A-shares are a type of stock that is only available to purchase by Mainland China investors. These shares are not available to foreign investors and are subject to different rules and regulations than other stocks.

The A-share market in China has been growing rapidly since it was first established in the early 1990s. As of 2017, there were 3,000 companies listed on the A-share market with a total market capitalization of over US$6 trillion.

A-shares are an important part of the Chinese economy and are a key driver of economic growth.

-What are A-Shares?

A-shares are a type of stock that is available for purchase on a stock exchange. They are typically denominated in the local currency, such as the Chinese yuan.

A-shares give foreign investors access to Chinese companies that are not yet listed on major international exchanges. These companies are usually smaller and riskier than those listed on Western exchanges, but they can offer higher potential rewards.

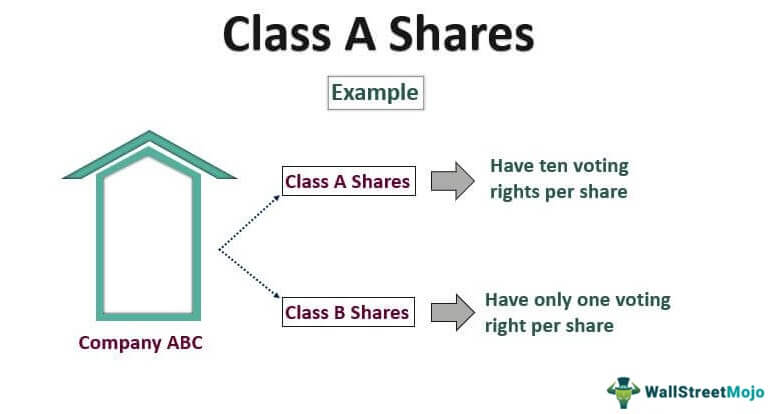

Not all A-shares are equally easy to trade. Those that are not freely traded (known as restricted A-shares) can only be bought and sold by certain types of investors, such as institutional investors or qualified foreign institutional investors.

The A-share market is the largest stock market in China, but it is still relatively undeveloped compared to other markets such as those in the United States or Europe. For example, there is no central clearinghouse for trades, and settlement can take up to three days.

-Advantages and Disadvantages of A-Shares

When it comes to A-Shares, there are advantages and disadvantages that come along with this type of investment. Advantages include the following:

1) A-shares offer investors exposure to the Chinese economy, which has been one of the fastest-growing economies in recent years.

2) A-shares tend to be less volatile than other types of shares, making them a more stable investment.

3) dividends from A-shares are often tax-free, which can make them more attractive to investors.

Disadvantages of A-shares include the following:

1) The Chinese government still has a lot of control over the country’s stock market, which can make it more difficult for foreign investors to trade A-shares.

2) Many international brokerages do not offer direct access to A-shares, so investors may have to go through a local broker in order to trade them.

3) There is still a lot of uncertainty surrounding the future of the Chinese economy, which can make investing in A-shares a risky proposition.

-How to Invest in A-Shares

A-shares are a type of equity security that represents ownership in a Chinese company. They are traded on the Shanghai and Shenzhen stock exchanges.

Foreign investors can invest in A-shares through one of two mechanisms: the Qualified Foreign Institutional Investor program or the Stock Connect program.

The Qualified Foreign Institutional Investor program allows foreign institutions to invest directly in A-shares. In order to participate, foreign institutions must first be approved by the China Securities Regulatory Commission.

The Stock Connect program allows foreign investors to trade A-shares through the Hong Kong stock exchange. This program provides access to a wider range of Chinese companies than the Qualified Foreign Institutional Investor program.

When investing in A-shares, foreign investors should be aware of the following risks:

-Political risk: The Chinese government has a history of intervening in the stock market in order to achieve its political goals. This intervention can take the form of buying or selling large quantities of shares, changing regulations, or even shutting down exchanges.

-Economic risk: The Chinese economy is growing rapidly, but it is still less developed than economies in other parts of the world. This means that there is more potential for economic shocks that could impact the value of A-shares.

-Currency risk: The value of the Chinese yuan is not fully convertible into other currencies. This means that changes in the value of the yuan can impact the value of

What Is A-Shares? – A-Shares Financial Definition

An A-share is a type of stock that is traded on the Shanghai or Shenzhen stock exchange in China. They are denominated in Chinese yuan and are available to domestic investors. Foreign investors can also trade A-shares through certain investment vehicles, such as the Qualified Foreign Institutional Investor program.

A-shares tend to be more volatile than other types of stocks because they are subject to different regulations and accounting standards. For example, the Chinese government imposes a limit on the amount of foreign ownership in A-share companies. As a result, A-shares are often seen as a riskier investment than other types of stocks.