If you’re like many college students, you may be facing a lot of debt. But don’t worry, you’re not alone. Every year, thousands of students struggle to pay off their loans, credit cards, and other debts. Luckily, there are a few strategies you can use to pay off your debt and stay in the black. In this article, you’ll learn the best ways to pay off debt and keep your finances in check. So if you’re ready to get out of the red and stay in the black, read on to find out more!

Make a budget

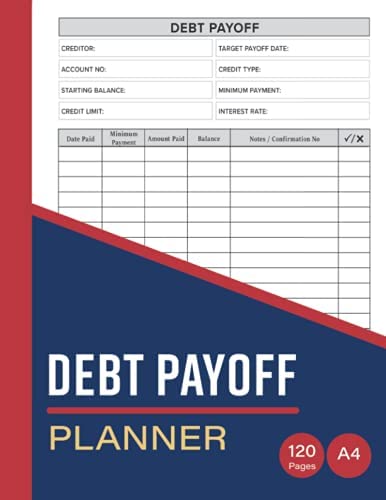

Making a budget is one of the most important steps when it comes to paying off debt. It may seem daunting, but it doesn’t have to be. Start by tracking your spending for a month and see where your money is going. Use a budgeting app or spreadsheet to organize your income and expenses. Make sure to leave room for savings, emergency funds, and small luxuries. With a budget in place, you’ll be ready to start tackling your debt.

As a college student, I know how hard it can be to pay off debt. I’ve tried a few strategies like budgeting and setting up automatic payments, but nothing works better than creating a plan and sticking to it. The key is to stay disciplined and consistent, so you can pay off your debt quickly and start saving for the future.

Cut expenses

When trying to pay off debt, cutting down on expenses is a must. From eating out less, to canceling subscriptions you don’t need, it’s important to save as much money as you can. Even small changes like bringing lunch from home or shopping at thrift stores can have a big impact. Doing this consistently helps you pay off your debt faster and keeps you from spending more than you should.

Being a student, I know how hard it is to pay off debt. Whether it’s student loans, credit cards, or other types of debt, it can feel overwhelming to figure out how to pay it off. Thankfully, there are strategies you can use to pay off debt quickly and effectively and stay in the black. Some of these strategies include creating a budget, setting up payment plans, and negotiating with creditors. With the right approach, you can get out of debt and back in the black in no time!

Prioritize debt

If you’re looking to pay off debt, it’s important to prioritize what you’ll pay off first. The best way I’ve found to do this is to pay off the debts with the highest interest rate first and work your way down. This will help you save money in the long run, since you’ll be paying less interest overall. It’s also important to make sure you’re making payments on all your debt – even the ones with lower interest rates – to make sure you stay out of the red and in the black.

As a student, I know first-hand how hard it can be to pay off debt. I used to feel like I was constantly stuck in the red, but I’ve recently learned some smart strategies to help me stay in the black. With budgeting, debt consolidation, and even a little help from credit counseling, I’m now on my way to financial freedom.

Increase income

I’m an 18-year-old college student and I’m trying to get out of debt. One of the best strategies for getting out of debt and staying in the black is to increase your income. This could mean taking on a second job or starting a side hustle. Not only will the extra money help you pay off debt faster, it could also help you stay out of debt for good.

As a recent college grad, I know how hard it is to pay off debt. I’m using a few strategies to get out of the red and stay in the black. I’m budgeting and cutting back on expenses, like eating out and shopping, to free up extra cash. I’m also paying more than the minimum on my loans to reduce the interest I’m being charged. Lastly, I’m looking for ways to increase my income, such as taking on a side gig. With commitment and discipline, I’m confident I’ll be debt free soon.

Negotiate payments

If you’re struggling with debt, one way to get back on track is to negotiate payments with creditors. First, make sure you have a budget that you can stick to and build an emergency fund. Then, reach out to your creditors and explain your situation. Try to negotiate lower interest rates and make sure you have a repayment plan that works for both you and the creditor. It may take some time, but it’s worth it!

I’m an 18 year old student and I’m trying to pay off my debt. It’s been a struggle but I’ve finally figured out a few strategies that have been working for me. I’m focusing on budgeting and cutting costs, utilizing debt consolidation and settlement, and making extra payments whenever I can. These tactics have been instrumental in helping me pay off my debt and stay in the black.

Set goals.

Setting goals is essential to paying off debt. There are a few things to keep in mind when setting goals: be realistic, make sure they are measurable, and make sure they are achievable. For example, set a goal to pay off $500 of debt each month and create a budget to make sure you can hit this goal. Make sure it’s realistic for your situation, track your progress, and celebrate when you hit your goal. It will give you the motivation to keep going!