As an 18-year-old student, I understand how overwhelming it can be to think about the future and how to ensure financial security for my family. Fortunately, building a strong financial foundation for your family’s future doesn’t have to be a daunting task. With the right guidance and resources, you can create a plan to help your family achieve financial stability and success. In this article, I’ll be sharing my tips and insights on how to build a strong financial foundation for your family’s future.

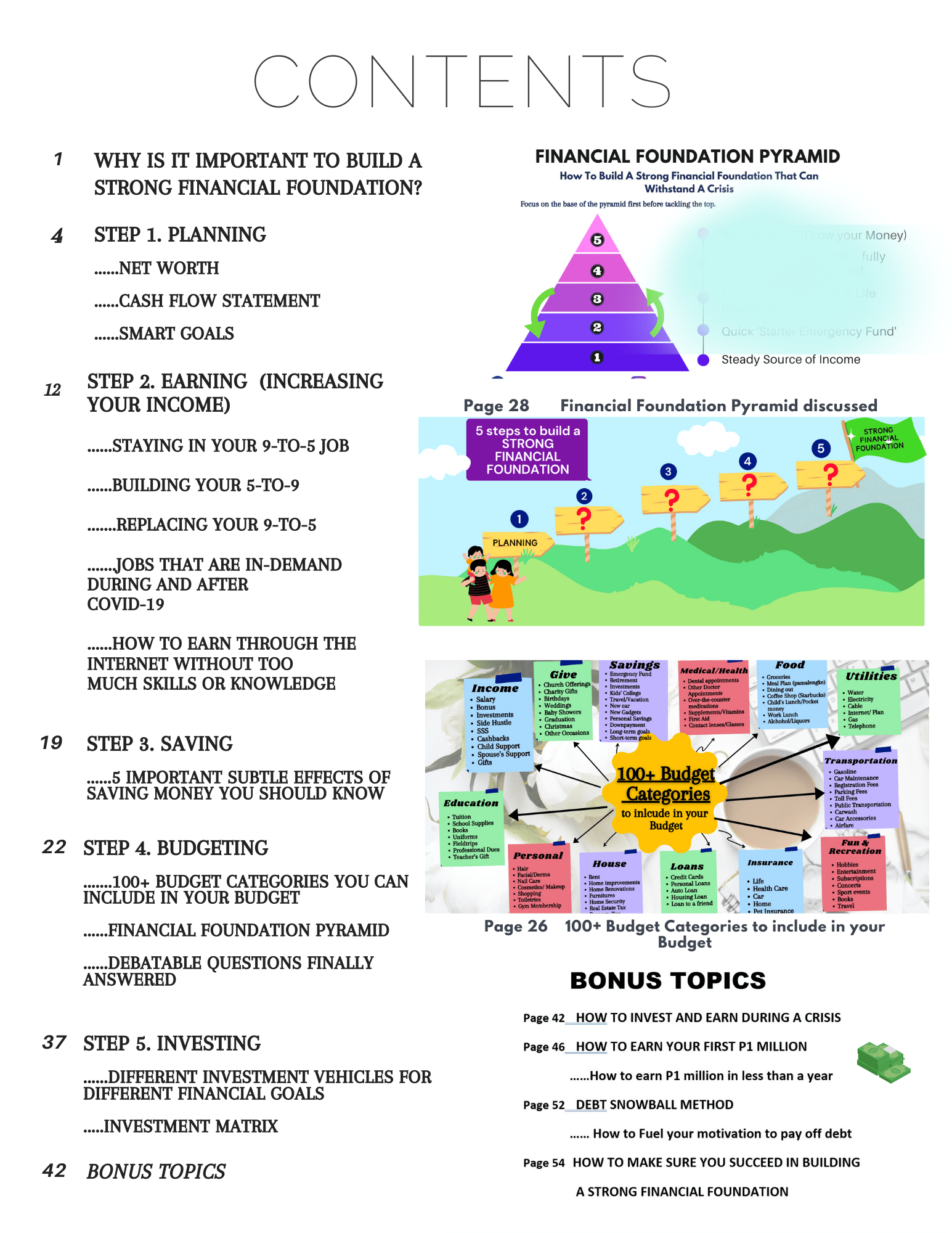

Set Financial Goals

Setting financial goals is essential for building a strong financial foundation for my family’s future. It’s important to think long-term and create achievable goals that I can work towards. I want to make sure I’m saving for retirement, paying off debt, and building an emergency fund. It can be daunting to plan for the future, but it’s worth it in the long run!

Create a Budget

Creating a budget is a great way to start building a strong financial foundation for your future family. Start by tracking your spending and setting limits, so you know exactly how much money you have to work with each month. This will help you prioritize your spending and focus on saving for your family’s future.

Save Regularly

Saving regularly is essential for your family’s financial foundation. Even if it’s just a little bit each month, it’s important to get into the habit of setting aside some of your income for the future. As someone in their early twenties, I understand the temptation to spend my money on fun experiences and items, but I also recognize the importance of saving money for when I need it. Regularly setting aside cash can help build a stronger financial future for you and your family.

Invest Strategically

As an 18-year-old, I understand the importance of investing strategically for my family’s future. I’ve been researching different investment options, such as stocks and bonds, to help build a strong financial foundation. I’m learning how to diversify my portfolio in order to maximize returns and minimize risk. I’m also researching different tax-advantaged strategies to help minimize the amount of taxes I pay on my investments.

Protect Finances

As a 21 year old student, I know how important it is to protect your family’s finances. Setting up a budget and sticking to it is a good way to start. Additionally, having an emergency fund that you can draw from in case of unexpected expenses is a must. Investing in insurance policies such as health and life insurance is also important in order to prepare for the future.

Track Progress

Tracking your family’s financial progress is a great way to stay on top of your goals. I use a budgeting app to keep track of my spending, savings, and investments. This helps me see how my money is being used and if I’m staying on track. It’s also a helpful reminder to stay disciplined so I can reach my financial goals and secure a bright future for my family.