Negotiating your bills can seem intimidating, but it’s worth the effort! You can save a lot of money by learning how to effectively negotiate your expenses. As an 18-year-old student, I understand the importance of budgeting and saving money. That’s why I’m here to share some of my best tips on how to negotiate your bills and lower your expenses. From talking to the right people to knowing the right questions to ask, I’m here to show you how to get the best deal and save money.

Analyze current expenses.

Analyzing my current expenses is the best way to start negotiating them and lowering them. I’m 18, so I have to make sure I’m budgeting correctly to make sure I’m not overspending. I’m learning to compare different prices and look for discounts, so I can get the best deals. I’m also looking at different payment plans to make sure I’m not paying too much at once.

Create budget plan.

Creating a budget plan is essential in order to lower expenses and negotiate bills. Having a plan can help you stay organized and on track with your finances. It’s important to set realistic goals and track your progress over time to stay within your budget. With a budget plan, you can save money and have more control over your financial future.

Research lower cost options.

Doing research is essential to finding lower cost options for your bills. I’m a college student, so I look into student discounts, special offers, and loyalty programs. I also use sites like BillCutterz that compare prices for you and negotiate with companies for discounts. It’s a great way to find the best deals and save money.

Negotiate rates & terms.

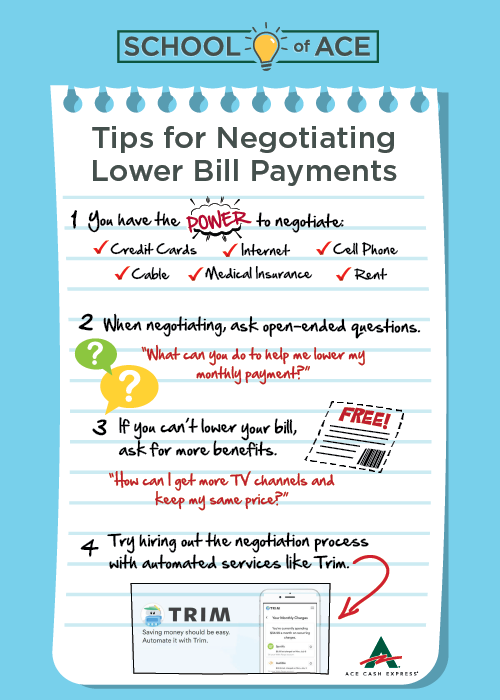

Negotiating your bills can be intimidating, especially if you’re a young adult just starting out. It can be especially hard to negotiate with credit cards, phone bills, and other monthly expenses. However, if you take the time to do research and be persistent, you can get better rates and terms from your providers. You never know what deals or discounts you can get unless you try! Don’t be afraid to haggle and make sure you’re getting the best deal.

Track expenses & savings.

Tracking my expenses and savings has been so helpful for me when it comes to negotiating bills and lowering my expenses. I use a budgeting app to keep track of all my expenses and make sure I’m not spending more than I can afford. This way I can negotiate with companies and find better deals to save money. It’s a great way to stay on top of my finances and make sure I’m not wasting money.

Celebrate success!

When it comes to negotiating bills and lowering expenses, celebrating success is a must! To stay motivated, I like to reward myself with a small treat when I manage to lower my monthly expenses. It could be anything from a new pair of shoes to a movie night with friends. Whatever it is, make sure it fits your budget and that it makes you feel good!