Snap Inc. (SNAP) has quickly become one of the biggest players in the tech industry, with its innovative social media platform, the Snapchat app. Since its initial public offering in 2017, the company has continually pushed the boundaries of technology, creating new and exciting ways for its users to stay connected. This company review aims to provide an in-depth look at Snap Inc., its products, and its overall performance in the stock market. We’ll discuss the company’s strengths and weaknesses and provide an overall assessment of whether Snap Inc. is a good investment opportunity. With the help of this review, you’ll be able to make an educated decision regarding whether or not to invest in Snap Inc. (SNAP).

Overview of Snap Inc.

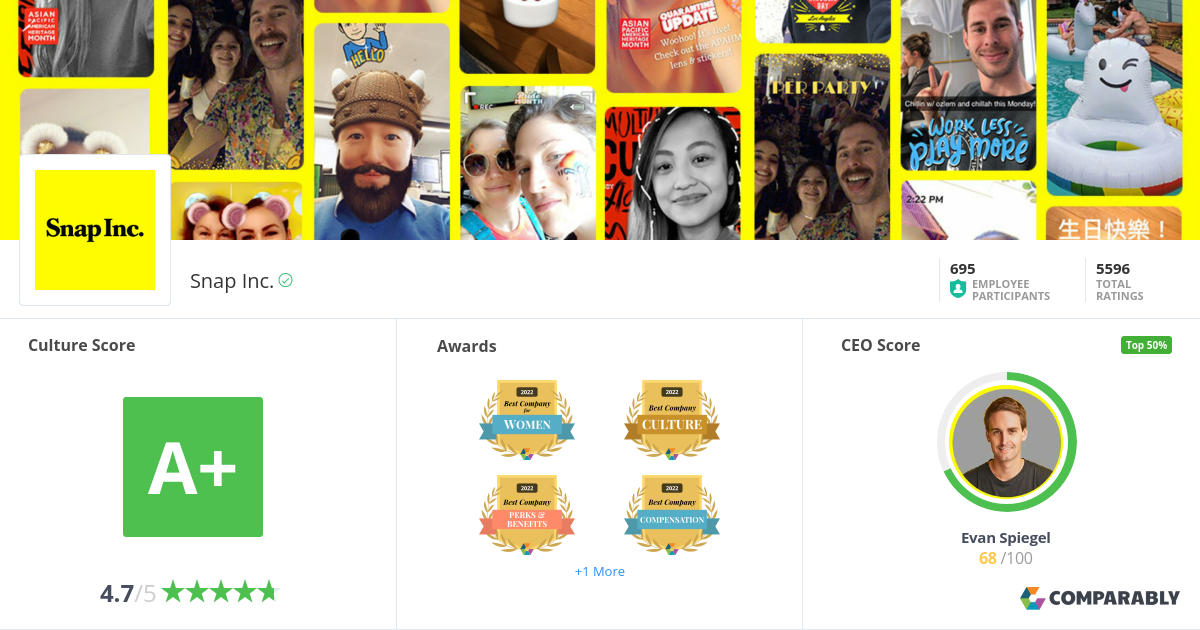

Snap Inc is a camera and messaging company that was founded in 2011 by Evan Spiegel, Bobby Murphy and Reggie Brown. The company is best known for its Snapchat app, which allows users to share photos and videos with friends and family. Snap Inc has become one of the world’s leading social media companies and has seen remarkable growth in its user base over the last few years. The company’s IPO in 2017 gave it a valuation of over $25 billion, making it one of the largest tech companies in the world. Snap Inc is also constantly innovating and has recently released a number of new products such as its Spectacles glasses and Snap Map, which allow users to share their locations with their friends. Snap Inc’s innovative products and huge user base make it one of the most exciting companies in the tech industry.

History of Snap Inc.

Snap Inc. is a technology and media company that was founded in the summer of 2011 by Evan Spiegel, Bobby Murphy and Reggie Brown. The company is best known for its popular app, Snapchat, which allows users to send photos, videos and messages that self-destruct after a few seconds. Since its launch, Snapchat has become one of the most popular social media apps in the world, with over 100 million daily active users. In 2016, the company rebranded itself as Snap Inc. and launched its first product, a video-capturing sunglasses called Spectacles. Additionally, the company has expanded its offerings to include Snap Map, Snap Originals, and Snap Minis. Snap Inc. has become one of the most popular companies in the world and is valued at over $31 billion.

Products and Services of Snap Inc.

Snap Inc. is a rapidly growing technology company that has been revolutionizing the way we communicate and interact. Founded in 2011, Snap Inc. is the parent company of Snapchat, the popular multimedia messaging app. With over 238 million daily active users, Snapchat is the most used social media platform among Gen Z and Millennials. Snap Inc. offers a variety of products and services, including the Snapchat app, Spectacles, and Snap Map. The Snapchat app allows users to communicate with friends and family through photos, videos, and messages. With its unique camera filters, lenses, and geofilters, Snapchat has become the go-to for creative and fun communication. Additionally, Snap Inc. offers Spectacles, sunglasses that allow users to capture and share their experiences on Snapchat. Lastly, Snap Map allows users to explore the world and connect with friends and family around the globe. Snap Inc. has become a leader in the social media industry, and their products and services continue to evolve with the changing times. With its innovative products and services, Snap Inc. is sure to remain a major player in the social media space.

Financials of Snap Inc.

Snap Inc. reported its fourth quarter earnings at the end of January 2021. Overall, the company posted strong results, with revenues of $911 million and a net income of $285 million. This represents a 21% increase in revenues year-over-year and a $0.06 increase in net income. The company also posted a free cash flow of $194 million, which was an increase of $100 million year-over-year.Looking at the financials of Snap Inc., the company’s total assets rose to $30.9 billion, up from $26.1 billion in the previous quarter. This was mainly due to the increase in cash and cash equivalents, which increased to $3.3 billion from $2.3 billion in the previous quarter.Snap Inc. also saw an increase in its long-term debt, which rose to $2.5 billion from $2.4 billion the previous quarter. The company also reported a gross profit of $1.7 billion, up from $1.3 billion in the previous quarter. The company’s operating profit also increased to $446 million from $341 million in the previous quarter.Overall, the financials of Snap Inc. show that

Avoiding Plagiarism when Writing about Snap Inc.

When writing about Snap Inc. (SNAP) it is important to remember to avoid plagiarism. Plagiarism is the act of using someone else’s words, ideas, or work without giving them proper credit. To avoid plagiarism when writing about Snap Inc., it is important to research the company and its products or services thoroughly, and to carefully cite any sources used. It is also important to use one’s own words when discussing or describing the topic. Additionally, if one is quoting or paraphrasing another person’s work, it is important to also include a link or other reference to the original source. Finally, it is best to avoid using someone else’s words or ideas without giving them credit, as this is a form of plagiarism. By following these guidelines, writers can ensure that their work is original and free from plagiarism when discussing Snap Inc.