Are you a student looking to build wealth over time and invest in real estate but don’t know where to start? This article will provide you with the basics of how to get started and make educated decisions about investing in real estate. Investing in real estate can be a great way to generate passive income and increase your net worth over time. It’s important to do your research and understand the risks and rewards of real estate investing before putting your money into it. With the right strategies and knowledge, investing in real estate can be a smart move for students looking to build wealth over time.

Research real estate investments.

I’m 18 and researching real estate investments can feel intimidating, but it’s not impossible. To properly invest in real estate, you must do your due diligence – read up on market trends, get familiar with local laws, and understand the types of investments available. Don’t forget to consult with knowledgeable professionals, as well as check out online resources such as real estate forums and blogs. By doing your research, you can make sure you’re investing in the right properties and setting yourself up for long-term wealth.

Set financial goals.

If you want to build wealth over time through investing in real estate, it’s important to set financial goals. I’m an 18 year old student and I understand that the earlier I start saving, the easier it is to achieve my goals. I’m setting small, achievable goals and using them as stepping stones to reach my bigger goals. It’s all about taking baby steps to reach financial freedom.

Create budget plan.

Creating a budget plan is the first step to investing in real estate. As an 18 year-old, it’s important to have an understanding of your finances and set a budget to save for a down payment. Once you understand your financial capabilities, you can determine how much you can invest and how long it will take you to make a return. This will help you plan for the long-term and build wealth over time.

Find financing options.

Finding financing options to invest in real estate can be tricky, especially as a young adult. As an 18 year old, I had to do a lot of research on the best financing options available to me. I found that looking into banks and credit unions was a great way to get started. I was also able to explore things like mortgages, home equity loans and lines of credit, and even peer-to-peer lending. With the right financing options, I was able to start building my wealth over time.

Calculate potential ROI.

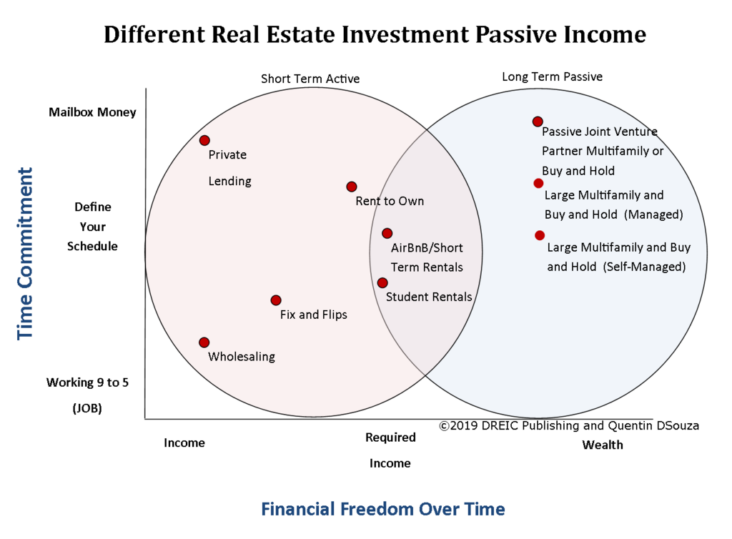

As an 18 year old, I’m starting to think about investing in real estate and want to know how to calculate potential ROI. To do this, I need to consider factors like the initial investment, potential appreciation, rental income, and ongoing costs. This will give me an idea of how much money I could potentially make over time.

Make prudent investment.

As a young investor, it’s important to make prudent investments in real estate to build wealth. Do your research and make sure you understand the risks, such as market changes, taxes, and regulations. Don’t jump into something without doing your due diligence and consulting with experts. Know your budget and stay within it, and always make sure you get the best return on your investments.