Activity-Based Costing (ABC) is an accounting method used to identify and assign costs to activities that create value for an organization. It is a tool used to identify and measure the cost of activities that enable a company to produce products, services, and other output. ABC helps organizations understand how costs are actually incurred and how cost drivers impact operations, allowing them to better manage their resources, improve efficiency, and maximize profits. This article will provide a comprehensive overview of Activity-Based Costing, including its purpose, advantages, and disadvantages.

What is Activity-Based Costing (ABC) and How Does it Work?

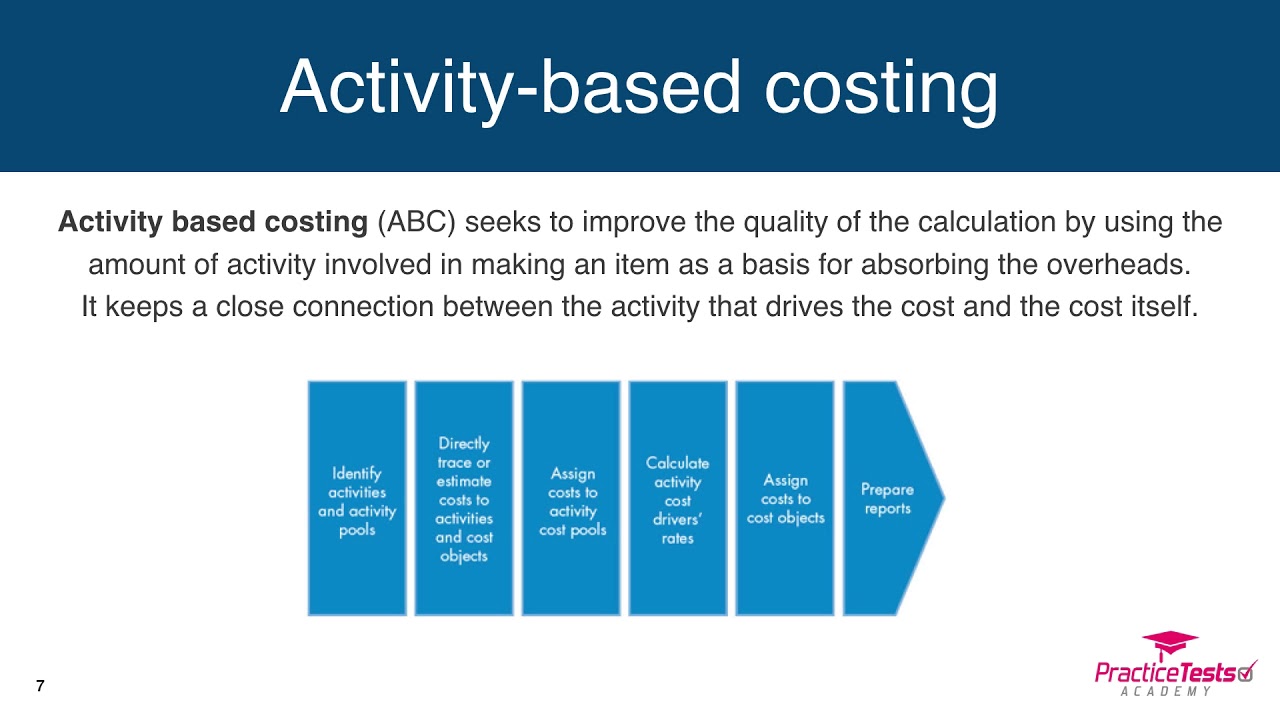

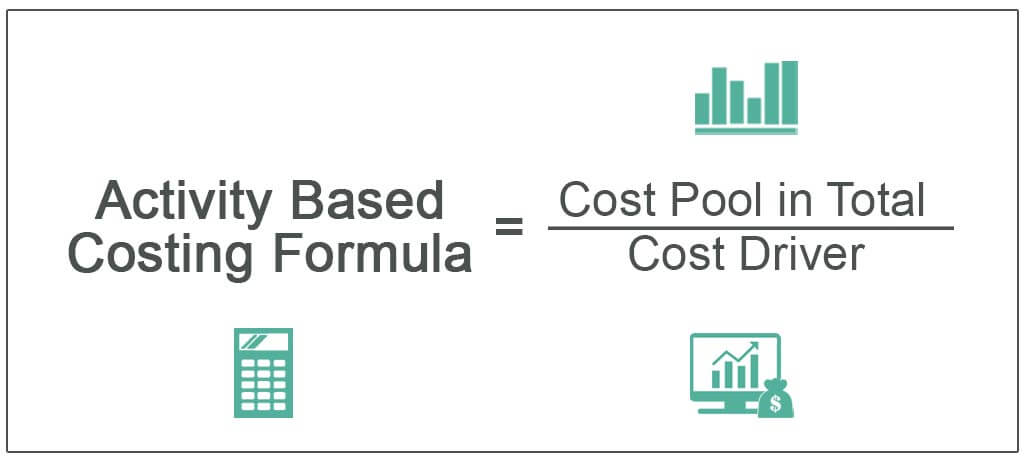

Activity-Based Costing (ABC) is a method of accounting that assigns costs to activities within a business. It helps to identify and assign costs to activities that are the most important to the success of the company. The goal of ABC is to provide businesses with an accurate picture of the costs associated with each activity, allowing them to make informed decisions on how to best allocate resources. ABC also helps identify cost savings opportunities, as it identifies activities that are consuming more resources than they should. ABC works by assigning costs to activities that are related to the production of a product or service. These activities are then grouped into cost pools, which are then allocated to the products or services produced. This allows businesses to accurately allocate costs to the activities that are most important to the success of the company.

ABC and its Benefits to Businesses

Activity-Based Costing (ABC) is a great way for businesses to streamline their budgeting and understand where their money is going. With ABC, businesses can assign costs to activities that are most important to the organization and determine how much it costs to do them. This detailed understanding of costs helps businesses to make better decisions about how to allocate resources, increase efficiency, and reduce costs. ABC also provides a more accurate picture of the total cost of activities, allowing businesses to better understand their true costs and better allocate resources. With ABC, businesses can get a much better idea of what activities are really worth, allowing them to make more informed decisions and maximize their profits. ABC also allows businesses to better plan for the future, allowing them to anticipate and prepare for potential changes and costs.

A Closer Look at ABC’s Components

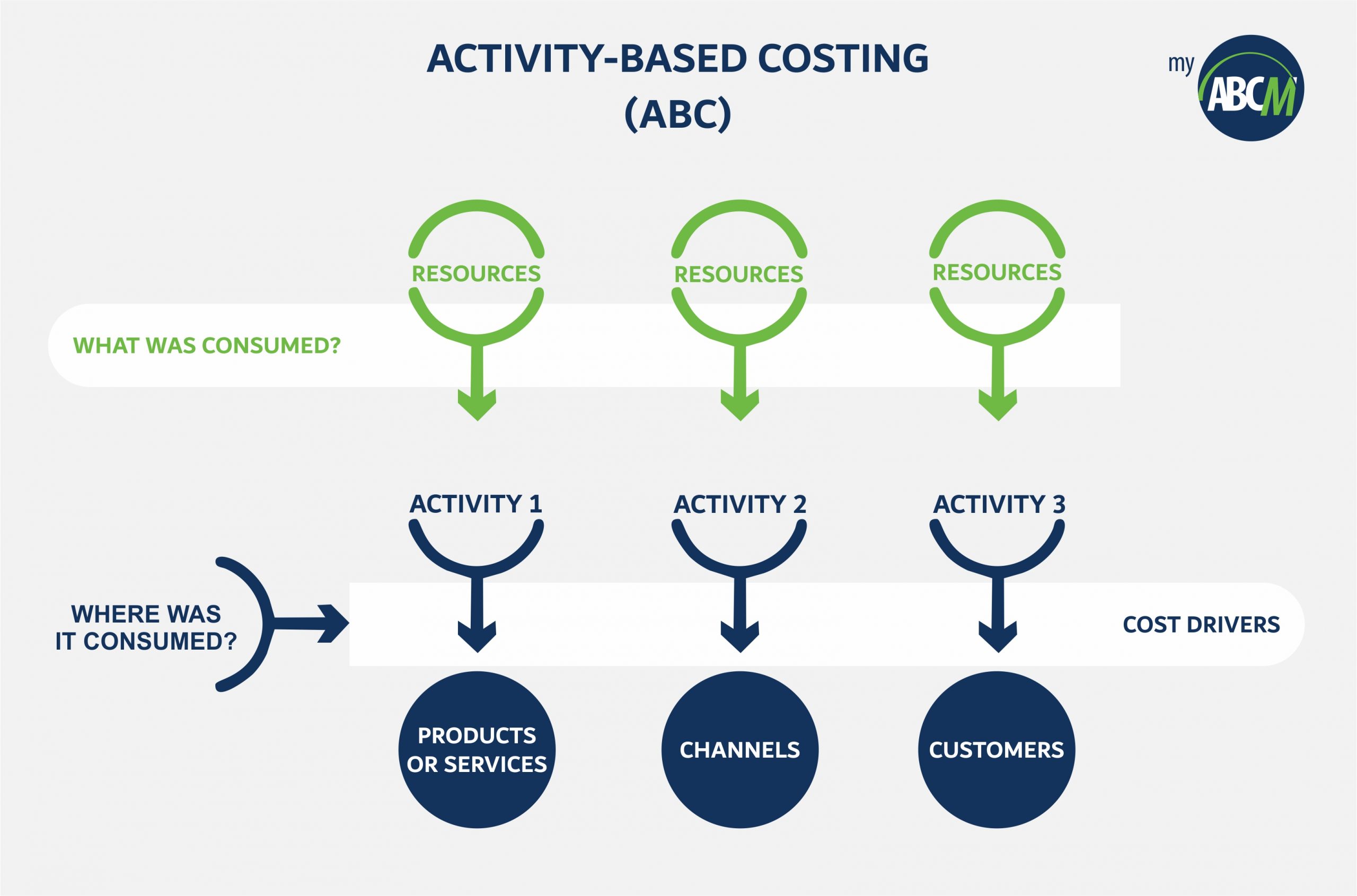

ABC has a few core components that make it a successful and helpful tool for businesses. Firstly, it requires the identification of activities that are the drivers of a company’s costs. This includes activities such as ordering supplies, customer service, and product design. From there, the company must assign costs to those activities. By doing this, a company can more accurately determine the costs associated with each activity and how it’s impacting their bottom line. Additionally, ABC allows companies to identify areas where they may be able to improve efficiency or reduce costs. By studying the cost drivers, companies are able to see where they should be investing resources and where they could potentially save money. Overall, ABC is an incredibly useful tool for businesses to understand where their money is going and how to best allocate it in order to be successful.

Examples of Activity-Based Costing

Activity-Based Costing (ABC) is a method of accounting that looks at the cost of a product or service by breaking down the activities that go into producing it. ABC looks at the costs associated with each activity and allocates them to the products or services that use those activities. This allows companies to get a better understanding of their true costs and to allocate these costs more accurately. Examples of Activity-Based Costing include looking at the cost of raw materials, labour, overhead, and marketing. By assessing the costs associated with each activity, ABC can provide a more accurate and comprehensive view of costs and can help companies make more informed decisions about their production processes. ABC can also help companies identify areas of waste and inefficiency, allowing them to streamline operations and save money.

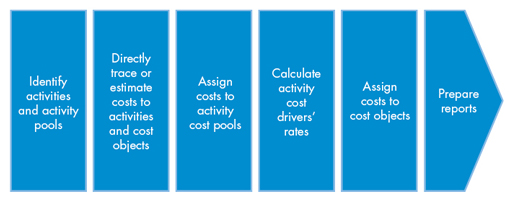

How to Implement Activity-Based Costing in Your Business

Activity-Based Costing (ABC) is a powerful tool for businesses of all sizes. It’s a great way to gain insight into the costs associated with specific business activities, and to understand how those activities contribute to your overall profitability. Implementing ABC in your business is relatively simple and can provide invaluable insights. Begin by gathering data on the activities and costs associated with each activity. Then, identify the cost drivers associated with each activity. Finally, allocate costs to the activities based on their cost drivers and analyze the data to find areas of cost savings and inefficiencies. ABC can help you make informed decisions about how to best allocate your resources in order to maximize profit.