Actuarial Gain Or Loss is a financial term used to describe the difference between the expected and actual cost of providing insurance to a policyholder. This difference is calculated by applying a set of actuarial assumptions to the policyholder’s expected future payments. Understanding Actuarial Gain or Loss is essential for anyone looking to better manage their risk and ensure financial security in the long-term. In this article, we’ll explain in more detail what Actuarial Gain or Loss is, the process for calculating it, and the implications for financial planning.

Understanding Actuarial Gain Or Loss: What Is It and How Does It Work?

Actuarial gain or loss is a term used in the insurance industry to describe the difference between the expected value of a life insurance policy and its actual value. It’s important to understand how this works in order to get the most out of your policy. Basically, an actuarial gain or loss is the difference between the expected amount of money that would be paid out in a life insurance policy and the actual amount that is paid out. This can be affected by the age of the insured, the amount of the policy, and other factors. The gain or loss is calculated by taking the expected value of the policy and subtracting it from the actual value. If there’s a gain, that means the policy is more valuable than it was expected to be. On the other hand, if there’s a loss, the policy is worth less than it was expected to be. Knowing how actuarial gain or loss works can help you make sure you’re getting the most out of your policy.

The Benefits of Actuarial Gain Or Loss: Why It’s an Essential Financial Tool

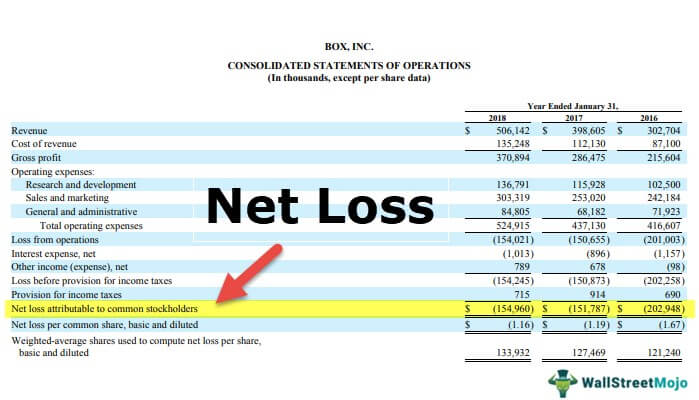

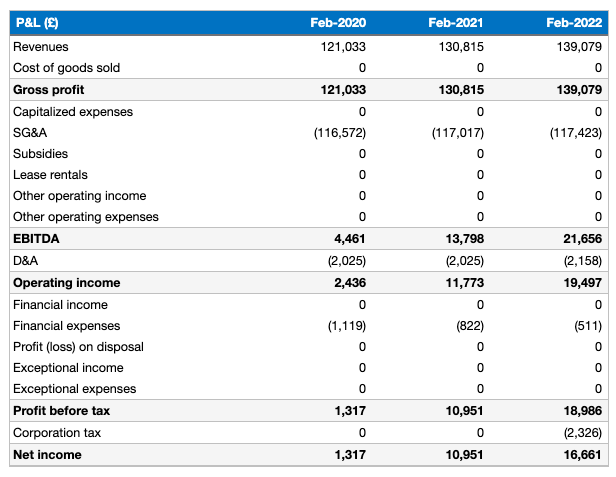

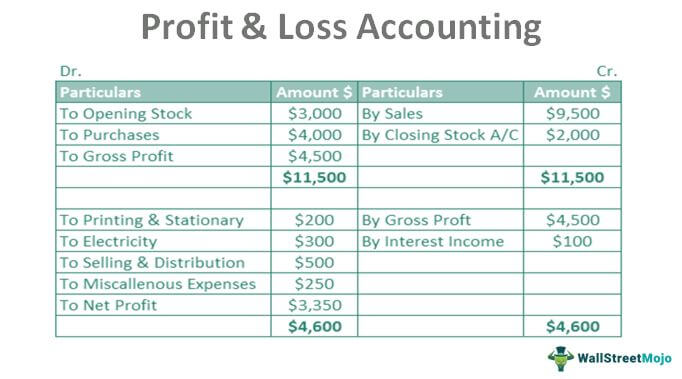

Actuarial gain or loss is an essential financial tool for business owners to understand. It can help you better understand the financial security of your business, plan for the future, and make sound decisions. Actuarial gain or loss is a calculation that helps to measure how much is gained or lost from a certain financial transaction. This calculation is done by taking into account the present value of assets and liabilities, along with any changes in assets and liabilities due to mortality, morbidity, and expenses. By using this tool, you can get a better understanding of the current and future financial state of your business. This can help you make better decisions and plan for the future to ensure the financial security of your business.

Common Uses of Actuarial Gain Or Loss and Its Applications in Real-World Settings

Actuarial gain or loss is a financial term used to describe the difference between the expected value of a portfolio and its actual value. This concept is commonly used in the insurance industry, where it is used to assess the financial stability of an insurer. Actuarial gain or loss is also important for investors, as it helps them understand the risks associated with their investments. In addition, actuarial gain or loss is also used to assess the performance of a company’s investments over time. In real-world settings, actuarial gain or loss can be used to analyze and calculate the expected return on investments, helping to identify areas of potential risk. Moreover, actuarial gain or loss can be used to compare different investment strategies, allowing investors to make informed decisions and maximize their returns. By understanding how actuarial gain or loss works, investors can gain a greater insight into the risks and rewards associated with their investments.

The Risks of Actuarial Gain Or Loss: What to Look Out For

Having an understanding of the risks associated with actuarial gain or loss is important for any business. Actuarial gain or loss can be a tricky concept to grasp, but the risks associated with it are undeniable. One of the biggest risks to be aware of is the potential to overestimate or underestimate the amount of future liabilities, which can lead to a shortfall or surplus in the actuarial gain or loss. Another major risk is the potential to miscalculate the cost of providing benefits to employees. This can cause the actuarial gain or loss to be overstated or understated, leading to inaccurate financial results. When it comes to actuarial gain or loss, it’s essential to take the time to understand the risks associated with it and take steps to mitigate any potential losses.

Tips for Calculating Actuarial Gain Or Loss: How to Ensure Accuracy and Avoid Errors

Calculating actuarial gains or losses can be a tricky process, but with a few tips and tricks, you can ensure you get the most accurate and up to date information. First and foremost, always double-check the numbers you input. This is the best way to avoid errors and make sure you are getting the most accurate numbers. Additionally, make sure to accurately record all relevant information that could affect the outcome, such as changes in interest rates or mortality rates. Finally, it is important to use the correct actuarial tables and formulas for your calculations. By following these tips, you can make sure you get the most accurate actuarial gain or loss calculations, and avoid any costly errors.