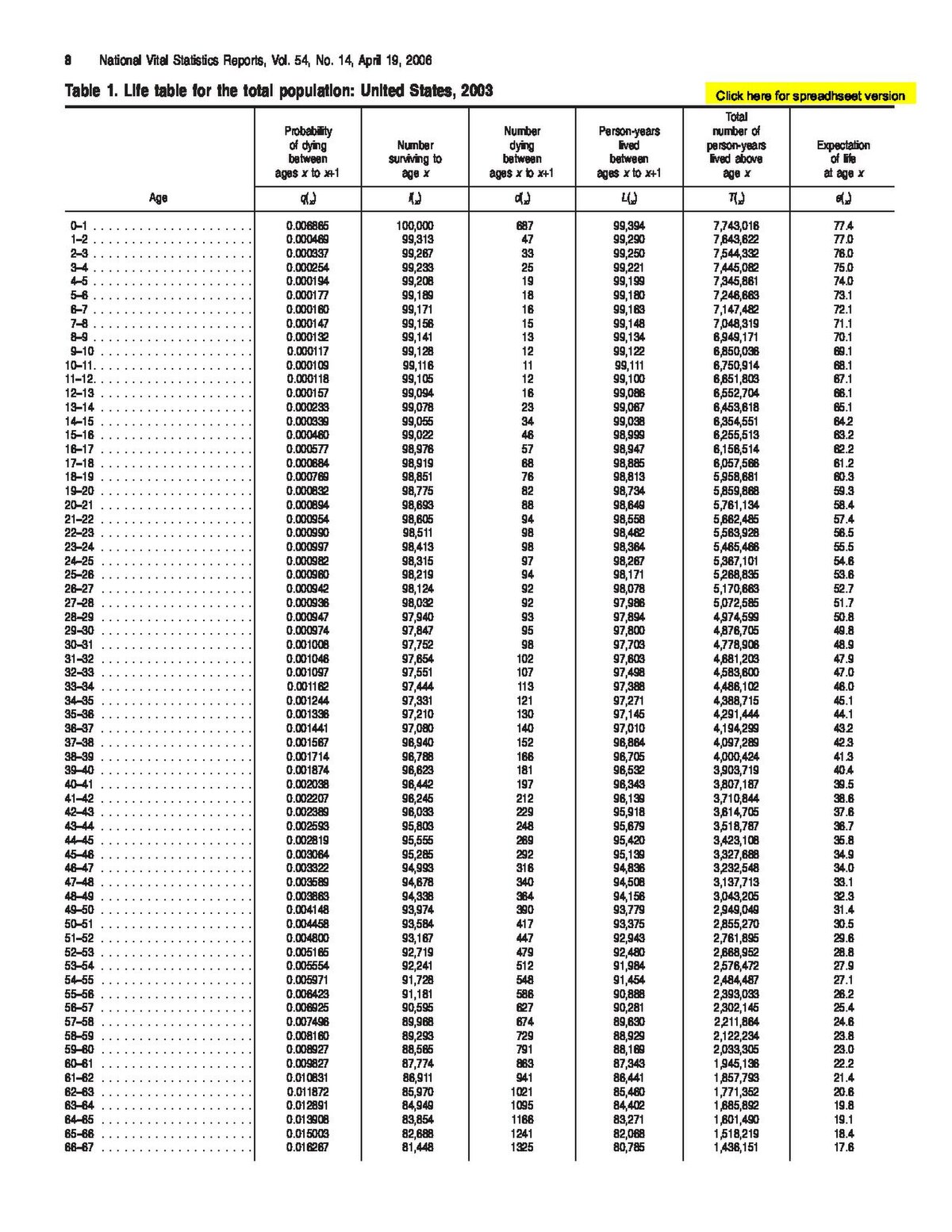

An actuarial life table is a chart that shows mortality rates for a certain population over a certain period of time. The components of an actuarial life table are age, mortality rate, survivorship, and life expectancy. Age is the age of the population being studied, mortality rate is the percentage chance that a person of that age will die within a certain period of time, survivorship is how many people are still alive at the end of that period of time, and life expectancy is the average number of years a person in the population can expect to live. These components are used to calculate the likelihood of an individual living to a certain age based on their age and the mortality rate of the population they belong to. This table is used by insurance companies and other financial institutions to calculate life insurance premiums and other financial products. Knowing the components of an actuarial life table is important for anyone interested in planning for their financial future.

How Is an Actuarial Life Table Used?

An actuarial life table is an important tool used by insurers and financial advisors to calculate the risk of death and the corresponding financial impact. It’s a type of statistical table that shows the probability of death in a given age group. This table is used to calculate actuarial values, which are used to determine life insurance premiums, annuity payouts, and other financial decisions. An actuarial life table can be used to assess the risks associated with different life insurance policies and other investments, as well as to estimate the cost of providing certain types of coverage. It’s a key tool for those in the insurance and financial industry, as it helps to determine the potential financial benefits or losses associated with certain decisions.

Reasons to Incorporate an Actuarial Life Table into Your Financial Plan

Actuarial life tables are incredibly useful tools for anyone looking to plan for the future. Incorporating an actuarial life table into your financial plan can help you better prepare for the future and have peace of mind that your financials are in order. An actuarial life table provides you with detailed information on mortality rates and expected life spans based on certain conditions and demographics. This information can help you determine the best way to invest and manage your money over the course of your lifetime. It can also provide you with valuable insights on the average life expectancy of certain age groups, helping you plan for your retirement and other long-term financial goals. An actuarial life table offers a comprehensive view of your financial future and can be an invaluable asset when planning for retirement, savings, and other investments. Incorporating this type of table into your financial plan can help you make more informed decisions and ensure that your money is working for you in the long run.

Tips for Using an Actuarial Life Table to Achieve Your Financial Goals

Using an actuarial life table to reach your financial goals is a great way to ensure a successful future. A life table can provide you with a snapshot of how long you might live and how much money you may need to cover your financial needs. It can also help you plan for retirement, figure out how much you should be saving and investing, and even help you determine how much insurance you may need. Understanding the basics of an actuarial life table can help you make smart financial decisions and reach your goals. First, you should understand the components of an actuarial life table and how it is used. It is based on mortality data, which tracks the average lifespan of a certain population. By analyzing the data, actuaries can predict how long someone is expected to live and how much money they will need to cover their financial obligations and goals. Additionally, you can use an actuarial life table to compare different cohorts and see how important factors like age, gender, and lifestyle can affect longevity. Knowing this information can help you plan for retirement and make sure you are taking the right steps to achieve your financial goals. Lastly, you should remember that an actuarial life table is an estimate of your life expectancy and financial needs. It’s important to stay flexible and