Activity Ratios are key performance indicators that allow investors, lenders, and business owners to measure the efficiency and profitability of a company. These ratios take into account the company’s assets and liabilities, as well as its income and expenses, to give an accurate representation of the firm’s overall financial health. Understanding activity ratios can be invaluable for any business looking to maximize their efficiency and profitability. By analyzing activity ratios, investors, lenders, and business owners can identify areas for improvement and take the necessary steps to increase their success.

What Are Activity Ratios and How Can They Help Your Business?

Activity ratios are essential for any business. They measure how efficiently a company is using its resources and how profitable it is. By analyzing activity ratios, you can get a better understanding of how well your business is doing and identify areas for improvement. Activity ratios can help you make better decisions, strengthen your financials, and boost your bottom line. They are a great way to measure the performance of your business and compare it to industry averages. Knowing your activity ratios can help you make informed decisions that lead to success.

The Benefits of Using Activity Ratios to Measure Financial Performance

Activity ratios are an incredibly useful tool in measuring financial performance. They help to provide a clearer picture of a company’s financial health by looking at the company’s ability to utilize its resources to generate profits. By analyzing activity ratios, investors can gain insight into the company’s ability to convert inventory into sales and its success in collecting receivables. This helps to provide a better understanding of the company’s financial stability and growth potential. Activity ratios also allow investors to compare the performance of a company to its competitors, providing a more comprehensive overview of the company’s competitive positioning. With activity ratios, investors can better understand how a company has been performing financially and can make more informed decisions about whether to invest in it.

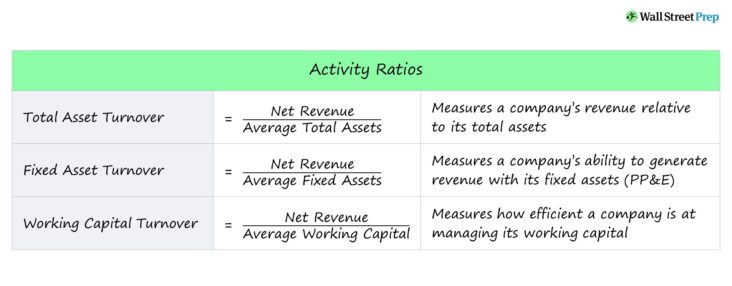

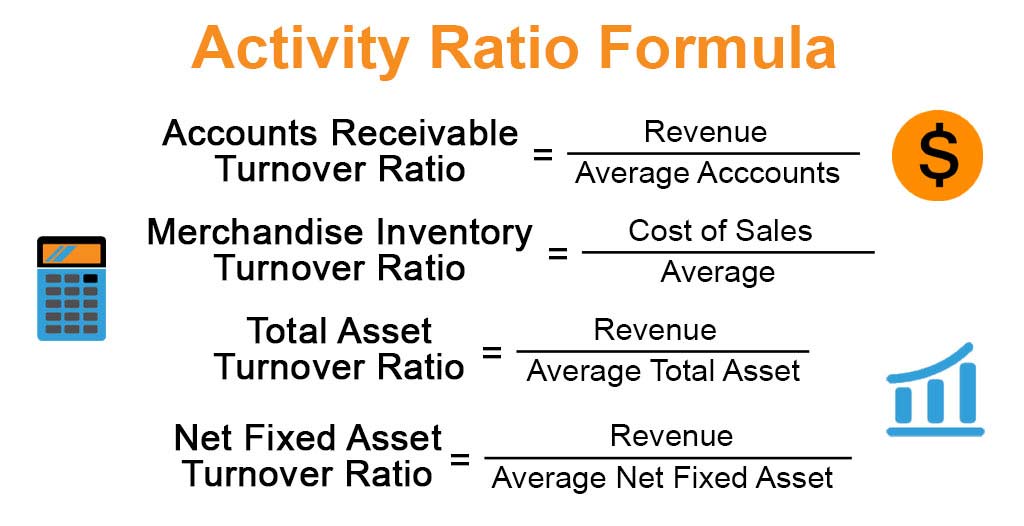

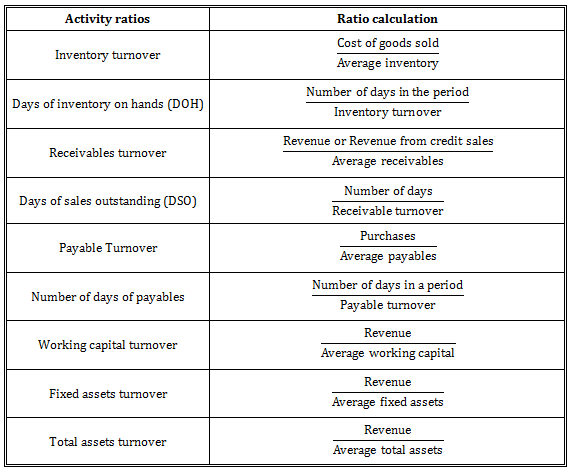

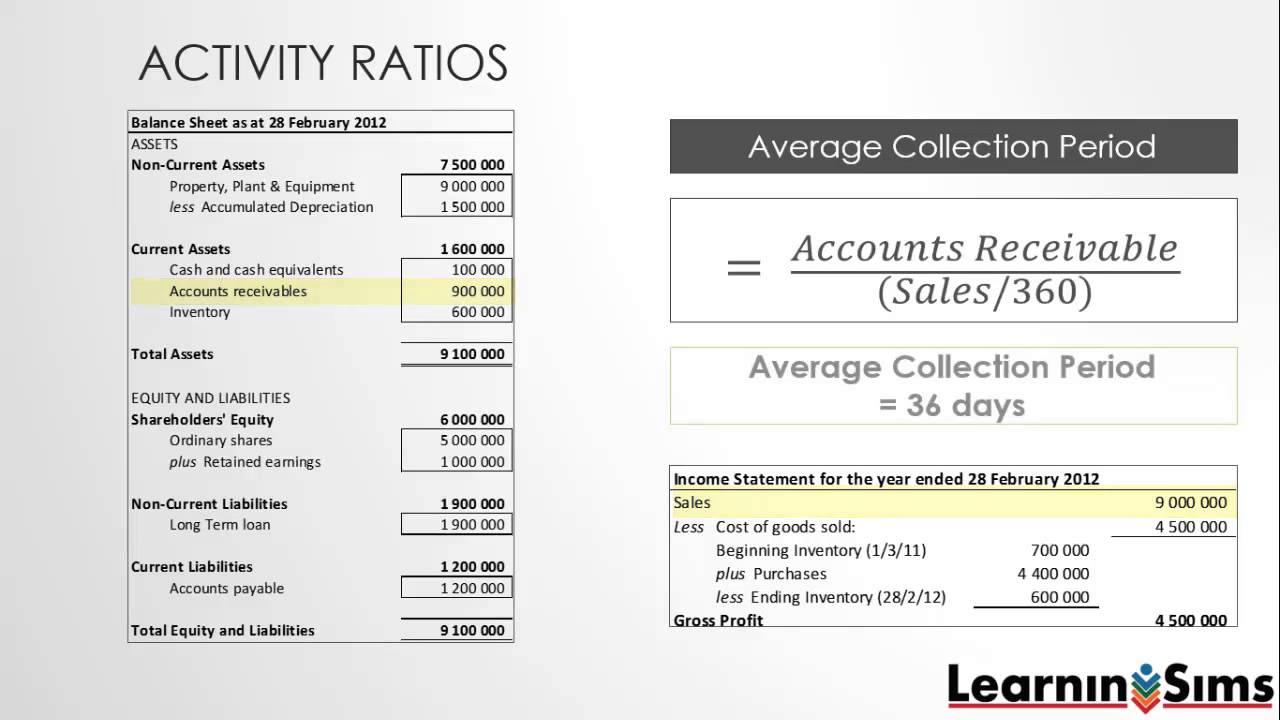

How to Calculate Activity Ratios and Understand Their Significance

Activity ratios are a great way to measure a company’s financial performance. They are used to analyze how efficient a company is in managing its assets, liabilities, and equity. To calculate activity ratios, you need to examine the company’s financial statements, which include its balance sheet and income statement. Once you have these documents, you can start looking at the company’s performance in terms of assets, liabilities, and equity. Activity ratios provide insight into how well a company is utilizing its resources, how quickly it is generating cash, and how much debt it has. Understanding activity ratios helps investors make more informed decisions about investing in a company. It can also be used to compare different companies and make more informed financial decisions. Knowing how to calculate and interpret activity ratios is an important part of being a savvy investor.

Common Types of Activity Ratios and Their Uses

Activity ratios are a great way to measure the financial performance of a business. They measure the efficiency of a company’s operations by taking into account how quickly it converts its assets into cash. Common types of activity ratios include inventory turnover, accounts receivable turnover, and accounts payable turnover. Inventory turnover measures how quickly a company is able to move its inventory, while accounts receivable turnover measures how quickly a company can collect payments from its customers. Accounts payable turnover measures how quickly a company is able to pay its outstanding bills. All of these activity ratios are important in assessing the company’s financial performance and can help to identify areas where improvements can be made. By using these activity ratios, business owners and managers can better understand how their company is performing and make changes to improve their financial performance.

Tips for Interpreting Activity Ratios and Making Informed Financial Decisions

Activity ratios are a great way to measure the financial health of a business. They provide a snapshot of how the business is performing and can be used to make informed decisions about the future direction of the business. To get the most out of activity ratios, it’s important to understand how they work and how to interpret them correctly. To get started, consider looking at the liquidity ratios, which measure the business’s ability to pay its debts, or the solvency ratios, which measure the business’s ability to manage its assets. Once you understand these ratios, you can start to compare them to industry averages and assess how they are impacting the business. It’s also important to keep in mind other factors that may affect activity ratios, such as industry trends, economic conditions, and the company’s own operations. By taking these into consideration, you can make informed decisions about the business’s financial health and future prospects.