Creating a budget isn’t always easy, especially as a student. But don’t worry, I’m here to show you exactly how to make a budget that works for you and your individual lifestyle. With some simple tips, you’ll be able to craft a budget that takes into consideration your income, expenses, and savings goals so you can get your finances in order and stay on track. So, let’s get started and make a budget that works for you!

Set financial goals.

Creating financial goals is essential for creating a budget that works for you. Start by thinking about what you want to achieve in the short-term and long-term. Maybe you want to pay off credit card debt in the next 6 months or save for a car in the next 3 years. Whatever your goals may be, make sure they are realistic and achievable. Break them down into manageable chunks to make them more achievable. The most important thing is to stay motivated and keep striving for success!

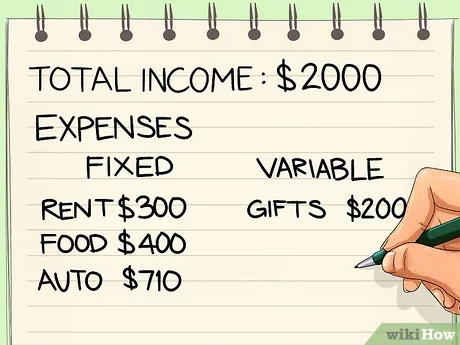

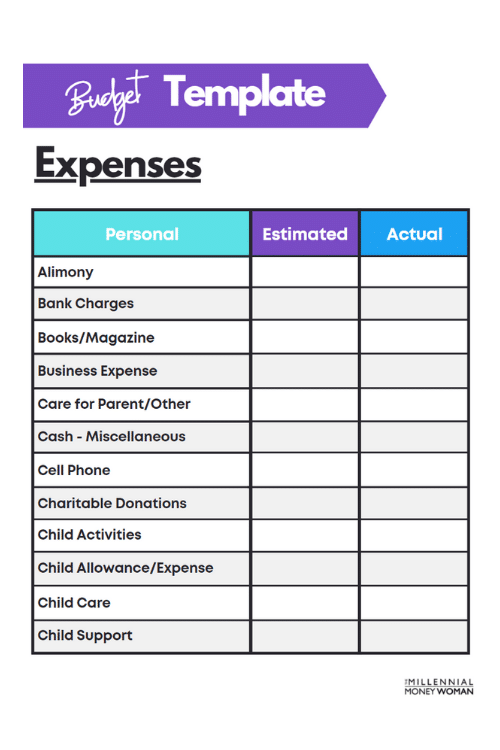

Estimate income/expenses.

As a student, creating a budget that works for you isn’t always easy. Estimating income and expenses can be tricky, but it’s important to start with a realistic idea of how much money you have coming in and how much you’ll be spending. That way, you can create a budget that fits your lifestyle and helps you reach your financial goals.

Prioritize needs/wants.

As a student, it’s important to prioritize needs over wants when creating a budget. Needs include essential items such as rent, food, and transportation, while wants are extras like clothes, entertainment, and eating out. It’s important to have a budget that’s realistic and easy to follow so you can stay on track and make sure your bills are paid while still having a little fun.

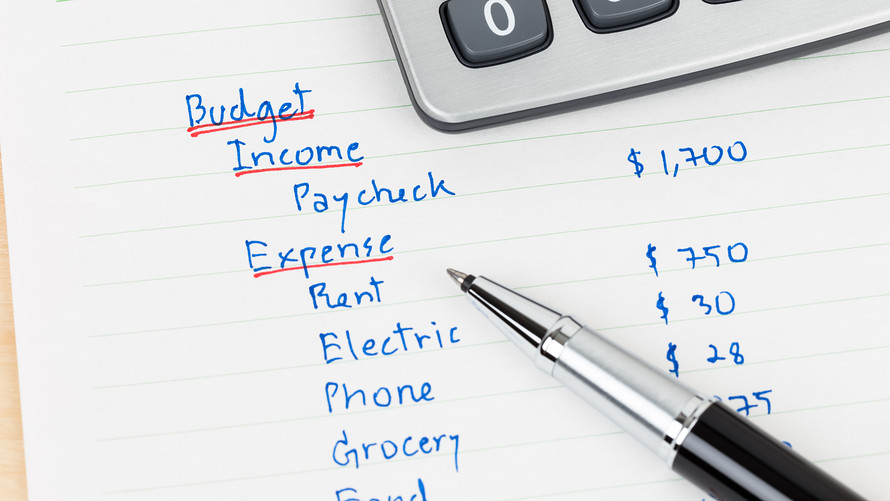

Track spending daily.

Tracking your spending daily is key to creating a budget that works for you. To get started, I recommend tracking all of your purchases using an app or notebook. This will give you a clear understanding of what you’re spending your money on and will help you stay on track with your budget. Keep track of your purchases, no matter how small they may seem, to get an accurate picture of your spending.

Adjust budget as needed.

Creating a budget isn’t a one time thing, it’s something that needs constant adjusting. As your life changes, your budget should evolve with it. If you get a raise, increase your savings or budget for something you’ve been wanting. If you get a new job or move, factor in new expenses like transportation or rent. Be realistic when creating a budget and adjust it as needed.

Review progress regularly.

Staying on track with your budget is a challenge, but monitoring your progress regularly can help make it easier. Reviewing your budget every few months or so can help ensure that you’re still on the right track, and can alert you to any changes you may need to make. Doing this can also help you get a better understanding of your finances, and can help you stay motivated to stick to your budget.