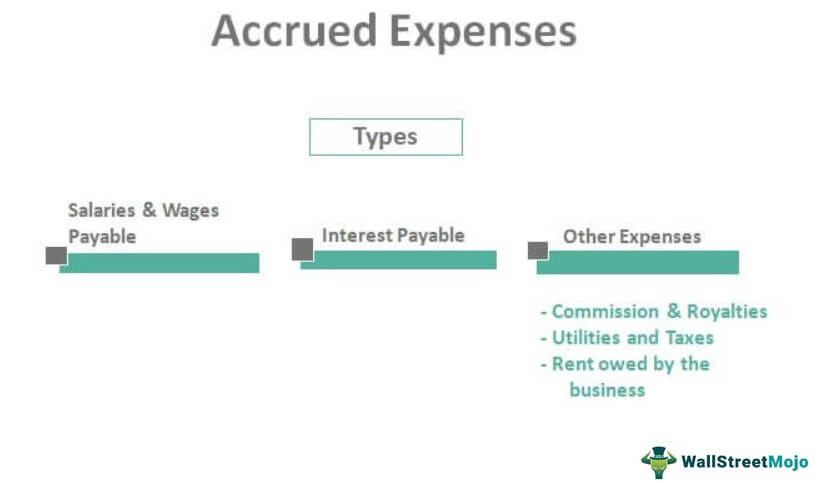

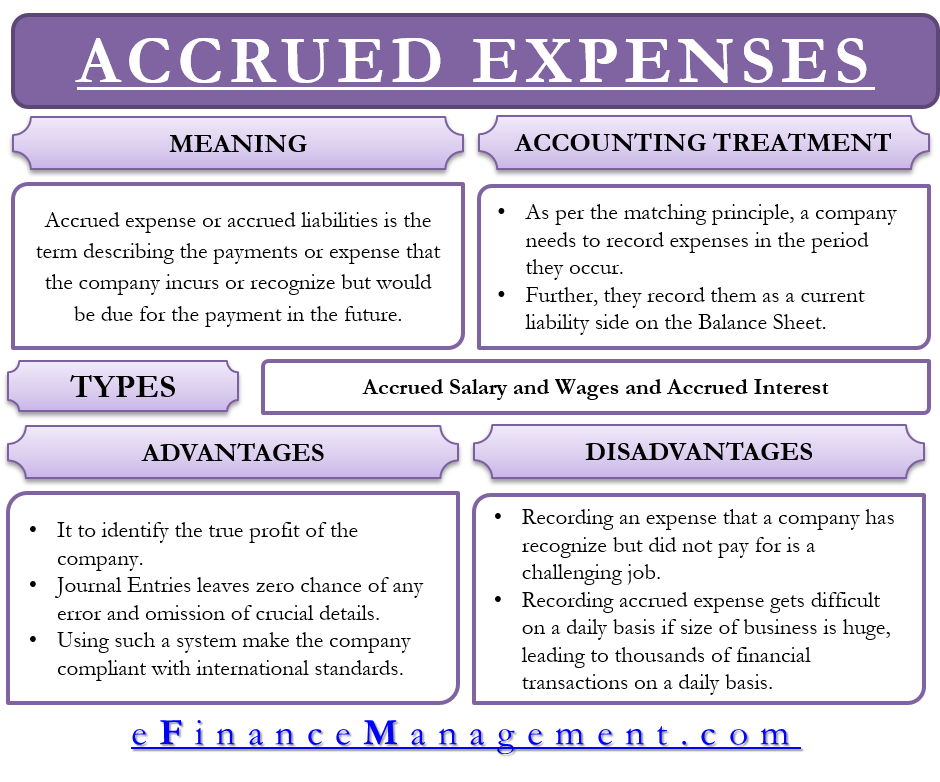

Accrued expenses are expenses that have been incurred, but not yet paid. They are liabilities on a company’s balance sheet and represent the cost of goods and services received, but not yet paid for. Accrued expenses are important to track and understand for businesses of all sizes, as they are an indication of how much money is owed. Understanding what an accrued expense is and how to properly record them is key to maintaining accurate financial records, and can help a business make better decisions about its finances.

How to Identify and Record Accrued Expenses

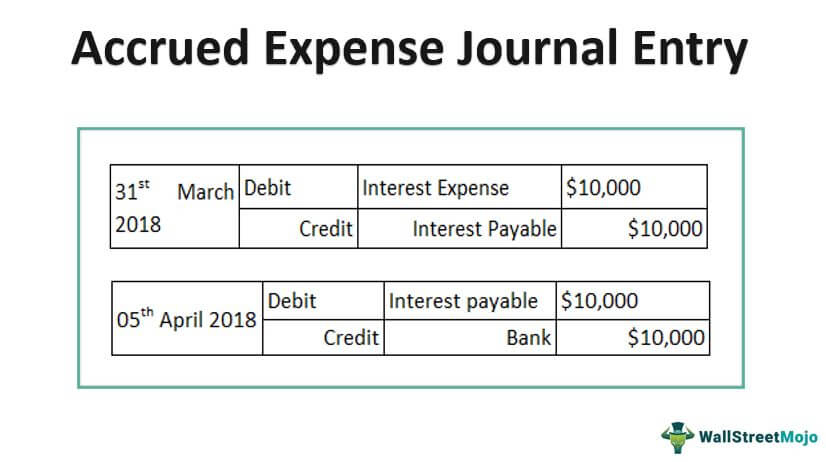

Accrual accounting is a great way to keep track of your expenses, but it can be tough to know exactly when to record them. That’s why it’s important to know how to identify and record accrued expenses. Accrued expenses are costs that have been incurred but not yet paid. They can be short-term expenses such as unpaid wages, or long-term expenses like unpaid interest. To identify and record these expenses, you first need to determine when the expense was incurred. Then you need to calculate the total amount owed and enter it into your accounting system. This will help you keep an accurate record of your expenses and ensure that your finances are up to date.

What Are the Benefits of Accrued Expenses

Accrued expenses are a great way to keep track of your finances and stay organized. They make it easier to plan for future expenses and prevent unnecessary spending. Accrued expenses are also beneficial in that they provide a better understanding of cash flow, allowing you to make better decisions with your money. Knowing your financial obligations in advance allows you to plan and budget accordingly. Additionally, accrued expenses can help you save money in the long run by allowing you to pay bills earlier, which can lower your interest payments. Lastly, accrued expenses can provide you with the peace of mind knowing that you are on top of your finances. Accrued expenses are an excellent way to ensure you are in control of your money and are prepared for any financial obligations that come your way.

Understanding the Basics of Accrued Expenses

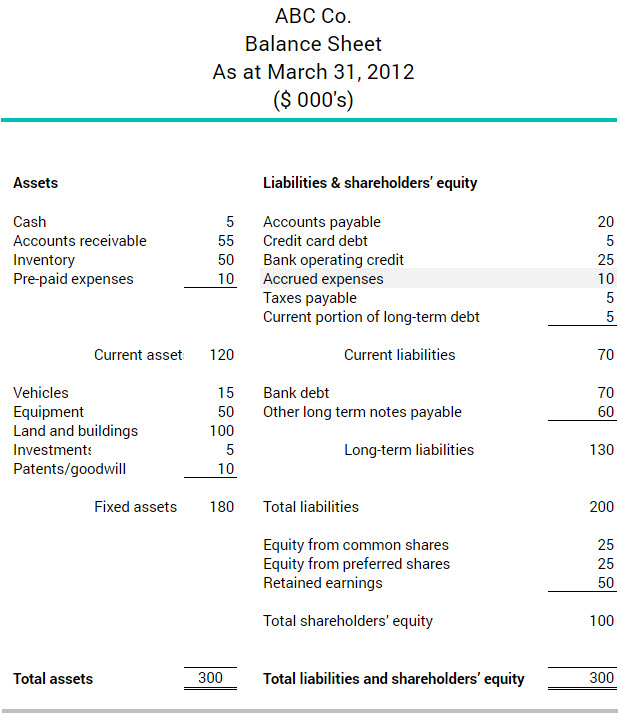

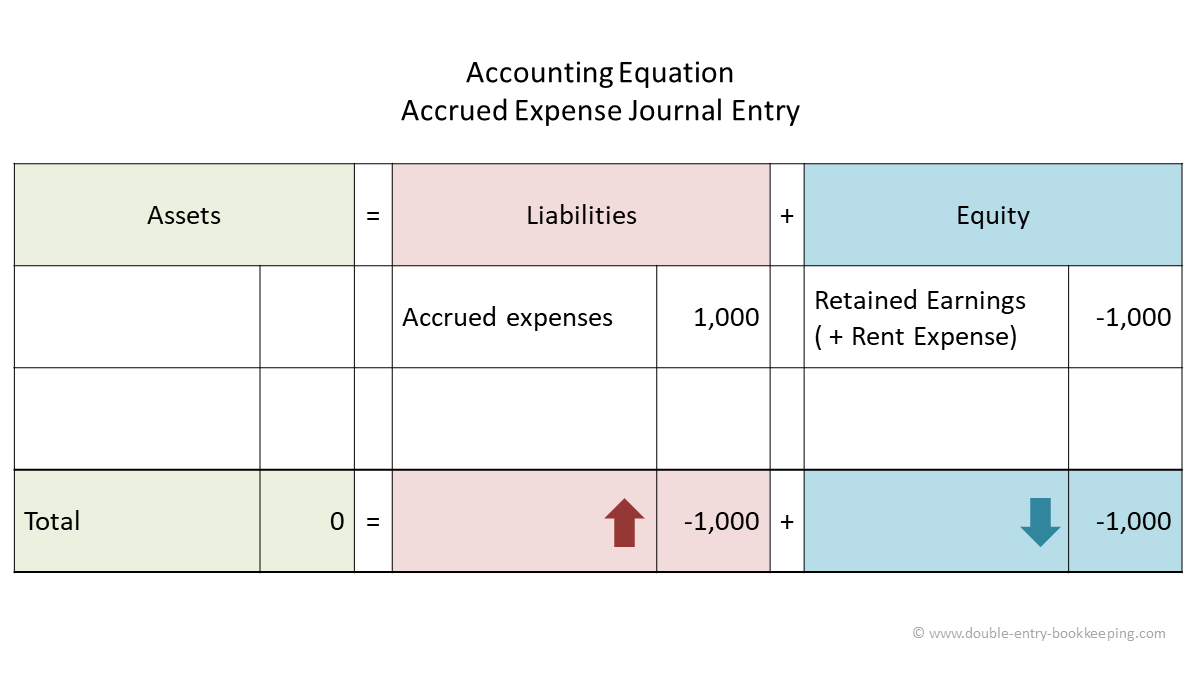

Accrued expenses are a type of expense that has been incurred but not yet paid for. This means that the company has used up a resource or service, but the bill has not yet been received or paid. Accrued expenses can be found on the balance sheet and are important for companies to track as they can indicate how much money is owed or owing. Accrued expenses are usually for services or products that have been used prior to the end of an accounting period, such as electricity or a lease agreement. By tracking these expenses, companies can be sure they are paying the right amount for their services and not overspending. Accrued expenses are also important to track when preparing financial reports, as they can affect the overall financial picture of a company.

Best Practices for Managing Accrued Expenses

When it comes to managing accrued expenses, the best practices are to stay organized, track all expenses, and plan for the future. Staying organized is the most important part of the process. Make sure to keep a detailed ledger of all expenses so that you know what is owed and when. Keeping track of expenses will help you avoid any surprises at the end of the month. Additionally, it’s important to plan for the future by setting up a budget and ensuring that you are accounting for any future expenses. This will help you avoid any cash flow issues down the road. By following these best practices, you can ensure that your accrued expenses are managed properly and that your business is prepared for any unexpected costs.

Common Misconceptions About Accrued Expenses

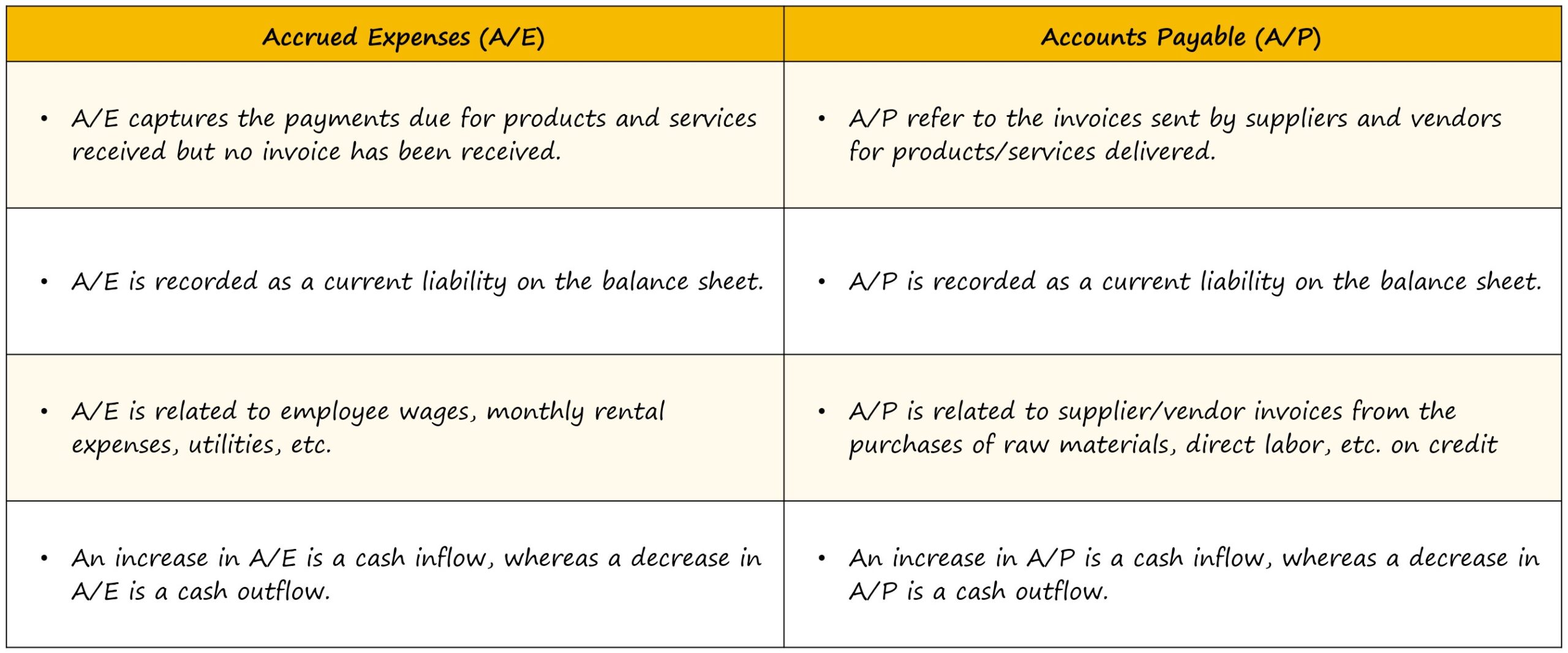

Common misconceptions about accrued expenses can be a source of confusion for many people. It can be easy to assume that accrued expenses are simply unpaid bills, but this is not the case. Accrued expenses are expenses that have been incurred but not yet paid. This means that a company has used goods or services, but since the invoice has not yet been paid, they are not considered an outstanding debt. Instead, the expense is recorded as an accrued liability on the balance sheet until the invoice is paid. Knowing the difference between accrued expenses and unpaid bills can help you better manage your finances and ensure that your company is properly accounting for all of its expenses.